Airtran 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

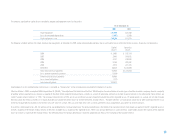

The weighted-average fair value of options granted during 2004 and 2003, with option prices less than the market price on the date of grant was $9.52 and $4.35, respectively.

During 2005 and 2004 we granted stock awards to our officers and key employees pursuant to our 2002 Long-Term Incentive Plan. Stock awards are grants that entitle the holder to shares of our common stock as

the award vests. The market value of the stock awards at the date of the grant is recorded as unearned compensation, a component of stockholders’ equity and is being charged on a straight-line basis to expense

over the respective vesting period. During 2005 and 2004 we granted approximately 320,000 and 650,000 stock awards, respectively, with a weighted average fair value of $9.11 and $10.91, respectively. We recorded

deferred compensation related to such awards of $2.9 million and $7. 1 million during 2005 and 2004, respectively. Approximately $3.5 million and $2.5 million of deferred compensation were amortized as compensation

expense during 2005 and 2004, respectively.

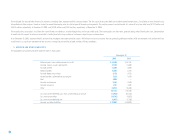

: : 11. INCOME TAXES : :

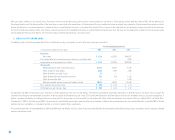

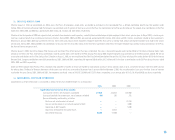

The components of the provision (benefit) for income taxes are as follows (in thousands):

For Year Ended December 31,

2005 2004 2003

Current provision (benefit):

Federal $ — $ — $ —

State —150 255

Total current provision (benefit) —150 255

Deferred provision:

Federal 1,878 4,368 (12,853)

State (678) 3,250 (755)

Total deferred provision 1,200 7,618 (13,608)

Provision (benefit) for income taxes $1,200 $7,768 $(13,353)

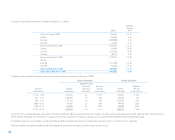

A reconciliation of taxes computed at the statutory federal tax rate on income before income taxes to the provision (benefit) for income taxes is as follows (in thousands):

For Year Ended December 31,

2005 2004 2003

Tax computed at federal statutory rate $ 1,023 $ 7,008 $ 30,508

State income tax, net of federal tax benefit 107 820 2,672

Change in state effective tax rate (1,695) 48 —

Reduction state net operating loss carryforwards 910 2,532 —

Debt discount amortization —— 591

Utilization of preacquisition net operating loss carryforwards —— 2,252

Stock grant, nondeductible compensation expense 627 431 —

Other 228 220 331

Valuation allowance, including the effect of changes to

prior year deferred tax assets —(3,291) (49,707)

$ 1,200 $ 7,768 $(13,353)

:: ::

41