Assurant 2015 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2015 Assurant annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ASSURANT, INC. – 2015 Form 10-K8

PART I

ITEM 1 Business

Products and Services

After a comprehensive review of strategic alternatives, the

Company decided to exit the health insurance market as

it focuses on its housing and lifestyle protection offerings�

Assurant began to wind down its major medical operations in

June 2015, and the Company expects to substantially complete

its exit of the health insurance market by the end of 2016.

Until we put Assurant Health in run-off in 2015, it competed in

the individual and small-group medical insurance markets by

offering major medical insurance, short-term medical insurance,

and supplemental coverage options to individuals and families.

Our products were offered with different plan options to meet

a broad range of customer needs, levels of affordability and to

meet the requirements of the Patient Protection and Affordable

Care Act and the Health Care and Education Reconciliation Act

of 2010, and the rules and regulations thereunder (together, the

“Affordable Care Act”)� Assurant Health also offered medical

insurance to small employer groups�

Individual Medical

Assurant Health provided medical insurance products to

individuals, primarily between the ages of 18 and 64, and

their families, who did not have employer-sponsored coverage.

We offered a wide variety of benet plans at different price

points, which allow customers to tailor their coverage to

t their unique needs. These plans include those with the

essential health benets required under the Affordable Care

Act, as well as supplemental products.

Small Employer Group Medical

Assurant Health provided group medical insurance to small

companies with two to fty employees, although larger

employer coverage is available. We offered fully insured

products with the essential health benets required by the

Affordable Care Act, as well as self-funded employer options

and individual products sold through the workplace.

On October 1, 2015, we sold our supplemental and small-

group self funded lines of business and certain assets to

National General Holdings Corp. (“National General”) for

cash consideration of $14,000�

In March 2012, we entered into a new provider network

arrangement with Aetna Signature Administrators

®

(“Aetna”)�

This multi-year agreement provides our major medical

customers with access to more than one million health care

providers and 7,500 hospitals nationwide.

Marketing and Distribution

Until we put Assurant Health in run-off in 2015, our health

insurance products were principally marketed through a

network of independent agents. We also marketed through

a variety of exclusive and non-exclusive national account

relationships and direct distribution channels�

Underwriting and Risk Management

Following the passage of the Affordable Care Act, many of the

traditional risk management techniques used to manage the

risks of providing health insurance have become less relevant.

Assurant Health took steps to adjust its products, pricing and

business practices to comply with the new requirements.

Following the announcement of the Company’s decision

to exit the health insurance market, sales of new health

insurance policies have ended.

Please see “Management’s Discussion and Analysis — Assurant

Health” and “Risk Factors — Risks Related to our Industry

— Reform of the health insurance industry could materially

reduce the protability of certain of our businesses or render

them unprotable” for further details.

Assurant Employee Benets

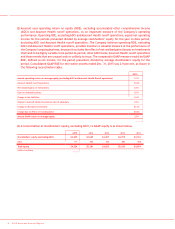

For the Years Ended

December 31, 2015

December 31, 2014

Net Earned Premiums:

Group disability $398,172 $ 409,028

Group dental 396,925 392,502

Group life 204,526 200,285

Group supplemental and vision products 67,131 49,910

TOTAL $ 1,066,754 $ 1,051,725

Voluntary $ 478,588 $ 441,479

Employer-paid and other 588,166 610,246

TOTAL $ 1,066,754 $ 1,051,725

Fees and other income $ 25,006 $ 24,204

Segment net income $ 47,322 $ 48,681

Loss ratio(1) 68.4% 68.2%

Expense ratio(2) 36.5% 37.1%

Equity(3) $ 532,332 $ 540,964

(1) The loss ratio is equal to policyholder benefits divided by net earned premiums.

(2) The expense ratio is equal to selling, underwriting and general expenses divided by net earned premiums and fees and other income.

(3) Equity excludes accumulated other comprehensive income.