Avon 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The valuation allowance primarily represents amounts for foreign

tax loss carryforwards. The basis used for recognition of deferred

tax assets included the profitability of the operations, related

deferred tax liabilities and the likelihood of utilizing tax credit

carryforwards during the carryover periods. The net increase in

the valuation allowance of $110.0 during 2009 was mainly due

to several of our foreign entities continuing to incur losses during

2009, thereby increasing the tax loss carryforwards for which a

valuation allowance was provided.

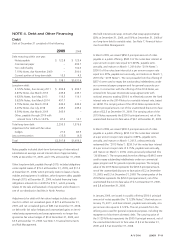

Income before taxes for the years ended December 31 was

as follows:

2009 2008 2007

United States $(144.1) $(19.2) $(31.6)

Foreign 1,070.6 1,257.5 827.7

Total $926.5 $1,238.3 $796.1

The provision for income taxes for the years ended December 31

was as follows:

2009 2008 2007

Federal:

Current $(17.5) $(45.9) $23.2

Deferred (38.5) (2.6) (37.2)

(56.0) (48.5) (14.0)

Foreign:

Current 476.4 469.8 348.2

Deferred (121.4) (59.4) (75.8)

355.0 410.4 272.4

State and other:

Current 2.1 1.2 3.8

Deferred (2.8) (.4) .6

(0.7) .8 4.4

Total $298.3 $362.7 $262.8

The effective tax rate for the years ended December 31 was

as follows:

2009 2008 2007

Statutory federal rate 35.0% 35.0% 35.0%

State and local taxes, net

of federal tax benefit .2 .2 .4

Taxes on foreign income (4.9) (2.8) .5

Tax audit settlements,

refunds, and amended

returns (.7) (4.5) (1.0)

Net change in valuation

allowances 3.4 1.2 (2.0)

Other (.8) .2 .1

Effective tax rate 32.2% 29.3% 33.0%

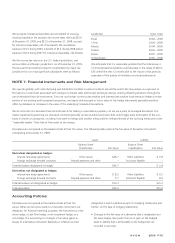

At December 31, 2009, we had foreign tax loss carryforwards of

$1,255.4. The loss carryforwards expiring between 2010 and

2024 are $110.7 and the loss carryforwards which do not expire

are $1,144.7. We also had minimum taxcredit carryforwards of

$32.9 which do not expire,capital loss carryforwards of $4.0

that will expire between 2010 and 2013, and foreign tax credit

carryforwards of $144.2 that will expire between 2016 and 2019.

Uncertain Tax Positions

Effective January 1, 2007, we adopted the provisions for recog-

nizing and measuring tax positions taken or expected to be

taken in atax return that affect amounts reported in the finan-

cial statements as required by the Income Taxes Topic of the

Codification. As aresult of the implementation, we recognized

an $18.3 increase in the liability for unrecognized tax benefits

including interest and penalties, which was accounted for as a

reduction to the January 1, 2007 balance of retained earnings. At

December 31, 2009, we had $113.4 of total gross unrecognized

tax benefits of which approximately $102 would impact the

effective tax rate, if recognized.

Areconciliation of the beginning and ending amount of unrecog-

nized tax benefits is as follows:

Balance at January 1, 2007 $135.6

Additions based on tax positions related to the

current year 24.2

Additions for tax positions of prior years 5.4

Reductions for tax positions of prior years (3.6)

Reductions due to lapse of statute of limitations (2.9)

Reductions due to settlements with tax authorities (4.4)

Balance at December 31, 2007 $154.3

Additions based on tax positions related to the

current year 22.2

Additions for tax positions of prior years 3.9

Reductions for tax positions of prior years (59.0)

Reductions due to lapse of statute of limitations (4.2)

Reductions due to settlements with tax authorities (12.9)

Balance at December 31, 2008 104.3

Additions based on tax positions related to the

current year 16.8

Additions for tax positions of prior years 9.7

Reductions for tax positions of prior years (5.8)

Reductions due to lapse of statute of limitations (2.9)

Reductions due to settlements with tax authorities (8.7)

Balance at December 31, 2009 $113.4