Atmos Energy 2005 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2005 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 3

f i n a n c i a l h i g h l i g h t s l e t t e r t o s h a r e h o l d e r s

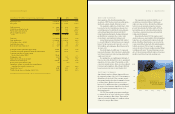

YEARENDEDSEPTEMBER30(Dollarsinthousands,exceptpersharedata) 2 0 0 5 2 0 0 4 C h a n g e

Operatingrevenues $4,973,326 $ 2,920,037 70.3%

Grossprofit $1,129,090 $ 562,191 100.8%

Utilitynetincome $81,117 $ 63,096 28.6%

Naturalgasmarketingnetincome 23,404 16,633 40.7%

Pipelineandstoragenetincome 30,599 2,767 1,005.9%

Othernonutilitynetincome 665 3,731 -82.2%

Total $135,785 $ 86,227 57.5%

Totalassets $5,653,527 $ 2,912,627 94.1%

Totalcapitalization* $3,785,526 $ 1,994,770 89.8%

Netincomepershare–diluted $1.72 $ 1.58 8.9%

Cashdividendspershare $1.24 $ 1.22 1.6%

Bookvaluepershareatendofyear $19.90 $ 18.05 10.2%

Consolidatedutilitysegmentthroughput(MMcf) 411,134 246,033 67.1%

Consolidatednaturalgasmarketingsegmentthroughput(MMcf) 238,097 222,572 7.0%

Consolidatedpipelineandstoragesegment

transportationvolumes(MMcf) 375,604 — —

Heatingdegreedays 2,587 3,271 -20.9%

Degreedaysasapercentageofnormal 89% 96% -7.3%

Metersinserviceatendofyear 3,157,840 1,679,136 88.1%

Returnonaverageshareholders’equity 9.0% 9.1% -1.1%

Shareholders’equityasapercentageoftotalcapitalization

(includingshort-termdebt)atendofyear 40.7% 56.7% -28.2%

Shareholdersofrecord 26,242 27,555 -4.8%

Weightedaveragesharesoutstanding–diluted(000s) 79,012 54,416 45.2%

*Totalcapitalizationrepresentsthesumofshareholders’equityandlong-termdebt(excludingcurrentmaturities).

D E A R F E L L O W S H A R E H O L D E R :

Ouracquisitionofthedistributionandpipeline

operationsofTXUGashascreatedapowerfulunion—

whichisthesubjectofmuchofthisyear’sreport.

Theacquisition,whichclosedonOctober1,2004,

hasexceededourbestexpectations,asmeasuredon

severaldimensions.ItcontributedtoAtmosEnergy’s

extraordinaryfinancialresultsinfiscal2005.It

transformedAtmosEnergyintothelargestall-natural-

gasdistributioncompanyinthecountry,andit

createdmajoropportunitiesforfuturegrowth.

AtmosEnergy’sgrossprofitinfiscal2005doubled

toexceed$1billionforthefirsttimeinourcompany’s

history.Netincomeincreased58percenttoarecord

$135.8million,andearningsperdilutedsharegrewby

14centsto$1.72.

Fiscal2005markedourfifthyearofconsistently

improvedperformance.Ourtotalreturntoshareholders

was17.2percent,andourreturnonaverageshareholders’

equitywas9.0percent.

Recognizingtheseaccomplishments,theBoardof

Directorsraisedthedividendby2centstoanindicated

annualrateof$1.26pershare.Thismarkedour18th

consecutiveannualincrease.Moreover,whenadjusted

formergersandacquisitions,AtmosEnergy’sdividend

hasgoneupeveryyearsinceitwasformedin1983.

E X C E P T I O N A L P E R F O R M A N C E

AtmosEnergy’semployeesdidmorethanjustdeliveron

thecompany’spromiseof$1.65to$1.75inearningsper

dilutedshareforfiscal2005.Theyovercamewarmer-

than-normalweatherthatreducedearningsby29cents

perdilutedshare,dilutionfromayear-over-year

increaseof24.6millionmoresharesoutstandingand

theravagesoftwohurricanesthataffectedtwo-thirds

ofourLouisianaoperationsandaportionofour

Mississippiterritory.

TheTXUGasacquisitionwasamajorcontributor

toearnings.Itwasaccretiveinthefirstyear—adding

18centstoearningsperdilutedshare.Thatresultfar

surpassedouroriginalestimateofacontributionfrom

5centsto10centsperdilutedshare.

Theacquisitionhasnearlydoubledthesizeof

ourutilityoperationsbyadding1.5milliongas

utilitycustomersinTexas.Overall,theadditional

territoryexceedsnationalaveragesforcustomer

growth.Inparticular,theDallasandFortWorth

metropolitanareasaswellasthenorthernsuburbs

ofAustinareexperiencingstrongresidentialand

commercialdevelopment.

IntegratingtheformerTXUGasemployeesand

operationshasgoneexceptionallywell.Ourintegration

teamshaveexceededgoalsandcompletedworkwell

aheadofdeadlines.Inparticular,weareproudofthe

conversionofalltheformerback-officeandinformation

technologysystems.Wenolongerareusingany

outsourcedservicesformeterreading,customerbilling

ortelephonecallcenters.Weexpectthatusingourown

state-of-the-artsystemswillleadtoimprovedcustomer

satisfactionandlowerlong-termoperatingcosts.

$1.72

$1.58

$1.54

$1.47 $1.45

$1.80

1.50

1.20

0.90

0.60

2001 2002 2003 2004 2005

E a r n i n g s R e v i e w

Netincomeperdilutedshare