Assurant 2015 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2015 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 Assurant Annual Report | 7

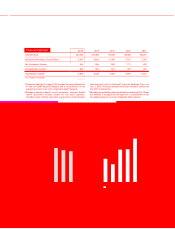

Non-GAAP Financial Measures

Assurant uses the following non-GAAP nancial measures to analyze the Company’s operating performance

for the periods presented in this report. Because Assurant’s calculation of these measures may differ from

similar measures used by other companies, investors should be careful when comparing Assurant’s non-GAAP

nancial measures to those of other companies.

(1) Assurant uses net operating income as an important measure of the Company’s operating performance. As

shown in the following reconciliation table, net operating income equals net income, excluding Assurant

Health runoff operations, net realized gains (losses) on investments and other unusual and/or infrequent

items. The Company believes net operating income provides investors a valuable measure of the

performance of the Company’s ongoing business, because it excludes both the effect of net realized gains

(losses) on investments that tend to be highly variable from period to period, and those events that are

unusual and/or unlikely to recur.

2015

2014 2013 2012 2011

Assurant Solutions $197.2

$218.9 $125.2 $123.8 $136.1

Assurant Specialty Property

307.7 341.8 423.6

305.0

303.7

Assurant Employee Benets

47.3 48.7

34.6 58.1

43.1

Corporate and other

(70.4) (67.7)

(82.9) (62.4)

(60.0)

Amortization of deferred gain on disposal of

businesses

8.4 (1.0)

10.6 12.0

13.3

Interest expense

(35.8) (37.9)

(50.5) (39.2)

(39.2)

Net operating income

454.4 502.8

460.6 397.3

397.0

Adjustments:

Assurant Health runoff operations

(367.9) (63.7)

5.9 52.0

40.9

Net realized gains on investments

20.8 39.4

22.4 41.8

21.1

Change in tax valuation allowance

- -

- -

80.0

Gain (loss) on divested business

10.7 (19.4)

- -

-

Change in tax liabilities

16.0 14.0

- (7.4)

-

Payment received related to previous sale

of subsidiary

9.9 -

- -

-

Change in derivative investment

(2.3)

(2.2) - -

-

Net income

$141.6 $470.9 $488.9 $483.7 $539.0

(dollars in millions, net of tax)