Airtran 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

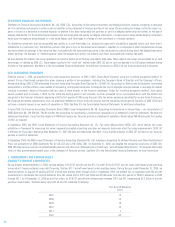

EMPLOYEES :

As of December 31, 2006, approximately 48.2 percent of our employees were represented by unions and of the employees represented by unions, none of those

agreements become amendable in 2007. The pilots’ agreement became amendable in 2005 and is currently in mediation. While there can be no assurance that our

generally good labor relations with our employees will continue we have established as a significant component of our business strategy the preservation of good

relations with our employees.

3. FINANCIAL INSTRUMENTS AND RISK MANAGEMENT :

Financial instruments that potentially subject us to significant concentrations of credit risk consist principally of cash and cash equivalents, short-term investment

and accounts receivable. We maintain cash and cash equivalents and short-term investments with various high-credit-quality financial institutions or in short-

duration, high-quality debt securities. Investments are stated at fair value, which approximates cost. We periodically evaluate the relative credit standing of those

financial institutions that are considered in our investment strategy. There were no material realized or unrealized gains or losses on our available-for-sale

securities for the years ended December 31, 2006, 2005 or 2004. We use specific identification of securities for determining gains and losses. Contractual

maturities of our available-for-sale securities at December 31, 2006 exceed 10 years while the auction re-set periods are 28 to 35 days. The balance of these

available-for-sale securities at December 31, 2006 and 2005 was approximately $151.1 million and $0.1 million, respectively.

The estimated fair value of other financial instruments, excluding debt, approximates their carrying amount. The fair values of long-term debt are based on quoted

market prices, if available, or are estimated using discounted cash flow analyses, based on current incremental borrowing rates for similar types of borrowing

arrangements. The carrying amounts and estimated fair values of long-term debt and capital leases were $811.1 million and $857.9 million, respectively, at

December 31, 2006, and $473.0 million and $536.6 million, respectively, at December 31, 2005.

The majority of our receivables result from the sale of tickets to individuals, mostly through the use of major credit cards. These receivables are short-term, generally

being settled shortly after sale.

CASH FLOW HEDGING :

During 2006, we entered into interest rate swap agreements that effectively convert a portion of our floating-rate debt to a fixed-rate basis for the next 12 years,

thus reducing the impact of interest-rate changes on future interest expense. Approximately 11.0 percent ($85.2 million) of our outstanding debt had its interest

payments designated as hedged forecasted transactions to interest rate swap agreements at December 31, 2006. Under these agreements, we pay fixed rates of

5.085 percent and 4.9875 percent and receive the London InterBank Offered Rate (LIBOR) every three months, expiring in 2018. The primary objective for our use

of interest rate hedges is to reduce the volatility of interest rates. We account for the interest rate hedges as cash flow hedges, as defined by SFAS 133. The fair

values of interest rate swap derivatives are included in other assets. As of December 31, 2006, the fair value of the interest rate swaps included in other assets is

$0.1 million. The effective portion of the gain or loss on the derivative instrument is reported as a component of other comprehensive income and reclassified into

earnings in the same line item associated with the forecasted transaction in the same period or periods during which the hedged transaction affects earnings (for

example, in “interest expense” when the hedged transactions are interest cash flows associated with floating-rate debt). During 2006 amounts reclassified into

earnings were not material.

FUEL RISK MANAGEMENT :

Efforts to reduce our exposure to increases in the price and availability of aviation fuel include the utilization of fuel purchase contracts involving both fixed-price

arrangements and cap arrangements. Fixed-price arrangements consist of an agreement to purchase defined quantities of aviation fuel from a third party at

defined prices. Cap arrangements consist of an agreement to purchase defined quantities of aviation fuel from a third party at a price not to exceed a defined price,

limiting our exposure to upside market risk. Because agreements are accounted for under the normal sales and use exception included in SFAS 133, these

agreements are not considered derivative financial instruments. As of December 31, 2006, utilizing forward fuel purchase contracts, we had committed to purchase

62.1 million gallons of aviation fuel at a weighted average price per gallon, excluding taxes and related fees, of $1.77 for 2007. This represents 16.2 percent of our

anticipated fuel needs for 2007, including delivery to our operations hub in Atlanta and other locations. As of February 14, 2007, the Company entered into additional

advanced fuel purchase contracts for 23.0 million gallons of aviation fuel. Combined, these contracts represent 23.2 percent of our anticipated fuel needs for 2007,

including delivery into our operations hub in Atlanta and other locations at a weighted average price per gallon, excluding fees and taxes, of $1.75. Additionally,

during the first quarter 2007, we entered into jet fuel swap contracts to hedge an additional 36.1 million gallons, or 9.8 percent of our 2007 projected fuel usage.

Such contracts will be accounted for as derivative financial instruments.

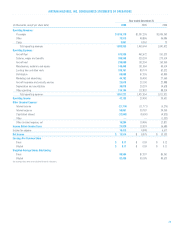

4. OTHER ASSETS AND ACCRUED AND OTHER LIABILITIES :

The components of other assets were (in thousands):

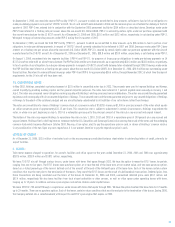

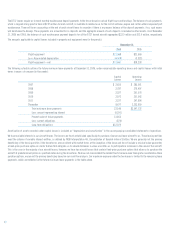

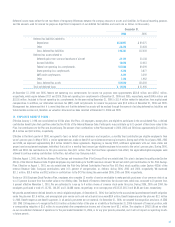

December 31,

2006 2005

Aircraft maintenance deposits $33,878 $12,873

Deposits 13,308 9,892

Other 3,790 3,325

Other assets $50,976 $26,090

38