Air Canada 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 Air Canada annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2010 Management’s Discussion and Analysis

11

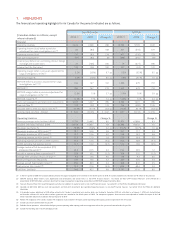

5. OVERVIEW

Air Canada’s results of operations for the fourth quarter of 2010 and for the full year 2010 are discussed in sections 6 and

7, respectively, of this MD&A.

In summary, Air Canada’s results of operations for 2010 compared to 2009 are as follows:

Air Canada recorded net income of $107 million or $0.37 per diluted share in 2010 compared to a net loss of $24 million

or $0.18 loss per diluted share in 2009. Air Canada’s net income in 2010 included foreign exchange gains of $145 million

which were primarily attributable to a stronger Canadian dollar at December 31, 2010, compared to December 31, 2009.

The December 31, 2010 noon day exchange rate was US$1 = C$0.9946 while the December 31, 2009 noon day exchange

rate was US$1 = C$1.0466. Air Canada’s net loss in 2009 included foreign exchange gains of $657 million.

In the first quarter of 2008, Air Canada recorded a provision of $125 million related to alleged anti-competitive cargo

pricing activities. In the fourth quarter of 2010, Air Canada recorded a net reduction of $46 million to this provision. For

additional information, refer to section 18 “Risk Factors” of this MD&A.

In 2010, Air Canada recorded operating income (before a net reduction of $46 million to the provision for cargo investigations)

of $361 million, an improvement of $677 million from the operating loss of $316 million recorded in 2009. EBITDAR (before

a net reduction of $46 million to the provision for cargo investigations) amounted to $1,386 million in 2010 compared to

EBITDAR of $679 million in 2009, an increase of $707 million. See section 20 “Non-GAAP Financial Measures” of this MD&A

for additional information.

In 2010, Air Canada recorded operating revenues of $10,786 million, an increase of $1,047 million or 11% from the operating

revenues of $9,739 million recorded in 2009. The increase in operating revenues was mainly due to passenger and cargo

revenue growth of $1,036 million or 12% from 2009. The year-over-year system passenger revenue growth of $928 million

or 11% was due to an 8.3% increase in system passenger traffic and a 2.3% improvement in system yield. The passenger

traffic growth in 2010 was greater than the capacity increase of 7.0% which resulted in a 1.0 percentage point improvement

in system passenger load factor from 2009. The system yield improvement of 2.3% in 2010 was achieved despite a negative

impact of $293 million relating to the stronger Canadian dollar on foreign currency denominated passenger revenues, which

were approximately 29% of 2010 passenger revenues. System RASM in 2010 increased 3.6% year-over-year due to both the

yield growth and the passenger load factor improvement. The stronger Canadian dollar in 2010 compared to 2009 reduced

the RASM improvement by 3.2 percentage points in 2010. Excluding the unfavourable impact of foreign exchange, RASM

increased 6.8% in 2010. Cargo revenue growth of $108 million or 30% from 2009 was due to a 34% increase in cargo traffic.

In 2010, Air Canada recorded operating expenses of $10,425 million, an increase of $370 million or 4% from the operating

expenses of $10,055 million recorded in 2009. The increase in operating expenses in 2010 was largely driven by the capacity

growth of 7.0%, higher base fuel prices year-over-year representing $517 million of the increase, and increases in wages,

salaries and benefits, commissions, ownership, and communication and information technology costs from 2009. Higher credit

card fees and an increase in expenses related to ground packages at Air Canada Vacations were also contributing factors to

the operating expense increase year-over-year. Operating expense increases were partly offset by several factors, including

the impact of a stronger Canadian dollar on foreign currency denominated expenses which reduced operating expenses by

approximately $439 million from the same period in 2009, notable reductions in aircraft maintenance and capacity purchase

fees paid to Jazz, as well as by the impact of Cost Transformation Program (“CTP”) initiatives.

Initiatives relating to the CTP have had a favourable impact on various operating expense categories, including wages and

salaries, airport user fees, capacity purchase fees with Jazz, food, beverage and supplies, information technology, terminal

handling and “other” operating expenses. In mid-2009, Air Canada launched the CTP, identifying and implementing initiatives

with a goal of generating annualized revenue gains and cost savings, including through contract and operating process

improvements and productivity gains. As of the date of this MD&A, Air Canada has achieved annual benefits of $330 million,

$30 million more than its $300 million CTP target for 2010, the result of having completed planned 2011 CTP initiatives earlier

than expected. To date, Air Canada has achieved $400 million of its overall CTP target of $530 million for the end of 2011, on

a run-rate basis. Air Canada views the CTP as one of its most important priorities.

CASM decreased 3.1% from 2009. Excluding fuel expense, CASM decreased 4.5% from 2009. The 4.5% decrease in CASM

(excluding fuel expense) for 2010 was in line with the 4.0% to 4.5% CASM (excluding fuel expense) decrease projected in

Air Canada’s news release dated November 4, 2010.