Airtran 2005 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2005 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

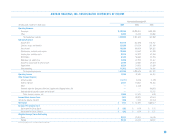

:: NON-OPERATING EXPENSES : :

Other (income) expense, net increased by $13.7 million primarily due to the receipt in 2003 of a government reimbursement pursuant to the Wartime Act of $38.1 million, partially offset by a $12.3 million charge

related to the write off of unamortized debt discount and issuance costs due to the early retirement of debt and of conversion of debt to equity and by a $8.9 million reduction in 2004 in interest expense as a result

of having reduced our outstanding debt obligations.

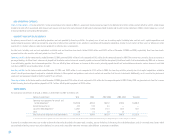

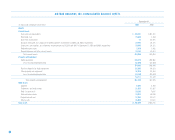

: : LIQUIDITY AND CAPITAL RESOURCES : :

Our primary source of funds is cash provided by operations and cash provided by financing activities. Our primary uses of cash are for working capital (including labor and fuel costs), capital expenditures and

general corporate purposes, which may include the acquisition of other airlines and their assets, whether in connection with bankruptcy proceedings relating to such carriers of their assets or otherwise in other

investments in strategic alliances, code-sharing agreements or other business arrangements.

Our total cash, including cash and cash equivalents, restricted cash and short-term investments totaled $390.1 million and $342.3 million at December 31, 2005 and 2004, respectively. Short-term investments

represent auction rate securities with reset periods less than 12 months.

Operating activities for the twelve months ended December 31, 2005 generated $64.6 million of cash compared to $38.1 million for the comparable period in 2004. The increase was, primarily, due to an increase in

passenger bookings for future travel, a decrease in prepaid fuel inventories and an increase in accounts payable and accrued liabilities due primarily to deferred credits that we received during 2005 and an increase

in our outstanding payables due to increased operations. This was offset by lower net income, an increase in other assets, primarily prepaid aircraft rent and maintenance reserves, and an increase in restricted

cash during 2005 for our outstanding letters of credit.

Investing activities for the twelve months ended December 31, 2005 used $80.2 million in cash compared to $73.3 million in 2004. Our investing activities primarily consist of capital expenditures related to

aircraft, aircraft purchase deposits required for scheduled deliveries in future periods and purchases and sales of auction rate securities that for cash investments. Additionally, cash is used for the purchase of

spare parts and equipment related to the B717 and B737 aircraft fleets.

Financing activities for the twelve months ended December 31, 2005 generated $78.6 million of cash compared to $3.9 million for the comparable period in 2004. During 2005, we generated cash from the issuance

of debt financing for aircraft pre-delivery deposits of $96.7 million, offset by debt repayments of $24.6 million.

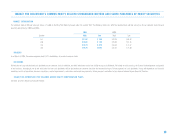

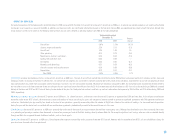

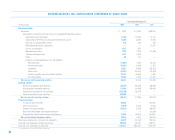

:: COMMITMENTS : :

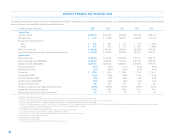

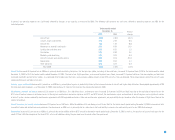

Our contractual commitments to be paid as follows as of December 31, 2005 (in millions) are:

Nature of commitment Total 2006 2007–2008 2009–2010 Thereafter

Operating lease payments for aircraft and

facility obligations(1) $6,074.0 $265.5 $647.2 $752.4 $4,408.9

Aircraft fuel purchases 23.2 14.9 8.3 ——

Long-term debt obligations(1) 1,180.7 139.0 173.5 153.5 714.7

Other 6.0 1.5 3.0 1.5 —

Total contractual obligations and Commitments $7,283.9 $420.9 $832.0 $907.4 $5,123.6

(1) Includes related interest payments and assumes that we will lease all aircraft, except for fifteen aircraft committed under debt financing, even though financing has not been arranged for all aircraft.

A variety of assumptions were necessary in order to derive the information described in the above table, including, but not limited to: (i) the timing of aircraft delivery dates; and (ii) estimated rental factors which

are correlated to floating interest rates prior to delivery. Our actual results may differ from these estimates under different assumptions or conditions.

:: ::

16