Avnet 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

If the Company fails to maintain effective internal controls, it may not be able to report its financial results accurately or timely or detect

fraud, which could have a material adverse effect on the Company

’s business or the market price of the Company's securities.

Effective internal controls are necessary for the Company to provide reasonable assurance with respect to its financial reports and to

effectively prevent fraud. If the Company cannot provide reasonable assurance with respect to its financial reports and effectively prevent fraud,

its brand and operating results could be harmed. Pursuant to the Sarbanes-

Oxley Act of 2002, the Company is required to furnish a report by

management on internal control over financial reporting, including management's assessment of the effectiveness of such control. Internal

control over financial reporting may not prevent or detect misstatements because of its inherent limitations, including the possibility of human

error, the circumvention or overriding of controls, or fraud. Therefore, even effective internal controls cannot provide absolute assurance with

respect to the preparation and fair presentation of financial statements. In addition, projections of any evaluation of effectiveness of internal

control over financial reporting to future periods are subject to the risk that the control may become inadequate because of changes in conditions,

or that the degree of compliance with the policies or procedures may deteriorate. If the Company fails to maintain the adequacy of its internal

controls, including any failure to implement required new or improved controls, or if the Company experiences difficulties in their

implementation, the Company's business and operating results could be harmed, and the Company could fail to meet its reporting obligations,

which could have a material adverse effect on its business or the market price of the Company's securities.

If the Company

’

s internal information systems fail to function properly, or if the Company is unsuccessful in the integration or upgrade of

information systems, its business operations could suffer.

The Company's expanding operations put increasing pressure on the Company's information systems to facilitate the day- to-

day

operations of the business and to produce timely, accurate and reliable reports on financial and operational results. Currently, the Company's

global operations are tracked with multiple information systems, some of which are subject to on-

going IT projects designed to streamline or

optimize its global information systems. There is no guarantee that the Company will be successful at all times in these efforts or that there will

not be integration difficulties that will adversely affect the Company's operations or the accurate and timely recording and reporting of financial

data. In addition, the Company's information technology is subject to security breaches, computer hacking or other general system failures.

Maintaining and operating these systems requires continuous investments. A data privacy breach may pose a risk that sensitive data may be

exposed to unauthorized persons or to the public. A failure of any of these information systems in a way described above or material difficulties

in upgrading these information systems could have material adverse effects on the Company's business and its compliance with reporting

obligations under federal securities laws.

Major disruptions to the Company

’s logistics capability could have a material adverse impact on the Company’s operations.

The Company's global logistics services are operated through specialized and centralized distribution centers around the globe. The

Company also depends almost entirely on third-

party transportation service providers for the delivery of products to its customers. A major

interruption or disruption in service at one or more of its distribution centers for any reason (such as natural disasters, pandemics, or significant

disruptions of services from our third-

party providers) could cause cancellations or delays in a significant number of shipments to customers and,

as a result, could have a severe impact on the Company's business, operations and financial performance.

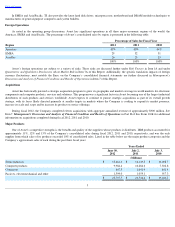

The Company may not have adequate or cost-effective liquidity or capital resources.

The Company's ability to satisfy its cash needs depends on its ability to generate cash from operations and to access the financial markets,

both of which are subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond the Company's

control.

The Company may need to satisfy its cash needs through external financing. However, external financing may not be available on

acceptable terms or at all. As of June 30, 2012, Avnet had total debt outstanding of $2.144 billion under various notes and committed and

uncommitted lines of credit with financial institutions. The Company needs cash to make interest payments on, and to refinance, this

indebtedness and for general corporate purposes, such as funding its ongoing working capital and capital expenditure needs. Under the terms of

any external financing, the Company may incur higher than expected financing expenses and become subject to additional restrictions and

covenants. Any material increase in the Company's financing costs could have a material adverse effect on its profitability.

10