Airtran 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On September 1, 2005, we closed the second PDP facility (“PDP-2”), pursuant to which we are entitled to draw amounts sufficient to fund all of our obligations to

make pre-delivery payments in respect of 12 B737 aircraft. Ten of such aircraft were delivered in 2006 and the remaining two are scheduled for delivery in the first

quarter of 2007. PDP-2 was entered into in conjunction with the September 2005 permanent facility for $354 million as described above. Drawings made under

PDP-2 bear interest at a floating rate per annum above the one-month U.S. Dollar LIBOR. PDP-2 is secured by certain rights under our purchase agreement with

the aircraft manufacturer for the 12 B737 aircraft. As of December 31, 2006 and 2005, $10.5 million and $57.2 million, respectively, is outstanding under PDP-2.

We expect to repay all outstanding amounts under PDP-2 during the first quarter of 2007.

On December 7, 2005, we closed the third PDP facility (“PDP-3”), pursuant to which we are entitled to draw amounts up to $65 million to fund a portion of our

obligations to make pre-delivery payments in respect of 19 B737 aircraft currently scheduled to be delivered in 2007 and 2008. Drawings made under PDP-3 bear

interest at a floating rate per annum above the one-month U.S. Dollar LIBOR. PDP-3 is secured by certain rights under our purchase agreement with the aircraft

manufacturer for the 19 B737 aircraft. As of December 31, 2006 and December 31, 2005, $38.8 million and $20.0 million, respectively, is outstanding under PDP-3.

On August 1, 2006, we entered into two separate facilities (“PDP-4 and PDP-5”), for purposes of financing our obligations to make pre-delivery payments on 14

B737 aircraft on order with an aircraft manufacturer. The PDP facilities entitle us to draw amounts up to approximately $30.3 million and $30.4 million, respectively,

to fund a portion of our obligations to make pre-delivery payments in respect of 14 B737 aircraft with delivery dates scheduled through 2008. Drawings made under

the PDP facilities bear interest at a floating rate per annum above the one-month U.S. Dollar LIBOR. As of December 31, 2006, $20.9 million was outstanding under

these facilities. We intend to make additional drawings under PDP-4 and PDP-5 for approximately $36.6 million, through November 2007, at which time the deposit

requirements for the 14 aircraft will have been met.

7% CONVERTIBLE NOTES :

In May 2003, Holdings completed a private placement of $125 million in convertible notes due in 2023. The proceeds were used to improve Holdings and Airways

overall liquidity by providing working capital and for general corporate purposes. The notes bear interest at 7 percent payable semi-annually on January 1 and

July 1. The notes are unsecured senior obligations ranking equally with Holdings’ existing unsecured senior indebtedness. The notes are unconditionally guaranteed

by Airways and rank equally with all unsecured obligations of Airways. The unsecured notes and the note guarantee are junior to any secured obligations of Holdings

or Airways to the extent of the collateral pledged and are also effectively subordinated to all liabilities of our subsidiaries (other than Airways).

The notes are convertible into shares of Holdings’ common stock at a conversion rate of 89.9281 shares per $1,000 in principal amount of the notes which equals

an initial conversion price of approximately $11.12 per share. This conversion rate is subject to adjustment in certain circumstances. Holdings may redeem the

notes, in whole or in part, beginning on July 5, 2010 at a redemption price equal to the principal amount of the notes plus any accrued and unpaid interest.

The holders of the notes may require Holdings to repurchase the notes on July 1, 2010, 2013 and 2018 at a repurchase price of 100 percent plus any accrued and

unpaid interest. Holdings filed a shelf registration statement with the U.S. Securities and Exchange Commission covering the resale of the notes and the underlying

common stock which became effective in October 2003. We may, at our option, elect to pay the repurchase price in cash, in shares of Holdings’ common stock or

in any combination of the two. Upon any such repurchase, it is our present intention to pay the repurchase price in cash.

LETTERS OF CREDIT :

As of December 31, 2006, $13.5 million of restricted cash on the accompanying consolidated balance sheet relates to outstanding letters of credit, primarily for

airport facilities.

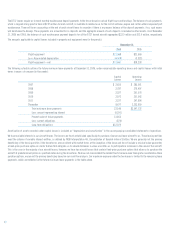

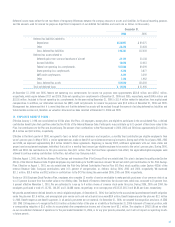

6. LEASES :

Total rental expense charged to operations for aircraft, facilities and office space for the years ended December 31, 2006, 2005 and 2004 was approximately

$287.5 million, $238.0 million and $187.1 million, respectively.

We lease 79 B717 aircraft through various lessors, under leases with terms that expire through 2022. We have the option to renew the B717 leases for periods

ranging from one to four years. The B717 leases have purchase options at or near the end of the lease term at fair market value, and two have purchase options

based on a stated percentage of the lessor’s defined cost of the aircraft at the end of the thirteenth year of the lease term. Each of the leases contains return

conditions that must be met prior to the termination of the leases. Forty-one of the B717 leases are the result of sale/leaseback transactions. Deferred gains from

these transactions are being amortized over the terms of the leases. At December 31, 2006 and 2005, unamortized deferred gains were $59.7 million and

$62.4 million, respectively. We also lease facilities from local airport authorities or other carriers, as well as office space under operating leases with terms

ranging up to 12 years. In addition, we lease spare engines and certain rotables under capital leases.

We lease 22 B737-700 aircraft through a single lessor, under leases with terms that expire through 2021. We have the option to extend the lease term for 12 months

up to 39 months. There are no purchase options. Each of the leases contains return conditions that must be met prior to the termination of the leases. During 2006,

the Company entered into a sales/leaseback with respect to one B737 spare engine that expires in 2022.

41