Avnet 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AVNET INC

FORM 10-K

(Annual Report)

Filed 08/25/09 for the Period Ending 06/27/09

Address 2211 SOUTH 47TH STREET

PHOENIX, AZ 85034

Telephone 4806432000

CIK 0000008858

Symbol AVT

SIC Code

5065 - Electronic Parts and Equipment, Not Elsewhere Classified

Industry Electronic Instr. & Controls

Sector Technology

Fiscal Year 06/28

http://www.edgar-online.com

© Copyright 2009, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

... CIK Symbol SIC Code Industry Sector Fiscal Year 2211 SOUTH 47TH STREET PHOENIX, AZ 85034 4806432000 0000008858 AVT 5065 - Electronic Parts and Equipment, Not Elsewhere Classified Electronic Instr. & Controls Technology 06/28 http://www.edgar-online.com © Copyright 2009, EDGAR Online, Inc. All... -

Page 2

Table of Contents -

Page 3

... or organization) 11-1890605 (I.R.S. Employer Identification No.) 2211 South 47th Street, Phoenix, Arizona (Address of principal executive offices) 85034 (Zip Code) Registrant's telephone number, including area code (480) 643-2000 Securities registered pursuant to Section 12(b) of the Act: Title... -

Page 4

... treasury shares. DOCUMENTS INCORPORATED BY REFERENCE Portions of the registrant's definitive proxy statement (to be filed pursuant to Reg. 14A) relating to the Annual Meeting of Shareholders anticipated to be held on November 5, 2009 are incorporated herein by reference in Part III of this Report. -

Page 5

...in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information PART III Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters... -

Page 6

... groups - Electronics Marketing ("EM") and Technology Solutions ("TS"). Both operating groups have operations in each of the three major economic regions of the world: the Americas; Europe, the Middle East and Africa ("EMEA"); and Asia/Pacific, consisting of Asia, Australia and New Zealand ("Asia... -

Page 7

... lifecycle, customers and suppliers can accelerate their time to market and realize cost efficiencies in both the design and manufacturing process. EM Design Chain Services EM Design Chain Services offers engineers a host of technical design solutions in support of the sales process. With access... -

Page 8

...'s Discussion and Analysis of Financial Condition and Results of Operations in Item 7 of this Report. Acquisitions Avnet has historically pursued a strategic acquisition program to grow its geographic and market coverage in world markets for electronic components and computer products. This... -

Page 9

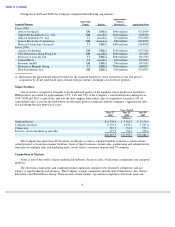

...Solutions Pvt. Ltd. Source Electronics Corporation Horizon Technology Group plc Fiscal 2008 Azzurri Technology YEL Electronics Hong Kong Ltd. Division of Acal plc Ltd. ChannelWorx Betronik GmbH Division of Magirus Group Flint Distribution Ltd. EM EM TS EM TS EM EM TS TS EM TS EM EMEA Asia/Pac Asia... -

Page 10

... amendments to the Code of Conduct, committee charters and waivers granted to directors and executive officers under the Code of Conduct, if any, will be posted in this area of the website. These documents can be accessed at www.avnet.com under the "Investor Relations - Corporate Governance" caption... -

Page 11

... for approximately 15% of the Company's consolidated sales in fiscal year 2009. Management expects IBM products and services to continue to account for roughly a similar percentage of the Company's consolidated sales in fiscal year 2010. The Company's contracts with its suppliers, including those... -

Page 12

...the Company's inventory or unexpected order cancellations by the Company's customers could materially, adversely affect its business, results of operations, financial condition or liquidity. The electronic components and computer products industries are subject to rapid technological change, new and... -

Page 13

... of effectiveness of internal control over financial reporting to future periods are subject to the risk that the control may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. If the Company fails to maintain... -

Page 14

... and its compliance with securities laws. Major disruptions to the Company's logistics capability could have a material adverse impact on the Company's operations. The Company's global logistics services are operated through specialized and centralized distribution centers around the globe. The... -

Page 15

...% is located in the United States. The following table summarizes certain of the Company's key facilities. Location Sq. Footage Leased or Owned Primary Use Chandler, Arizona Tongeren, Belgium Poing, Germany Chandler, Arizona Tsuen Wan, Hong Kong Phoenix, Arizona Tempe, Arizona Nogales, Mexico 399... -

Page 16

... PART II Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Market price per share The Company's common stock is listed on the New York Stock Exchange under the symbol AVT. Quarterly high and low sales prices (as reported for the New... -

Page 17

.... Issuer Purchases of Equity Securities The following table includes the Company's monthly purchases of common stock during the fourth quarter ended June 27, 2009: Total Number of Shares Purchased Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs Maximum Number (or... -

Page 18

... Income: Sales Gross profit Operating income (loss) Income tax provision Net income (loss) Financial Position: Working capital(e) Total assets Long-term debt Shareholders' equity Per Share: Basic earnings (loss) Diluted earnings (loss) Book value Ratios: Operating income (loss) margin on sales Net... -

Page 19

... of acquisitions by adjusting Avnet's prior periods to include the sales of businesses acquired as if the acquisitions had occurred at the beginning of the period presented and, in the discussion that follows, this adjustment for acquisitions is referred to as "pro forma sales" or "organic sales... -

Page 20

... with the market conditions. Approximately 90% of the total of $225 million in annualized cost savings had been achieved through the end of the fiscal 2009, with the remaining actions expected to be completed by the end of the first quarter of fiscal 2010. In addition, the Company expects to... -

Page 21

... Corporation Fiscal 2008 Azzurri Technology YEL Electronics Hong Kong Ltd. Division of Acal plc Ltd. ChannelWorx Betronik GmbH Division of Magirus Group Flint Distribution Ltd. Fiscal 2007 Azure Technologies Access Distribution EM EM TS TS EM EM EM TS TS EM TS EM TS TS EMEA Asia/Pac Asia/Pac EMEA... -

Page 22

...forma basis. In response to the year-over-year organic sales contraction in both operating groups, management took actions during fiscal 2009 to reduce costs. See discussion under Selling, General and Administrative Expenses later in this MD&A. EM sales of $9.19 billion declined 11.0% over the prior... -

Page 23

... by the combination of a regional mix shift to Asia, which represented 31% of EM sales as compared with 28% in the prior year, and lower margins in the Americas region. TS gross profit margin was up 10 basis points year over year as the EMEA region's improvement was mostly offset by declines in the... -

Page 24

... even further, in particular in EM Americas and EM EMEA which have been the Company's most profitable regions. As a result of the poor market conditions through mid-March, the Company took actions to reduce costs by approximately $200 million on an annualized basis and expected such actions to... -

Page 25

...and after tax and $0.41 per share recognized in the fourth quarter of fiscal 2009, $41.4 million related to the recently acquired business in Japan, which was assigned to the EM Asia reporting unit. Accounting standards require goodwill from an acquisition to be assigned to a reporting unit and also... -

Page 26

... groups with employee reductions of approximately 1,400 in EM, 400 in TS and the remaining from centralized support functions. Exit costs for vacated facilities related to 29 facilities in the Americas, 13 in EMEA and three in Asia/Pac and consisted of reserves for remaining lease liabilities... -

Page 27

... Avnet-owned building in EMEA and Access integration costs. The write-down of the building was based on management's estimate of the current market value and possible selling price, net of selling costs, for the property. The integration costs related to incremental salary costs, primarily of Access... -

Page 28

... 2007, the Company recorded a gain related to the receipt of contingent purchase price proceeds from the fiscal 2006 sale of a TS end-user business. The gain amounted to $3.0 million pre-tax, $1.8 million after tax and $0.01 per share on a diluted basis. Debt Extinguishment Costs During fiscal 2007... -

Page 29

...and other charges Gain on sale of assets Debt extinguishment costs Total Critical Accounting Policies $ $ (7,353) - - (7,353) $ $ (7,353) 3,000 (27,358) (31,711) $ $ (5,289) 1,814 (16,538) (20,013) $(0.03) 0.01 (0.11) $(0.13) The Company's consolidated financial statements have been prepared... -

Page 30

.... The Company's inventories include high-technology components, embedded systems and computing technologies sold into rapidly changing, cyclical and competitive markets wherein such inventories may be subject to early technological obsolescence. The Company regularly evaluates inventories for excess... -

Page 31

... and Litigation From time to time, the Company may become liable with respect to pending and threatened litigation, tax, environmental and other matters. Management does not anticipate that any contingent matters will have a material adverse impact on the Company's financial condition, liquidity or... -

Page 32

...and other charges and exit-related costs accrued through purchase accounting. Cash Flows from Financing Activities During fiscal 2009, the Company utilized cash of $406.8 million related to net repayments of notes and bank credit facilities, $300 million of which related to the extinguishment of the... -

Page 33

... bonds, short-term and long-term bank loans and an accounts receivable securitization program. For a detailed description of the Company's external financing arrangements outstanding at June 27, 2009, refer to Note 7 to the consolidated financial statements appearing in Item 15 of this Report. The... -

Page 34

... in Europe, Asia and Canada. Avnet generally guarantees its subsidiaries' debt under these facilities. Covenants and Conditions The Securitization Program discussed previously requires the Company to maintain certain minimum interest coverage and leverage ratios as defined in the Credit Agreement... -

Page 35

...Long-term debt, including amounts due within one year (1) $972.2 Operating leases $265.3 (1) Excludes discount on long-term notes. $ $ 23.3 77.2 $ 3.1 $ 102.1 $ 395.5 $ 54.5 $ 550.3 $ 31.5 At June 27, 2009, the Company had a liability for income tax contingencies (or unrecognized tax benefits... -

Page 36

... the scheduled maturities of the Company's debt outstanding at June 27, 2009 (dollars in millions): 2010 2011 2012 Fiscal Year 2013 2014 Thereafter Total Liabilities: Fixed rate debt(1) Floating rate debt (1) Excludes discounts on long-term notes. $ 2.1 $21.2 $1.9 $- $1.2 $- $ 1.1 $93.2 $301... -

Page 37

... of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate. Management conducted an evaluation of the effectiveness of the Company's internal control over financial reporting as of June 27, 2009. In making this assessment, management used the framework... -

Page 38

...on November 5, 2009. Item 11. Executive Compensation The information called for by Item 11 is incorporated in this Report by reference to the Company's definitive proxy statement relating to the Annual Meeting of Stockholders anticipated to be held on November 5, 2009. Item 12. Security Ownership of... -

Page 39

... a. The following documents are filed as part of this Report: Page 1. 2. 3. Consolidated Financial Statements: Report of Independent Registered Public Accounting Firm Avnet, Inc. and Subsidiaries Consolidated Financial Statements: Consolidated Balance Sheets at June 27, 2009, and June 28, 2008... -

Page 40

... or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized. AVNET, INC. (Registrant) By: /s/ ROY VALLEE Roy Vallee, Chairman of the Board, Chief Executive Officer and Director KNOW ALL MEN BY... -

Page 41

Table of Contents Signature Title /s/ GARY L. TOOKER Gary L. Tooker /s/ RAYMOND SADOWSKI Raymond Sadowski Director Senior Vice President, Chief Financial Officer and Principal Accounting Officer 38 -

Page 42

... designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company's internal control over financial reporting includes those policies... -

Page 43

... 2009, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. As discussed in Note 9 to the consolidated financial statements, on July 1, 2007, the Company adopted the provisions of Financial Accounting... -

Page 44

...' EQUITY Current liabilities: Borrowings due within one year (Note 7) Accounts payable Accrued expenses and other (Note 8) Total current liabilities Long-term debt, less due within one year (Note 7) Other long-term liabilities (Note 9 and 10) Total liabilities Commitments and contingencies... -

Page 45

..., 2009 2008 2007 (Thousands, except per share amounts) Sales Cost of sales Gross profit Selling...expense Gain on sale of assets (Note 2 and 5) Debt extinguishment costs (Note 7) Income (loss) before income taxes Income tax provision (Note 9)... 149,613 See notes to consolidated financial statements 42 -

Page 46

...of $16,767 (Notes 4, 10 and 15) Comprehensive loss (Note 4) Stock option and incentive programs, including related tax benefits of $653 Balance, June 27, 2009 146,667 $1,010,336 $ 1,487,575 $ 186,876 $ (271) $ 2,831,183 ...218,094 $ (931) $ 2,760,857 See notes to consolidated financial statements 43 -

Page 47

... and amortization Deferred income taxes (Note 9) Stock-based compensation (Note 12) Impairment charges (Note 6) Gain on sale of assets, net (Note 2 and 5) Other, net (Note 15) Changes in (net of effects from business acquisitions): Receivables Inventories Accounts payable Accrued expenses and other... -

Page 48

...- Goodwill represents the excess of the purchase price over the fair value of net assets acquired. Annual tests for goodwill impairment are performed by applying a fair-value based test to Avnet's reporting units, defined as each of the three regional businesses, which are the Americas, EMEA (Europe... -

Page 49

... the fourth quarter of fiscal 2009. The non-cash charge had no impact on the Company's compliance with debt covenants, its cash flows or available liquidity, but did have a material impact on its consolidated financial statements. The Company's annual impairment tests in fiscal 2008 and 2007 yielded... -

Page 50

... with no associated cost of sales. During the third quarter of fiscal 2007, in conjunction with the acquisition of Access (see Note 2) and reflecting recent industry trends, the Company reviewed its method of recording revenue related to the sales of supplier service contracts and determined that... -

Page 51

.... The carrying amounts of the Company's financial instruments, including cash and cash equivalents, receivables and accounts payable approximate their fair values at June 27, 2009 due to the short-term nature of these instruments. As at June 27, 2009, the Company had $463,403,000 of cash equivalents... -

Page 52

... about fair value of financial instruments in interim financial statements in order to provide more timely information about the effects of current market conditions on financial instruments. FSP 107-1, 28-1 is effective beginning the Company's first interim period of fiscal 2010. The adoption of... -

Page 53

... operations based upon the Company's level of acquisition activity. In December 2007, the FASB issued SFAS No. 160 Non-controlling Interests in Consolidated Financial Statements - an amendment to ARB No. 51 ("SFAS 160"). SFAS 160 will change the accounting and reporting for minority interests, which... -

Page 54

... the fiscal fourth quarter), the Company acquired UK-based Azzurri Technology Ltd., a design-in distributor of semiconductor and embedded systems products which had annual revenues of approximately $100 million. The acquisition is reported as part of the EM EMEA reporting unit. On December 31, 2007... -

Page 55

... acquisition of Access Distribution ("Access"), a leading value-added distributor of complex computing solutions, which had sales of approximately $1.90 billion in calendar year 2006. The purchase price of $437,554,000 was funded primarily with debt plus cash on hand. The Access business is reported... -

Page 56

... related primarily to facility exit costs and other contractual lease obligations which are expected to be substantially utilized by the end of fiscal 2013. 3. Accounts receivable securitization The Company has an accounts receivable securitization program (the "Program") with a group of financial... -

Page 57

... basis. Due to local tax allowances, the gain on the building sale was not taxable. 6. Goodwill and intangible assets The following table presents the carrying amount of goodwill, by reportable segment, for the periods presented: Electronics Marketing Technology Solutions Total Carrying value at... -

Page 58

... pre- and after tax and $0.41 per share recognized in the fourth quarter, $41,433,000 related to the recently acquired business in Japan, which was assigned to the EM Asia reporting unit. Accounting standards require goodwill from an acquisition to be assigned to a reporting unit and also requires... -

Page 59

... on comparable terms, except for an increase in facility and borrowing costs to reflect current market conditions; however, the increase will not have a material impact on the Company's consolidated financial statements. There were no amounts outstanding under the Program at June 27, 2009 or June... -

Page 60

...-term debt" in the consolidated financial statements. In addition, there were $1,511,000 in letters of credit issued under the Credit Agreement which represent a utilization of the Credit Agreement capacity but are not recorded in the consolidated balance sheet as the letters of credit are not debt... -

Page 61

Table of Contents AVNET, INC. AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Aggregate debt maturities for fiscal 2010 through 2014 and thereafter are as follows (in thousands): 2010 2011 2012 2013 2014 Thereafter Subtotal Discount on notes Total debt $ 23,294 1,893 1,169... -

Page 62

...Includes a benefit of 2.9% and 5.5% related to tax audit settlements in fiscal 2009 and 2008, respectively. Foreign tax rates generally consist of the impact of ... against the Company's otherwise realizable foreign loss carry-forwards. The change in the fiscal 2009 effective tax rate over prior... -

Page 63

... the standard, the Company reclassified $94,460,000 of income tax liabilities from current classification in "accrued expenses and other" on the consolidated balance sheet to long-term classification in "other long-term liabilities." The total amount of gross unrecognized tax benefits upon adoption... -

Page 64

... year 2002. The open years, by major jurisdiction, are as follows: Jurisdiction Fiscal Year United States (federal and state) Germany United Kingdom Netherlands Belgium Singapore Taiwan Hong Kong 2004 - 2009 2006 - 2009 2007 - 2009 2003 - 2009 1999 - 2009 2002 - 2009 2004 - 2009 2003 - 2009 61 -

Page 65

... to freeze future benefit accruals for compensation paid by the Company on or after July 1, 2009. The Plan was also amended to change the interest credit applied to participants' cash balances to comply with applicable regulations resulting in an unamortized prior service credit of $55,190,000 which... -

Page 66

... thereafter (in thousands): 2010 2011 2012 2013 2014 2015 through 2019 $ 22,720 17,263 17,497 19,788 20,091 103,351 The Plan's assets are held in trust and were allocated as follows as of the June 30 measurement date for fiscal 2009 and 2008: 2009 2008 Equity securities Debt securities 77% 23 77... -

Page 67

...as follows (in thousands): 2010 2011 2012 2013 2014 Thereafter Total 12. Stock-based compensation plans $ 77,168 57,750 44,331 33,977 20,523 31,546 $265,295 The Company measures all share-based payments, including grants of employee stock options, at fair value and recognizes related expense in the... -

Page 68

..., commencing with the first anniversary, and provide for a minimum exercise price of 100% of fair market value at the date of grant. Pre-tax compensation expense associated with stock options during fiscal 2009, 2008 and 2007 were $4,245,000, $6,155,000 and $8,356,000, respectively. The fair value... -

Page 69

...of June 27, 2009, there was $9,152,000 of total unrecognized compensation cost related to non-vested awards granted under the option ...employees, including Avnet's executive officers, may receive a portion of their long-term equity-based incentive compensation through the performance share program... -

Page 70

... 2009, 2008 and 2007, pre-tax compensation cost associated with the outside director stock bonus plan was $960,000, $780,000 and $638,000, respectively. Employee stock purchase plan The Company has an Employee Stock Purchase Plan ("ESPP") under the terms of which eligible employees of the Company... -

Page 71

... 15. Additional cash flow information Other non-cash and reconciling items consist of the following: June 27, 2009 Years Ended June 28, 2008 (Thousands) June 30, 2007 Provision for doubtful accounts Periodic pension costs (Note 10) Other, net Total 68 $32,777 10,166 (4,529) $38,414 $12,315 11,265... -

Page 72

...and procure electronic components throughout the lifecycle of their technology products and systems, including supply-chain management, engineering design, inventory replenishment systems, connector and cable assembly and semiconductor programming. TS markets and sells mid- to high-end servers, data... -

Page 73

...: Electronics Marketing Technology Solutions Corporate Capital expenditures: Electronics Marketing Technology Solutions Corporate Depreciation & amortization expense: Electronics Marketing Technology Solutions Corporate Sales, by geographic area, are as follows: Americas(2) EMEA(3) Asia/Pacific... -

Page 74

...-tax, $65,310,000 after tax and $0.43 per share during fiscal 2009 related to the cost reductions as well as integration costs associated with recently acquired businesses. The Company also recorded a reversal of $2,514,000 severance, lease and other reserves that were deemed excessive and credited... -

Page 75

...all three regions of both operating groups with employee reductions of approximately 1,400 in EM, 400 in TS and the remaining from centralized support functions. Exit costs for vacated facilities related to 29 facilities in the Americas, 13 in EMEA and three in Asia/Pac. Other charges included fixed... -

Page 76

... sales functions in connection with the cost reductions implemented during the second half of the fiscal year. Personnel reductions consisted of 100 employees in all three regions of EM and over 250 in the Americas and EMEA regions of TS. The facility exit charges related to five office facilities... -

Page 77

... Avnet-owned building in EMEA and Access integration costs. The write-down of the building was based on management's estimate of the current market value and possible selling price, net of selling costs, for the property. The integration costs related to incremental salary costs, primarily of Access... -

Page 78

...NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) As of June 27, 2009, the remaining FY 2007 reserves related to severance which management expects to utilize by the end of 2010. The remaining Memec FY 2006 reserves related to facility exit costs, which management expects to utilize by fiscal... -

Page 79

... paid to a former executive of an acquired company, environmental costs of $3.0 million pre-tax, $1.8 million after tax and $0.01 per share on a diluted basis associated with long outstanding environmental matters, the gain on sale of the Company's investment in Calence LLC in the fourth quarter... -

Page 80

... Additions Charged to Charged to Costs and Other Accounts - Expenses Describe (Thousands) Column D Column E Balance at End of Period Description Deductions - Describe Fiscal 2009 Allowance for doubtful accounts $ 76,690 $ 32,777 $ Valuation allowance on foreign tax loss carryforwards (Note 9) 344... -

Page 81

... 2034. (incorporated herein by reference to the Company's Current Report on Form 8-K dated March 8, 2004, Exhibit 4.2). Officers' Certificate dated August 19, 2005, establishing the terms of the 6.00% Notes due 2015. (incorporated herein by reference to the Company's Current Report on Form 8-K dated... -

Page 82

...for non-employee director (c) Form of incentive stock option agreement (d) Form of performance stock unit term sheet (incorporated by reference to the Company's Current Report on Form 8-K dated August 29, 2006, Exhibit 10.3). Avnet, Inc. 2006 Stock Compensation Plan (incorporated by reference to the... -

Page 83

... Receivables Purchase Agreement dated as of February 6, 2002 among Avnet Receivables Corporation, as Seller, Avnet, Inc., as Servicer, the Companies, as defined therein, the Financial Institutions, as defined therein, and Bank One, NA (Main Office Chicago) as Agent (incorporated herein by reference... -

Page 84

... 10.26 Securities Acquisition Agreement, dated April 26, 2005, by and among Avnet, Inc. and the sellers named therein and Memec Group Holdings Limited. (incorporated herein by reference to the Company's Current Report on Form 8-K dated April 26, 2005, Exhibit 2.1). 10.27 Stock and Asset Purchase... -

Page 85

... Exhibit Number Exhibit 21.** List of subsidiaries of the Company as of June 27, 2009. 23.1** Consent of KPMG LLP. 31.1** Certification by Roy Vallee, Chief Executive Officer, under Section 302 of the Sarbanes-Oxley Act of 2002. 31.2** Certification by Raymond Sadowski, Chief Financial Officer... -

Page 86

... a Delaware corporation (" Seller "), Avnet, Inc., a New York corporation (" Avnet "), as initial Servicer (the Servicer together with Seller, the " Seller Parties " and each a " Seller Party "), each Financial Institution signatory hereto (collectively, the " Financial Institutions "), each Company... -

Page 87

... be demanded at any time without regard to the timing of issuance of any financial statement by any Company or by any Affected Entity. (b) For purposes of this Section 10.5, the following terms shall have the following meanings: " Accounting Based Consolidation Event " means the consolidation, for... -

Page 88

... Entity " means (i) any Financial Institution, (ii) any insurance company, bank or other funding entity providing liquidity, credit enhancement or back-up purchase support or facilities to any Company, (iii) any agent, administrator or manager of any Company, or (iv) any bank holding company in... -

Page 89

...or to the "Purchase Agreement" shall mean the Purchase Agreement as amended hereby. This Amendment shall be construed in connection with and as part of the Purchase Agreement and all terms, conditions, representations, warranties, covenants and agreements set forth in the Purchase Agreement and each... -

Page 90

...by merger to Bank One, NA (Main Office Chicago)), in its capacity as a party to any applicable Funding Agreement with or for the benefit of Chariot Funding LLC (successor to Preferred Receivables Funding Company LLC) (" Chariot "), hereby (i) consents to Chariot's execution of this Amendment and the... -

Page 91

...CORPORATION, as Seller By: Name: Title: AVNET, INC., as Servicer By: Name: Title: CHARIOT FUNDING LLC (successor to Preferred Receivables Funding Company LLC), as a Company By: Its: By: Name: Title: JPMORGAN CHASE BANK, N.A. (successor by merger to Bank One, NA (Main Office Chicago)), as a Financial... -

Page 92

LIBERTY STREET FUNDING CORP., as a Company By: Name: Title: THE BANK OF NOVA SCOTIA, as a Financial Institution By: Name: Title: AMENDMENT NO. 12 TO AMENDED AND RESTATED RECEIVABLES PURCHASE AGREEMENT -

Page 93

AMSTERDAM FUNDING CORPORATION, as a Company By: Name: Title: ABN AMRO BANK N.V., as a Financial Institution By: Name: Title: By: Name: Title: AMENDMENT NO. 12 TO AMENDED AND RESTATED RECEIVABLES PURCHASE AGREEMENT -

Page 94

STARBIRD FUNDING CORPORATION, as a Company By: Name: Title: BNP PARIBAS, acting through its New York Branch, as a Financial Institution By: Name: Title: By: Name: Title: AMENDMENT NO. 12 TO AMENDED AND RESTATED RECEIVABLES PURCHASE AGREEMENT -

Page 95

... a Delaware corporation (" Seller "), Avnet, Inc., a New York corporation (" Avnet "), as initial Servicer (the Servicer together with Seller, the " Seller Parties " and each a " Seller Party "), each Financial Institution signatory hereto (collectively, the " Financial Institutions "), each Company... -

Page 96

... by reference into, the Purchase Agreement. Section 2. Amendment . Subject to the terms and conditions set forth herein, the Purchase Agreement is hereby amended by amending the definition of "Loss Percentage" appearing in Exhibit I thereto by deleting in its entirety the phrase "means at any time... -

Page 97

... of the Purchase Agreement and all terms, conditions, representations, warranties, covenants and agreements set forth in the Purchase Agreement and each other instrument or agreement referred to therein, except as herein amended, are hereby ratified and confirmed and shall remain in full force and... -

Page 98

(Signature Pages Follow) AMENDMENT NO. 13 TO AMENDED AND RESTATED RECEIVABLES PURCHASE AGREEMENT 4 -

Page 99

... officers as of the date first written above. AVNET RECEIVABLES CORPORATION, as Seller By: Name: Raymond Sadowski Title: President AVNET, INC., as Servicer By: Name: David R. Birk Title: Sr. Vice President CHARIOT FUNDING LLC (successor to Preferred Receivables Funding Company LLC), as a Company... -

Page 100

LIBERTY STREET FUNDING LLC (successor to Liberty Street Funding Corp.), as a Company By: Name: Title: THE BANK OF NOVA SCOTIA, as a Financial Institution By: Name: Title: AMENDMENT NO. 13 TO AMENDED AND RESTATED RECEIVABLES PURCHASE AGREEMENT -

Page 101

AMSTERDAM FUNDING CORPORATION, as a Company By: Name: Title: ABN AMRO BANK N.V., as a Financial Institution By: Name: Title: By: Name: Title: AMENDMENT NO. 13 TO AMENDED AND RESTATED RECEIVABLES PURCHASE AGREEMENT -

Page 102

STARBIRD FUNDING CORPORATION, as a Company By: Name: Title: BNP PARIBAS, acting through its New York Branch, as a Financial Institution By: Name: Title: By: Name: Title: AMENDMENT NO. 13 TO AMENDED AND RESTATED RECEIVABLES PURCHASE AGREEMENT -

Page 103

...2009 June 28, 2008 Fiscal Year Ended June 30, 2007 (in thousands) July 1, 2006 July 2, 2005 Earnings: Income (loss) from continuing operations before income taxes... Add fixed charges Total earnings (loss) Fixed charges: Interest on indebtedness Amortization of debt expense Interest... -

Page 104

... England England Norway Ireland Delaware England Hong Kong Australia United Kingdom New Zealand China Hong Kong Switzerland Germany Singapore Israel Singapore Malaysia Netherlands Germany Israel United Kingdom Mexico Puerto Rico Delaware Delaware Brazil Australia Poland Switzerland Austria France... -

Page 105

... Avnet Sunrise Limited Avnet Technology (Thailand) Ltd. Germany Belgium Netherlands France Netherlands Germany South Africa Australia United Kingdom Delaware Spain India Canada Delaware Italy Japan South Africa Korea, Republic of Ireland China Belgium Brazil Germany Arizona Singapore Texas Malaysia... -

Page 106

...Hungary United Kingdom Singapore Italy Romania Slovakia Turkey France Germany France Germany Delaware Hong Kong United Kingdom Ireland New York France England England Netherlands England Germany Denmark Greece France Germany Hungary Hong Kong Russia Estonia Italy Romania Slovakia France Poland Spain... -

Page 107

... Electronics (Shanghai) Limited YEL Electronics (Shenzhen) Ltd Turkey Ukraine Slovenia Germany Germany Austria England South Africa United Kingdom Mexico Germany England and Wales England United Kingdom Northern Ireland Ireland Ireland England Mexico Delaware Hong Kong United Kingdom United Kingdom... -

Page 108

Company Name Jurisdiction YEL Electronics Hong Kong Limited YEL Electronics Pte Ltd YEL Electronics Sdn Bhd YEL Korea (HK) Limited ZWEITE TENVA Property GmbH Im Technologiepark Hong Kong Singapore Malaysia Hong Kong Germany -

Page 109

... the years in the three-year period ended June 27, 2009, the related financial statement schedule, and the effectiveness of internal control over financial reporting as of June 27, 2009, which report appears in the June 27, 2009 annual report on Form 10-K of Avnet, Inc. As discussed in note 9 to the... -

Page 110

..., summarize and report financial information; and any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. b. Date: August 25, 2009 /s/ ROY VALLEE Roy Vallee Chief Executive Officer -

Page 111

... and report financial information; and any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. b. Date: August 25, 2009 /s/ RAYMOND SADOWSKI Raymond Sadowski Chief Financial Officer -

Page 112

..., of the Securities Exchange Act of 1934; and The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. Date: August 25, 2009 /s/ ROY VALLEE Roy Vallee Chief Executive Officer A signed original of this... -

Page 113

..., of the Securities Exchange Act of 1934; and The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. Date: August 25, 2009 /s/ RAYMOND SADOWSKI Raymond Sadowski Chief Financial Officer A signed original of...