Air Canada 2010 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2010 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 Air Canada Annual Report

18

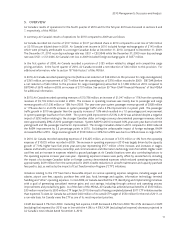

Cargo revenues increased 13% from the fourth quarter of 2009

Cargo revenues of $124 million in the fourth quarter of 2010 increased $14 million or 13% from the fourth quarter of

2009 due to a 10.0% increase in cargo traffic and, to a lesser extent, a 1.6% growth in cargo yield per revenue ton mile

(RTM). Traffic growth was reflected in all markets, with the exception of the domestic market where traffic declined 12.8%

from the fourth quarter of 2009. The system cargo yield per RTM improvement was mainly driven by growth in the Atlantic

market. Excluding the unfavourable impact of foreign exchange of $6 million relating to the stronger Canadian dollar on

foreign currency denominated cargo revenues, yield per RTM increased 6.3% from the fourth quarter of 2009.

The table below provides the dollar change in cargo revenues as well as year-over-year percentage changes in cargo revenues,

capacity as measured by effective ton miles (“ETM”), revenue per ETM, traffic as measured by revenue ton miles (“RTM”),

and yield per RTM for the fourth quarter of 2009 and the fourth quarter of 2010.

Fourth Quarter 2010

Versus

Fourth Quarter 2009

Cargo

Revenue

$ Change

(millions)

Cargo

Revenue

% Change

Capacity

(ETMs)

% Change

Rev / ETMs

% Change

Traffic

(RTMs)

% Change

Yield / RTM

% Change

Canada 1 (2.0) (13.3) 13.0 (12.8) 12.4

U.S transborder 1 16.6 24.7 (6.5) 37.0 (14.8)

Atlantic 7 18.8 5.4 12.7 14.6 3.6

Pacific 4 8.2 21.0 (10.6) 8.7 (0.5)

Other 1 18.3 4.0 13.8 8.9 8.6

System 14 13.0 7.7 3.9 10.0 1.6

Other revenues decreased 6% from the fourth quarter of 2009

Other revenues consist primarily of revenues from the sale of the ground portion of vacation packages, ground handling

services, and other airline-related services, as well as revenues related to the lease or sublease of aircraft to third parties.

Other revenues of $196 million in the fourth quarter of 2010 declined $12 million or 6% from the fourth quarter of 2009,

primarily due to a decrease in aircraft sublease revenues and lower third party revenues at Air Canada Vacations. The

decrease in aircraft sublease revenues was mainly due to the impact of a fewer number of aircraft subleased to third parties

compared to the fourth quarter of 2009. The reduction in third party revenues at Air Canada Vacations was largely driven

by a lower selling price of tour packages compared to the same quarter of 2009, due to competitive pressures from other

tour operators.

CASM decreased 3.4% from the fourth quarter of 2009. Excluding fuel expense, CASM decreased 4.1% from the

fourth quarter of 2009

In the fourth quarter of 2010, operating expenses of $2,531 million increased $100 million or 4% from the fourth quarter

of 2009. The increase in operating expenses in the fourth quarter of 2010 was mainly driven by the capacity growth

of 7.8%, higher base fuel prices year-over-year, as well as increases in wages, salaries and benefits, commissions, and

communications and information technology expenses. Operating expense increases were partly offset by several factors,

including the impact of a stronger Canadian dollar on foreign currency denominated operating expenses (mainly U.S.

dollars) compared to the fourth quarter of 2009 which reduced operating expenses by approximately $56 million from the

same period in 2009, a reduction in aircraft maintenance expense, the favourable impact of CTP initiatives and, to a lesser

extent, a decrease in food, beverages and supplies expense.

Unit cost in the fourth quarter of 2010, as measured by operating expense per available seat mile (CASM), decreased 3.4%

from the fourth quarter of 2009. Excluding fuel expense, CASM decreased 4.1% year-over-year. The 4.1% decrease in CASM

(excluding fuel expense) for the fourth quarter of 2010 was better than the 2.5% to 3.5% CASM (excluding fuel expense)

decrease projected in Air Canada’s news release dated November 4, 2010. This improvement was mainly driven by lower

than forecasted pension expense and food, beverages and supplies expense.