Avon 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

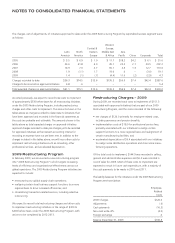

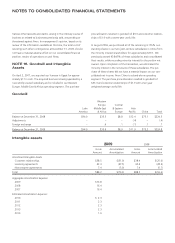

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

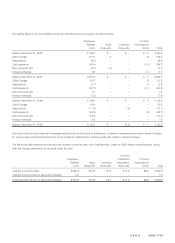

NOTE 18. Results of Operations by Quarter (Unaudited)

2009 First Second Third Fourth Year

Total revenue $2,179.8 $2,470.3 $2,551.3 $3,181.4 $10,382.8

Gross profit 1,368.6 1,536.0 1,596.5 1,993.4 6,494.5

Operating profit 168.4 182.9 258.5 408.4 1,018.2

Income before taxes 146.7 159.9 231.7 388.2 926.5

Net income 117.5 84.6 157.6 268.5 628.2

Net income attributable to Avon 117.3 82.9 156.2 269.4 625.8

Earnings per share

Basic $.27 $.19 $.36 $.63 $1.45(1)

Diluted $.27 $.19 $.36 $.62 $1.45(1)

2008 First Second Third Fourth Year

Total revenue $2,501.7 $2,736.1 $2,644.7 $2,807.6 $10,690.1

Gross profit 1,578.0 1,742.7 1,669.7 1,750.6 6,741.0

Operating profit 296.2 373.9 297.1 372.1 1,339.3

Income before taxes 278.6 344.4 279.2 336.1 1,238.3

Net income 186.2 237.0 224.7 227.7 875.6

Net income attributable to Avon 184.7 235.6 222.6 232.4 875.3

Earnings per share

Basic $.43 $.55 $.52 $.54 $2.04(1)

Diluted $.43 $.55 $.52 $.54 $2.03(1)

(1) The sum of per share amounts for the quarters does not necessarily equal that for the year because the computations were made independently.

Results of operations by quarter were impacted by the following:

2009 First Second Third Fourth Year

Costs to implement restructuring initiatives:

Cost of sales $– $.3$3.3 $3.1 $6.7

Selling, general and administrative expenses 14.5 89.1 30.2 30.9 164.7

Total costs to implement restructuring initiatives $14.5 $89.4 $33.5 $34.0 $171.4

2008 First Second Third Fourth Year

Costs to implement restructuring initiatives:

Cost of sales $– $.3$2.6 $.2$3.1

Selling, general and administrative expenses 25.5 13.0 11.8 7.2 57.5

Total costs to implement restructuring initiatives $25.5 $13.3 $14.4 $7.4 $60.6

Benefits related to our PLS program $– $(13.0) $– $– $(13.0)

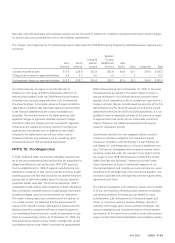

NOTE 19. Subsequent Events

Management evaluated subsequent events through February 25,

2010, which is the date the financial statements were issued.

Effective January 1, 2010, Avon will treat Venezuela as ahighly

inflationary economy for accounting purposes. Effective Jan-

uary 11, 2010, the Venezuelan government devalued its cur-

rency and moved to atwo-tier exchange structure. The official

exchange rate moved from 2.15 to 2.60 for essential goods and

to 4.30 for non-essential goods and services. Although no offi-

cial rules have yet been issued, most of Avon’s imports are

expected to fall into the non-essential classification.

On February 9, 2010, we announced an increase in our quarterly

cash dividend to $.22 per share from $.21 per share, beginning

with the first-quarter dividend payable March 1, 2010, to share-

holders of record on February 23, 2010. With this increase, the

indicated annual dividend rate is $.88 per share.