Aetna 2009 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2009 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Assets supporting experience-rated products (where the contract holder, not us, assumes investment and other risks

subject to, among other things, certain minimum guarantees) may be subject to contract holder or participant

withdrawals. For the years ended December 31, 2009, 2008 and 2007, experience-rated contract holder and

participant-directed withdrawals were as follows:

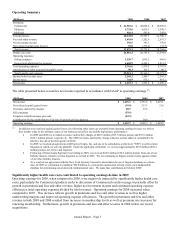

(Millions) 2009 2008 2007

Scheduled contract maturities and benefit payments (1) 267.2$ 338.8$ 353.6$

Contract holder withdrawals other than scheduled contract maturities and benefit payments (2) 10.6 31.1 39.4

Participant-directed withdrawals (2) 3.1 3.9 6.0

(1) Includes payments made upon contract maturity and other amounts distributed in accordance with contract schedules.

(2) Approximately $537.0 million, $524.3 million and $534.9 million at December 31, 2009, 2008 and 2007, respectively, of

experience-rated pension contracts allowed for unscheduled contract holder withdrawals, subject to timing restrictions and

formula-based market value adjustments. Further, approximately $95.9 million, $93.2 million and $118.7 million at December

31, 2009, 2008 and 2007, respectively, of experience-rated pension contracts supported by general account assets could be

withdrawn or transferred to other plan investment options at the direction of plan participants, without market value adjustment,

subject to plan, contractual and income tax provisions.

INVESTMENTS

At December 31, 2009 and 2008, our investment portfolio consisted of the following:

(Millions) 2009 2008

Debt and equity securities 17,159.7$ 13,993.3$

Mortgage loans 1,594.0 1,679.9

Other investments 1,220.1 1,196.2

Total investments 19,973.8$ 16,869.4$

The risks associated with investments supporting experience-rated pension and annuity products in our Large Case

Pensions business are assumed by the contract holders and not by us (subject to, among other things, certain

minimum guarantees). Anticipated future losses associated with investments supporting discontinued fully-

guaranteed Large Case Pensions products are provided for in the reserve for anticipated future losses on

discontinued products.

As a result of the foregoing, investment risks associated with our experience-rated and discontinued products

generally do not impact our results of operations (refer to Note 2 of Notes to Consolidated Financial Statements

beginning on page 48 for additional information). Our total investments supported the following products at

December 31, 2009 and 2008:

(Millions) 2009 2008

Supporting experience-rated products 1,681.1$ 1,582.8$

Supporting discontinued products 3,681.8 3,635.1

Supporting remaining products 14,610.9 11,651.5

Total investments 19,973.8$ 16,869.4$

Debt and Equity Securities

The debt securities in our portfolio had an average quality rating of A+ at December 31, 2009 and 2008, with

approximately $4.9 billion at December 31, 2009 and $4.3 billion at December 31, 2008 rated AAA. Total debt

securities that were rated below investment grade (that is, having a quality rating below BBB-/Baa3) at December

31, 2009 and 2008 were $1.3 billion and $640 million, respectively (of which 15% and 18% at December 31, 2009

and 2008, respectively, supported our discontinued and experience-rated products).

At December 31, 2009 and 2008, we held approximately $486 million and $824 million, respectively, of municipal

debt securities and $34 million and $64 million, respectively, of structured product debt securities that were

guaranteed by third parties, collectively representing approximately 3% and 5%, respectively, of our total

investments. These securities had an average credit rating of A+ at December 31, 2009 and AA- at December 31,

2008 with the guarantee. Without the guarantee, the average credit rating of the municipal debt securities was A+

on each date. The structured product debt securities are not rated by the rating agencies on a standalone basis. We

do not have any significant concentration of investments with third party guarantors (either direct or indirect).

Annual Report – Page 11