Avon 2005 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2005 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’SDISCUSSIONANDANALYSIS

OFFINANCIALCONDITIONANDRESULTSOFOPERATIONS

• Operating costs associated with Europe’s manufacturing loca-

tions increased (which reduced segment margin by .8 point),

primarily due to higher manufacturing overhead.

• Costs associated with planning and developing an enterprise

resource planning system negatively impacted operating margin

(which reduced segment margin by .7 point).

• In Central and Eastern Europe, operating margin declined

(which reduced segment margin by .6 point), primarily due to

a decline in Russia. Russia’s gross margin declined mainly due

to unfavorable pricing and product mix and adverse foreign

exchange movements.

• Operating margin was positively impacted by greater contribu-

tions from countries with higher operating margins (which

increased segment margin by .7 point), primarily driven by

revenue growth in the high margin Central and Eastern Europe

markets and Turkey.

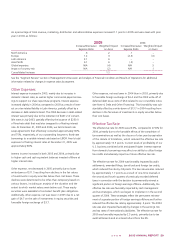

Europe – 2004 Compared to 2003

%/Point Change

Local

2004 2003 US$ Currency

Total revenue $2,102.2 $1,613.1 30% 20%

Operating profit 471.7 313.4 51% 39%

Operating margin 22.4% 19.4% 3.0 3.0

Units sold 22%

Active Representatives 16%

Total revenue increased significantly in 2004 driven by substantial

growth in units sold and the number of active Representatives, as

well as favorable foreign exchange, with the following markets

having the most significant impact:

• In Central and Eastern Europe, revenue grew significantly,

primarily driven by an increase in Russia and, to a lesser extent,

increases in all other markets in the region. Revenue in Central

and Eastern Europe was positively impacted by the successful

launch of a new personal care line, Senses, as well as consumer

promotion programs. In Russia, revenue growth reflected

increases in units sold and active Representatives resulting from

expansion into new territories, with penetration and access sup-

ported by additional distribution points throughout the country.

• In Western Europe, revenue increased mainly due to growth in

the United Kingdom, where revenue grew as a result of con-

sumer promotion programs that drove strong increases in the

average order per active Representative, in addition to favorable

foreign exchange.

• In Turkey, revenue increased reflecting growth in active

Representatives and units sold. Avon began consolidating its

Turkish subsidiary in the second quarter of 2003.

The increase in operating margin in Europe was most significantly

impacted by the following markets:

• Operating margin was positively impacted by greater contribu-

tions from countries with higher operating margins (which

increased segment margin by .8 point), primarily driven by

significant sales growth in the high margin Central and Eastern

Europe markets.

• In Western Europe, operating margin improved (which increased

segment margin by .8 point) primarily due to a decline in the

expense ratio in most markets reflecting the impact of field and

other restructuring programs, partially offset by an increase in

the expense ratio in the United Kingdom reflecting incremental

consumer and strategic investments. Operating margin in 2004

also included a gain on the sale of a warehouse and office build-

ing in Italy.

• In Central and Eastern Europe, operating margin improved

(which increased segment margin by .6 point), driven by a

decrease in the expense ratio resulting from greater sales lever-

age across the cluster.

• In South Africa, operating margin during 2003 was negatively

impacted by inventory adjustments. Primarily as a result of these

prior year adjustments, operating margin improved in 2004

(which increased segment margin by .4 point).

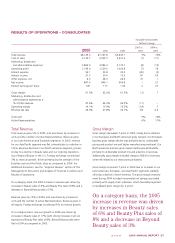

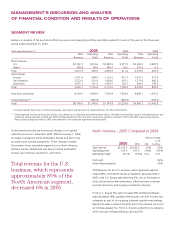

Latin America – 2005 Compared to 2004

%/Point Change

Local

2005 2004 US$ Currency

Total revenue $2,272.6 $1,934.6 17% 10%

Operating profit 516.0 479.1 8% 1%

Operating margin 22.7% 24.8% (2.1) (2.0)

Units sold 8%

Active Representatives 11%

Total revenue increased in 2005 with increases in all markets in the

region, except Mexico, reflecting growth in active Representatives,

as well as favorable foreign exchange. The purchase of our licensee

in Colombia favorably impacted Latin America’s revenue and active

Representative growth by 2 points.

• In Brazil, revenue grew significantly, primarily due to growth in

units sold and active Representatives, incremental consumer and

field incentive programs, as well as favorable foreign exchange.

• In Venezuela, revenue increased, mainly due to growth in

active Representatives, partially offset by the negative impact

of foreign exchange.

• In Mexico, revenue declined, reflecting increased competitive

intensity and significant decline in non-Beauty product offerings,

partially offset by favorable foreign exchange.