Aetna 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 Aetna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

duration rates reflecting recent experience and lower reserve discount rate assumptions based upon projected

investment returns. The decrease in our group benefit ratio in 2008 compared to 2007 was primarily due to favorable

life and disability experience.

Net realized capital gains (losses) for 2009 and 2007 were not significant. Net realized capital losses for 2008 were

due primarily to losses on OTTI of debt securities (refer to our discussion of Investments - Net Realized Capital Gains

and Losses on page 12 for additional information).

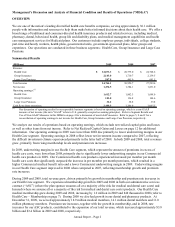

LARGE CASE PENSIONS

Large Case Pensions manages a variety of retirement products (including pension and annuity products) primarily for

tax qualified pension plans. These products provide a variety of funding and benefit payment distribution options

and other services. The Large Case Pensions segment includes certain discontinued products.

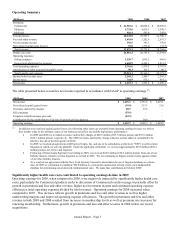

Operating Summary

(Millions) 2009 2008 2007

Premiums 172.2$ 193.2$ 205.3$

Net investment income 369.8 328.3 476.0

Other revenue 11.6 12.0 11.6

Net realized capital losses (5.8) (68.5) (1.4)

Total revenue 547.8 465.0 691.5

Current and future benefits 502.9 469.9 628.9

General and administrative expenses 10.0 14.9 18.2

Reduction of reserve for anticipated future losses on discontinued products - (43.8) (64.3)

Total benefits and expenses 512.9 441.0 582.8

Income before income taxes 34.9 24.0 108.7

Income taxes 8.5 1.2 32.0

Net income 26.4$ 22.8$ 76.7$

The table presented below reconciles net income to operating earnings reported in accordance with GAAP:

(Millions) 2009 2008 2007

Net income 26.4$ 22.8$ 76.7$

Net realized capital losses 5.8 44.5 .9

Reduction of reserve for anticipated future losses on discontinued products

(1)

- (28.5) (41.8)

Operating earnings 32.2$ 38.8$ 35.8$

(1) In 1993, we discontinued the sale of our fully-guaranteed large case pension products and established a reserve for anticipated future

losses on these products, which we review quarterly. We reduced the reserve for anticipated future losses on discontinued products by

$28.5 million ($43.8 million pretax) in 2008 and $41.8 million ($64.3 million pretax) in 2007. We believe excluding any changes to

the reserve for anticipated future losses on discontinued products provides more meaningful information as to our continuing products

and is consistent with the treatment of the results of operations of these discontinued products, which are credited or charged to the

reserve and do not affect our results of operations.

Discontinued Products in Large Case Pensions

Prior to 1993, we sold single-premium annuities (“SPAs”) and guaranteed investment contracts (“GICs”), primarily to

employer sponsored pension plans. In 1993, we discontinued selling these products, and now we refer to these

products as discontinued products.

We discontinued selling these products because they were generating losses for us, and we projected that they would

continue to generate future losses over their life (which is greater than 30 years); so we established a reserve

for anticipated future losses at the time of discontinuance. We provide additional information on this reserve,

including key assumptions and other important information, in Note 20 of Notes to Consolidated Financial Statements

beginning on page 82. Please refer to this note for additional information.

The operating summary for Large Case Pensions above includes revenues and expenses related to our discontinued

products, with the exception of net realized capital gains and losses, which are recorded as part of current and future

Annual Report – Page 9