Avon 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’SDISCUSSIONANDANALYSIS

OFFINANCIALCONDITIONANDRESULTSOFOPERATIONS

implement these initiatives, primarily for employee related costs,

including severance, pension and other termination benefits, asset

impairment charges, cumulative foreign currency translation charges

previously recorded directly to shareholders’ equity and professional

service fees related to these initiatives. Specific actions for this initial

phase of our multi-year restructuring plan include:

• organization realignment and downsizing in each region and

global through a process called “delayering”, taking out layers

to bring senior management closer to operations;

• the exit of unprofitable lines of business or markets, including the

closure of unprofitable operations in Asia, primarily Indonesia and

the exit of a product line in China, and the exit of the beComing

product line in the U.S.; and

• the move of certain services from markets within Europe to

lower cost shared service centers.

See Note 13, Restructuring Initiatives, for further information. The

charges included $8.4 to cost of sales for inventory write-offs, and

$48.1 to marketing, distribution and administrative expenses.

We expect to record additional restructuring expenses totaling

approximately $3.8 before taxes during 2006 to implement the

actions for which charges were recorded during the fourth quarter

of 2005. In March 2006, additional initiatives were approved under

the multi-year restructuring effort. These initiatives include the

termination of employees under our delayering process and the

termination of employees under initiatives to outsource certain

services and realign certain manufacturing processes. We expect

to record total charges of approximately $35 to $37 before taxes

in connection with these approved initiatives for employee related

costs. We also expect to announce additional initiatives as they

are approved.

Key Performance Indicators

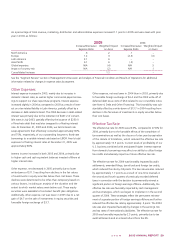

Within the following discussion and analysis, we utilize the key performance indicators (“KPIs”) defined below to assist in the evaluation of

our business.

KPI Definition

Change in Active Representatives This indicator is based on the number of Representatives submitting an order in a campaign,

totaled for all campaigns in the related period. This amount is divided by the number of billing

days in the related period, to exclude the impact of year-to-year changes in billing days (for

example, holiday schedules). To determine the Change in Active Representatives, this calculation

is compared to the same calculation in the corresponding period of the prior year.

Change in Units This indicator is based on the gross number of pieces of merchandise sold during a period, as

compared to the same number in the same period of the prior year. Units sold include samples

sold and product contingent upon the purchase of another product (for example, gift with

purchase or purchase with purchase), but exclude free samples.

Inventory Days This indicator is equal to the number of days of estimated future months’ cost of sales

covered by the inventory balance at the end of the period.

CRITICALACCOUNTINGESTIMATES

We believe the accounting policies described below represent

our critical accounting policies due to the estimation processes

involved in each. See Note 1, Description of the Business and

Summary of Significant Accounting Policies, for a detailed discus-

sion of the application of these and other accounting policies.

Restructuring Reserves

We record severance-related expenses once they are both probable

and estimable in accordance with the provisions of FAS No. 112,

“Employer’s Accounting for Post-Employment Benefits.” One-time

benefit arrangements and disposal costs, primarily contract termina-

tion costs and costs to consolidate or close facilities, are accounted

for under the provisions of FAS No. 146, “Accounting for Costs

Associated with Exit or Disposal Activities.” We evaluate impair-

ment issues under the provisions of FAS No. 144, “Accounting for

the Impairment or Disposal of Long-Lived Assets.” We estimate the

expense for these initiatives, when approved by the appropriate

corporate authority, by accumulating detailed estimates of costs for

such plans. This process includes the estimated costs of employee

severance and related benefits, impairment of property, plant and

equipment, contract termination payments for leases, and any

other qualifying exit costs. These estimated costs are grouped by

specific projects within the overall plan and are then monitored on

a monthly basis by global finance personnel, as well as by finance

personnel at each affected geographic region. Such costs represent

management’s best estimate, but require assumptions about the

programs that may change over time. Estimates are evaluated peri-

odically to determine if a change is required.