Airtran 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

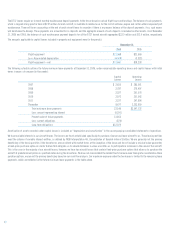

Accumulated

Additional Other Total

Common Stock Paid-in Unearned Comprehensive Accumulated Stockholders’

(In thousands)

Shares Amount Capital Compensation Loss Deficit Equity

Balance at January 1, 2004 84,209 $84 $337,145 $ — $ (271) $(34,745) $302,213

Net income — — — — — 10,103 10,103

Unrealized gain on derivative instruments — — — — 271 — 271

Total comprehensive income 10,374

Issuance of common stock for exercise

of options 2,292 2 9,717 — — — 9,719

Issuance of common stock under stock

purchase plan 116 1 1,255 — — — 1,256

Unearned compensation on common

stock issues — — 7,084 (7,084) — — —

Amortization of unearned compensation — — — 2,460 — 2,460

Tax benefit related to exercise of

nonqualified stock options — — 5,862 — — — 5,862

Balance at December 31, 2004 86,617 87 361,063 (4,624) — (24,642) 331,884

Net income — — — — — 8,076 8,076

Total comprehensive income 8,076

Issuance of common stock for exercise

of options 1,783 2 9,775 — — — 9,777

Issuance of common stock under stock

purchase plan 145 — 1,320 — — — 1,320

Unearned compensation on common

stock issues 246 — 2,917 (2,917) — — —

Tax benefit related to exercise of nonqualified

stock options and restricted stock — — 1,552 — — — 1,552

Amortization of unearned compensation — — — 3,513 — — 3,513

Balance at December 31, 2005 88,791 89 376,627 (4,028) — (16,566) 356,122

Net income — — — — — 15,514 15,514

Unrealized gain on derivative instruments,

net of $0 million deferred taxes —— — — 84 — 84

Total comprehensive income 15,598

Adjustment to initially apply SFAS 158,

net of $3.1 million deferred taxes — — — — (5,336) — (5,336)

Issuance of common stock for exercise

of options 951 1 5,952 — — — 5,953

Share-based compensation 305 — 4,443 — — — 4,443

Adjustment upon adoption of SFAS 123(R) — — (4,028) 4,028 — — —

Issuance of common stock for detachable

stock warrants 1,000 1 4,509 — — — 4,510

Issuance of common stock under employee

stock purchase plan 113 — 1,540 — — — 1,540

Balance at December 31, 2006 91,160 $91 $389,043 $ — $(5,252) $ (1,052) $382,830

See accompanying notes to consolidated financial statements.

33

AIRTRAN HOLDINGS, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY