Avnet 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

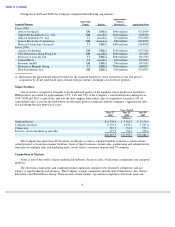

15

Item 6.

Selected Financial Data

Years Ended

June 27,

June 28,

June 30,

July 1,

July 2,

2009

2008

2007

2006

2005

(Millions, except for per share and ratio data)

Income:

Sales

$

16,229.9

$

17,952.7

$

15,681.1

$

14,253.6

$

11,066.8

Gross profit

2,023.0

2,313.7

2,048.6

1,839.0

(d)

1,459.0

Operating income (loss)

(1,019.3

)(a)

710.4

(b)

678.3

(c)

433.1

(d)

321.3

Income tax provision

39.4

(a)

209.9

(b)

193.5

(c)

111.6

(d)

71.5

Net income (loss)

(1,122.5

)(a)

499.1

(b)

393.1

(c)

204.5

(d)

168.2

Financial Position:

Working capital(e)

2,688.4

3,191.5

2,711.8

2,029.1

2,065.4

Total assets

6,273.5

8,200.1

7,355.1

6,215.7

5,098.2

Long

-

term debt

946.6

1,181.5

1,156.0

918.8

1,183.2

Shareholders

’

equity

2,760.9

4,134.7

3,400.6

2,831.2

2,097.0

Per Share:

Basic earnings (loss)

(7.44

)(a)

3.32

(b)

2.65

(c)

1.40

(d)

1.39

Diluted earnings (loss)

(7.44

)(a)

3.27

(b)

2.63

(c)

1.39

(d)

1.39

Book value

18.28

27.49

22.70

19.30

17.36

Ratios:

Operating income (loss) margin on

sales

(6.3

)%(a)

4.0

%(b)

4.3

%(c)

3.0

%(d)

2.9

%

Net income (loss) margin on sales

(6.9

)%(a)

2.8

%(b)

2.5

%(c)

1.4

%(d)

1.5

%

Return on capital

(26.7

)%(a)

10.9

%(b)

11.2

%(c)

7.6

%(d)

7.5

%

Quick

1.5:1

1.4:1

1.3:1

1.1:1

1.5:1

Working capital

2.1:1

2.1:1

2.0:1

1.8:1

2.2:1

Total debt to capital

26.0

%

22.9

%

26.2

%

30.4

%

37.2

%

(a)

Includes goodwill and intangible asset impairment charges of $1.41 billion pre-tax, $1.38 billion after tax and

$9.13 per share and includes the impact of restructuring, integration and other items which totaled $99.3 million

pre-tax, $34.9 million after tax and $0.23 per share (see Note 18 in the Notes to the Consolidated Financial

Statements

contained in Item 15 of this Report for further discussion of these items).

(b)

Includes the impact of restructuring, integration and other items, gains on sale of assets and other items which

totaled to a gain of $11.0 million pre-tax, $14.7 million after tax and $0.09 per share on a diluted basis (see

Note 18 in the

Notes to the Consolidated Financial Statements contained in Item 15 of this Report for further

discussion of these items).

(c)

Includes the impact of restructuring, integration and other items, gain on sale of assets, debt extinguishment costs

and other items which amounted to charges of $31.7 million pre-tax, $20.0 million after tax and $0.13 per share

on a diluted basis.

(d)

Includes the impact of restructuring, integration and other items recorded during fiscal 2006, including inventory

writedowns for terminated lines (recorded in cost of sales) in connection with an acquisition. These combined

charges amounted to $69.9 million pre-tax (including $9.0 million recorded in cost of sales), $49.9 million after

tax and $0.34 per share on a diluted basis. Fiscal 2006 results also include a loss on the sale of business lines of

$2.6 million pre-tax, $7.1 million after tax and $0.05 per share on a diluted basis. The Company also recognized

debt extinguishment costs of $22.6 million pre-tax, $13.6 million after tax and $0.09 per share on a diluted basis.

In addition, in comparison with fiscal 2005, fiscal 2006 results include incremental stock-based compensation

expense resulting from the Company

’

s adoption of accounting standards that require