Avnet 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 Avnet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

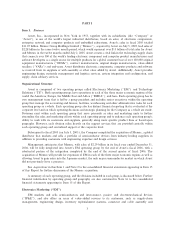

* Income amounts are from continuing operations and net assets from discontinued operations have been

classified as current assets. All amounts for fiscal 2001 have been restated for the acquisition of Kent

Electronics Corporation, which was completed in June 2001 and has been accounted for using the

""pooling-of-interests'' method.

(a) Includes the impact of restructuring and other charges recorded in both the first and second quarters of

fiscal 2004 in connection with cost cutting initiatives and the combination of the Computer Marketing

(""CM'') and Applied Computing (""AC'') operating groups into one operating group now called

Technology Solutions. These charges amounted to $55.6 million (all of which was included in operating

expenses), $38.6 million after-tax and $0.32 per share on a diluted basis. Fiscal 2004 results also include

the impact of debt extinguishment costs associated with the Company's cash tender offer completed

during the third quarter of fiscal 2004 for $273.4 million of the 7

7

/

8

% Notes due February 15, 2005. These

debt extinguishment costs amounted to $16.4 million pre-tax, $14.2 million after-tax and $0.12 per share

on a diluted basis. The total impact of these charges recorded in fiscal 2004 amounted to $72.0 million

pre-tax, $52.8 million after-tax and $0.44 per share on a diluted basis.

(b) Includes the impact of restructuring and other charges related to certain cost cutting initiatives instituted

during fiscal 2003, including severance costs, charges for consolidation of facilities and write-offs of

certain capitalized IT-related initiatives. These charges totaled $106.8 million pre-tax (all of which was

included in operating expenses), $65.7 million after-tax and $0.55 per share on a diluted basis. Fiscal

2003 results also include the impact of debt extinguishment costs associated with the Company's cash

tender offers and repurchases completed during the third quarter of fiscal 2003 for $159.0 million of its

6.45% Notes due August 15, 2003 and $220.1 million of its 8.20% Notes due October 17, 2003. These

debt extinguishment costs amounted to $13.5 million pre-tax, $8.2 million after tax and $0.07 per share

on a diluted basis. The total impact of the charges recorded in fiscal 2003 amounted to $120.3 million

pre-tax, $73.9 million after-tax and $0.62 per share on a diluted basis.

(c) Includes the impact of integration charges related to the write-down of certain assets acquired in the

fiscal 2001 acquisition of Kent, net of certain recoveries of previous write-downs and reserves, and other

restructuring charges taken in response to business conditions, including an impairment charge to write-

down certain investments in unconsolidated Internet-related businesses to their fair value and severance

charges for workforce reductions announced during the fourth quarter of fiscal 2002. The net restructur-

ing and integration charges amounted to $79.6 million pre-tax ($21.6 million included in cost of sales and

$58.0 million included in operating expenses), $62.1 million after- tax and $0.52 per share on a diluted

basis.

(d) The fiscal 2002 selected financial data excludes the impact of the Company's adoption of the Financial

Accounting Standards Board's Statement of Financial Accounting Standards No. 142 (""SFAS 142''),

Goodwill and Other Intangible Assets, on June 30, 2001, the first day of the Company's fiscal 2002.

SFAS 142, which requires that ratable amortization of goodwill, be replaced with periodic tests for

goodwill impairment, resulted in a transition impairment charge recorded by the Company of $580.5 mil-

lion, or $4.90 per share on a diluted basis for the year. This charge is reflected as a cumulative change in

accounting principle in the consolidated statements of operations.

(e) Includes the impact of charges related to the acquisition and integration of Kent, which was accounted

for as a ""pooling-of-interests,'' and other integration, reorganization and cost cutting initiatives taken in

response to business conditions. The charges amounted to $327.5 million pre-tax ($80.6 million included

in cost of sales and $246.9 million included in operating expenses), $236.7 million after-tax and $1.99 per

share on a diluted basis.

13