Avnet 2009 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2009 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Forward-Looking Statements And Risk Factors

This Report contains forward-looking statements with respect to the financial condition, results of operations

and business of Avnet. These statements are generally identified by words like “believes,” “expects,” “anticipates,”

“should,” “will,” “may,” “estimates” or similar expressions. Forward-looking statements are subject to numerous

assumptions, risks and uncertainties.

Avnet does not undertake any obligation to update any forward-looking statements, whether as a result of new

information, future events or otherwise. Factors that may cause actual results to differ materially from those

contained in the forward-looking statements include the following:

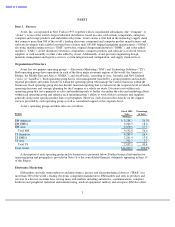

The current global economic downturn has affected the Company’s financial results and management can

offer no assurance that the effect of these conditions either will improve in the near future or will not worsen.

Beginning with the third quarter of fiscal 2008, the Company’

s financial results were impacted negatively by the

global economic slowdown as Avnet experienced a rapid decline in end market demand, first in its Technology

Solutions operating group and then in its Electronics Marketing operating group. Deterioration in the financial and

credit markets heighten the risk of reduced corporate spending on information technology, and continued market

weakness may result in a more competitive environment and lower sales. Even though management takes action to

better align the Company’

s cost structure with current market conditions, the benefits from these cost reductions may

take longer to fully realize or otherwise may not fully mitigate the impact of the reduced demand in the technology

supply chain.

An industry down-cycle in semiconductors could significantly affect the Company’s operating results as a large

portion of revenues comes from sales of semiconductors, which has been a highly cyclical industry.

The semiconductor industry historically has experienced periodic fluctuations in product supply and demand,

often associated with changes in technology and manufacturing capacity, and is generally considered to be highly

cyclical. During each of the last three fiscal years, sales of semiconductors represented over 50% of the Company’s

consolidated sales, and the Company’

s revenues, particularly those of EM, closely follow the strength or weakness of

the semiconductor market. Future downturns in the technology industry, particularly in the semiconductor sector,

could negatively affect the Company’s operating results and negatively impact the Company’s ability to maintain its

current profitability levels.

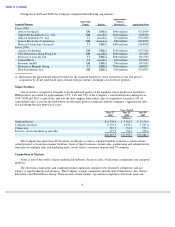

Failure to maintain its relationships with key suppliers could adversely affect the Company’s sales.

One of the Company’s competitive strengths is the breadth and quality of the suppliers whose products the

Company distributes. However, sales of products and services from one of the Company’

s suppliers, IBM, accounted

for approximately 15% of the Company’s consolidated sales in fiscal year 2009. Management expects IBM products

and services to continue to account for roughly a similar percentage of the Company’s consolidated sales in fiscal

year 2010. The Company

’s contracts with its suppliers, including those with IBM, vary in duration and are generally

terminable by either party at will upon notice. To the extent IBM or other primary suppliers significantly reduce their

volume of business with the Company in the future, the Company’s business and relationships with its customers

could be materially, adversely affected because its customers depend on the Company’s distribution of electronic

components and computer products from the industry’s leading suppliers. In addition, to the extent that any of the

Company’s key suppliers modify the terms of their contracts including, without limitation, the terms regarding price

protection, rights of return, rebates or other terms that protect the Company’s gross margins, it could materially and

adversely affect the Company’s results of operations, financial condition or liquidity.

8

Item 1A.

Risk Factors