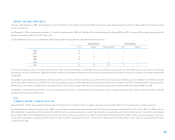

Airtran 2005 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2005 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

:: FORWARD-LOOKING STATEMENTS : :

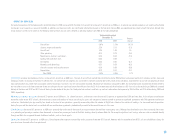

The information contained in this section has been derived from our historical financial statements and should be read together with our historical financial statements and related notes included elsewhere in this

document. The discussion below contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements involve risks and uncertainties including, but not limited to: consumer demand and acceptance of services offered by us, our ability to achieve and maintain acceptable

cost levels, fare levels and actions by competitors, regulatory matters, general economic conditions, commodity prices and changing business strategies. Forward-looking statements are subject to a number of

factors that could cause actual results to differ materially from our expressed or implied expectations, including, but not limited to: our performance in future periods, our ability to generate working capital from

operations, our ability to take delivery of and to finance aircraft, the adequacy of our insurance coverage and the results of litigation or investigation. Our forward-looking statements can be identified by the use of

terminology such as “anticipates,” “expects,” “intends,” “believes,” “will” or the negative thereof, or variations thereon or comparable terminology. We undertake no obligation to publicly update or revise any forward-

looking statement, whether as a result of new information, future events or otherwise.

: : OVERVIEW : :

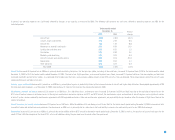

All of the operations of AirTran Holdings, Inc. are conducted by our wholly owned subsidiary, AirTran Airways, Inc. (Airways). Airways is one of the largest low-cost scheduled airlines in the United States in terms

of departures and seats offered. We operate scheduled airline service primarily in short-haul markets principally in the eastern United States, with a majority of our flights originating and terminating at our hub

in Atlanta, Georgia. As of March 1, 2006, we operated 85 Boeing 717-200 (B717) and 23 Boeing 737-700 (B737) aircraft making approximately 600 scheduled flights per day to 47 airports across the United States,

serving more than 60 communities in 25 states, the District of Columbia and the Bahamas.

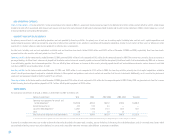

Our plans for 2006 focus on continuing the growth of our operations. We intend to do this by:

•adding two new B717 and 18 new B737 aircraft to our fleet;

•improving productivity;

•keeping our unit costs at levels that rank among the best in the industry;

•looking for new market opportunities that will satisfy the transportation needs of our customers; and

•providing our customers with a travel experience worth repeating.

We expect our mix of low fares, excellent customer service, an affordable Business Class product, and one of the youngest all-Boeing aircraft fleets will provide product value that customers will find attractive.

:: YEAR IN REVIEW : :

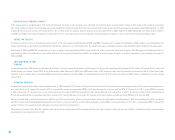

2005 was another challenging year for the airline industry; the year was marked by intense competition, high energy prices, hurricanes and capacity growth by airlines. As a result, we have seen three of our

competitors enter bankruptcy with one competitor liquidating in early 2006. At one point during 2005 nearly half of all of the domestic U.S. capacity was in bankruptcy. Despite the challenges of 2005, we concluded

the year as one of a few domestic passenger airlines to report a profit, recording $1.7 million in net income for the year.

The revenue environment improved throughout 2005 as several carriers reduced capacity. In our markets the competitive capacity reductions have been in the range of 12 percent to 15 percent year over year. It is

likely that further reductions in overall capacity will occur, including in the markets we serve.

:: ::

11

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS