Atari 2009 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2009 Atari annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL FINANCIAL REPORT – REGISTRATION DOCUMENT

16

manufacturers have exclusive rights. Its exposure is limited, however, by the fact that manufacturing facilities generally

have a dual structure.

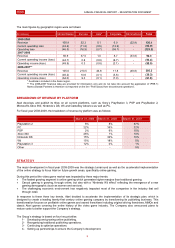

INSURANCE

The Group is insured worldwide against property damage, business interruption and civil and professional liability, and

insures its intellectual properties. It also purchases liability insurance for its corporate officers and directors. In general,

the Group's business does not expose it to any special or unusual risks, with the exception of the possible failure of a

supplier or the general recall of a game. Insurance purchased by the Group is complemented by local policies (in

particular in North America) that take into consideration the specific nature of the relevant market. The table below shows

current coverage provided under the main policies.

(€)

Property damage/Business interruption

Replacement value up to 19.9 million

Business liability

Ceiling of 10 million

Of which: Intellectual property liability

Ceiling of 5 million (excluding the United States)

Ceiling of 2 million (the United States)

Operating liability

Ceiling of 12 million

Liability of officers and directors

Ceiling of 20 million

During the fiscal year ended March 31, 2009, Atari paid a total of €590,000 in insurance premiums on the above policies

on its own behalf and on behalf of subsidiaries.

NON-RECURRING EVENTS AND LITIGATION

The main non-recurring events and litigation in fiscal year 2008-2009 were as follows:

The changes in the Board of Directors and senior management.

The Group‟s ongoing restructuring process.

The signing of a strategic distribution partnership with Namco Bandai Games Europe SAS in September 2008,

and the sale to Namco Bandai Games Europe SAS of 34% of its stake in the entity resulting from this

partnership, Namco Bandai Partners. In March 2009 the Company exercised its option to sell the remaining

66% stake and the transaction was completed in early July 2009.

The creation of a new in-house studio in London to develop online games announced in September 2008.

The acquisition in October 2008 of the Atari Inc. shares not yet held by the Company.

The acquisition in December 2008 of the development studio Cryptic Studios Inc.

The issue of bonds redeemable in new or existing shares and subscription warrants in January 2009.

The public exchange offer finalized in February 2009.

In the ordinary course of business, Group entities may be involved in various court, arbitration, administrative and tax

proceedings. The settlement of these proceedings is not expected to have a material impact on the Company‟s financial

statements.

The material legal risks to which the Group is exposed are described in this Registration Document, in the “Legal risks”

section of “Information on management and the financial statements”.

HUM AN RESOURCES AN D PERSONNEL

Over the past three fiscal years, the Group‟s average headcount was as follows:

Fiscal year 2006-2007:

Average headcount: 719.

As of March 31, 2007, the Group had an aggregate headcount of 604.

Fiscal year 2007-2008:

Average headcount: 596.

As of March 31, 2008, the Group had an aggregate headcount of 555.

Fiscal year 2008-2009:

Average headcount: 595.

As of March 31, 2009, the Group‟s headcount was 387 for continuing operations and 679 for discontinued operations and

continuing operations.

AGREEMENT ON WORKING HOURS

An agreement on the 35-hour working week was signed in July 2000 for French employees, who ratified it in September

of that year thereby bringing it into effect in October 2000. The agreement provides employees with 12 days of additional

“working hour reduction” paid leave, flextime for non-supervisory and certain supervisors, as well as an agreement on

annual time allowances for other executives.