Ameriprise 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 Ameriprise annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Ameriprise Financial, Inc. 2006 Annual Report 9

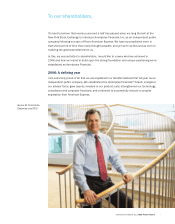

In 2006, we grew our mass affl uent and affl uent client base 10 percent. Our clients’ personal

relationships with their advisors are the cornerstone of our business, and our advisor force,

the third largest retail sales force among Securities Industry Association member fi rms, is

remarkably energized by our independence. By serving more mass affl uent clients and

developing deeper relationships with them, our advisors generated an 18 percent increase

in gross dealer concession, a measure of advisor productivity.

The bedrock of our client-advisor relationship is our commitment to providing comprehensive

fi nancial planning. We are a leader in planning, and we intend to grow this position by investing

signifi cant resources in new products and tools that will enable advisors to offer planning

to new clients more easily while serving existing clients more fully. One of these tools is

our Dream BookSM guide, which helps people identify their dreams and is the fi rst step in our

unique and collaborative Dream > Plan > Track >SM client experience — our approach to

fi nancial planning.

We help clients realize their dreams by providing an extensive product and service platform.

Advisors start with each client’s unique situation and, through the development of a fi nancial

plan, offer solutions — both from Ameriprise Financial and other companies — that address

cash management, savings, investing, income generation, protection and trust needs.

Investing in new products is a critical element of our strategy to grow client assets. In 2006,

we launched more than 40 asset management, insurance, annuity and banking products.

We also established Ameriprise Bank, FSB to better serve clients’ cash management,

borrowing and personal trust needs.

Our client-centered approach contributes to our ability to grow assets. With some help from

strong equity markets, we ended the year with $466 billion in owned, managed

and administered assets and $174 billion in life insurance in-force, both up 9 percent.

This growth also refl ected the impact of clients increasingly choosing fee-based relationships,

as evidenced by strong infl ows in investment advisory programs and variable annuities.

200620052004

$2,213

$1,879

$1,714

Gross Dealer Concession

(in millions)