Adidas 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas-Salomon

ANNUAL REPORT 2003

we will

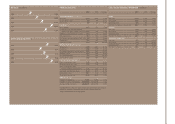

Table of contents

-

Page 1

adidas-Salomon ANNUAL REPORT 2003 we will -

Page 2

...â„¢ FOOTBALL, F50 FOOTBALL BOOT, GROUND CONTROL SYSTEMâ„¢, T-MAC 4 LACELESS FOOTWEAR TECHNOLOGY DELIVER CURRENCY-NEUTRAL TOP-LINE GROWTH AT ALL BRANDS EXPAND GROSS MARGIN FOR THE FIFTH CONSECUTIVE YEAR VISIBLY INCREASE OPERATING MARGIN CONTINUE TO OPTIMIZE WORKING CAPITAL MANAGEMENT > > DELIVER... -

Page 3

... tax rate 38.0 Net income as a percentage of net sales 4.2 Equity ratio 32.4 Financial leverage 69.8 Balance Sheet Data â,¬ in millions Total assets 4,188 Inventories 1,164 Receivables and other current assets 1,335 Working capital 1,433 Net total borrowings 946 Shareholders' equity 1,356 Per Share... -

Page 4

.... The adidas brand is structured in three divisions: Sport Performance, Sport Heritage and Sport Style. 11% /// Salomon is the Freedom Action Sports brand. Number one in the world for winter sports, with leading positions in alpine, nordic and snowboard products, Salomon is actively expanding its... -

Page 5

.... Whether it's the Olympic gold, a personal best or an ambitious corporate mission. Our ability to set high goals and achieve them is what gives each of us strength and makes "us" a winning team. At adidas-Salomon we have been writing sports history for more than 80 years. adidas-Salomon > we will. -

Page 6

Pushing forward Team leader, motivator, inspirator, fighter, driver...Sometimes I'm the bottom line who pushes ten men forward. To their limits and beyond. To victory. /// Oliver Kahn Goalkeeper of the German National Football Team -

Page 7

You can be anything. I was always a competitor. No matter what I was in, I wanted to be the best at it. Don't be afraid to dream, don't be afraid to shoot for the stars. /// Tim Duncan Two-time NBA Most Valuable Player Shooting for the stars -

Page 8

I've been practicing every day of my life. I can't remember not playing football. It's an integrated part of my life! /// David Beckham Real Madrid Football Player Practicing every day -

Page 9

Controlling the court The fate of that little yellow ball lies in my hands. My arm. My will. She who rules the ball, controls the court. The game. The opponent. /// Justine Henin-Hardenne World's Number One Ranked Tennis Player -

Page 10

Breaking records Going to the limit. And beyond. Feeling every muscle, every fiber, every urge to scream. With every extra kilo that I lift. That's how I break records. And that's how I'll reach the Olympic pinnacle. For the fourth time. /// Pyrros Dimas Three-time Olympic Weightlifting Champion -

Page 11

It's all about having just the right amount of aggression. At the poles. And between. Finding the optimal line. That's my life. And my talent. No-one hits the curve like I do. No one! /// Janica Kostelic / Three-time Olympic Champion and World Cup Winner My life -

Page 12

...them and develop as a person and a professional sportsman. I want to finish my career with no regrets, knowing I made the most of my potential as well as the opportunities given to me by the hard work and support of others. /// Jonny Wilkinson / Member of the English National Rugby Team / 2003 World... -

Page 13

My mark I was young when I grew intent on becoming a professional golfer and making my mark. The golf course was where I played. It was where I lived. It was what I dreamed. /// Mike Weir 2003 Golf Masters Champion -

Page 14

We screamed. We scored. We ran. We fought. We screamed. We sweat. We swore. We yelled. And we jumped. For joy. Because we scored. And we won what only one team can win: The World Cup. /// Women's German National Football Team / 2003 World Champions -

Page 15

Keeping my cool in the ice tunnel. Seeking the optimal line. It's all about the millisecond. I got it. Perfection. Once? Twice? Four times! Every time I win. /// Georg Hackl / Three-time Olympic Champion and World Cup Winner Every time I win -

Page 16

Waiting, provoking, finding the gap, pouncing. Spotting the feint. Anticipating every move. How long does it take to strike? And for the opponent to counter. It's up to me. And my will. /// Kristin Suchorski Member of the US Fencing World Championship Team It's up to me -

Page 17

My eyes focused on the finish. On the opponents. Waiting for the right moment. And then...I explode. Out of the slipstream, past them all. Fast, faster, beyond their reach. Again and again. Against the best in the world - and I am one of them. /// Erik Zabel Six-time Winner of the Best Sprinter ... -

Page 18

Over the bar, gravity fades. The air gets thinner. The competition thins out. And the training gets tougher. This is where I reign. And I won't share. With anybody. /// Hestrie Cloete / High Jump World Champion This is where I reign -

Page 19

... break Just 1,600 meters to go. 25,000 hours of training, 10,000 liters of sweat, 320 pairs of shoes and valleys of exhaustion behind me. Breaking away from the pack. Leaving the field behind, unmatched. The run of my life. /// Haile Gebrselassie Double Olympic and Four-time World 10,000m Champion -

Page 20

With your heart You can't win this game by playing with your feet alone. You only stand a chance if you play with your heart and your head. /// Zinedine Zidane / Three-time World Football Player of the Year -

Page 21

... Shareholders /// Page 18 Corporate Mission Statement /// Page 24 Locations /// Page 26 Operational and Sporting Highlights /// Page 28 Our Share /// Page 30 THE GROUP /// Letter to the Shareholders /// Corporate Mission Statement /// Locations /// Operational and Sporting Highlights /// Our Share -

Page 22

adidas-Salomon Executive Board /// At adidas-Salomon, our passion for sport and a sporting lifestyle influences everything we do. We are a team and together we are a global leader in the sporting goods industry. 18 THE GROUP LETTER TO THE SHAREHOLDERS -

Page 23

... financial arenas. Add to that exchange rate differentials (especially the euro / US dollar), which widened continuously throughout the year and reduced reported sales by over â,¬ 300 million, plus a slowdown in both our North American and Sport Heritage businesses within brand adidas, and you get... -

Page 24

... helped us secure low interest expenses on our long-term borrowings. But I don't want to beat around the bush. 2003 also had more than its share of challenges. Performance at our adidas business in North America was disappointing. Sales declined due to the very promotional retail environment and... -

Page 25

... GLOBAL OPERATIONS / AMERICAN We will > lead in supply chain innovation by creating and delivering products to our markets in ways which exceed our customers' expectations. MANFRED IHLE, 62 /// LEGAL AND ENVIRONMENTAL AFFAIRS / GERMAN We will > approach future challenges and opportunities as a team... -

Page 26

...financial structure, resources and performance as a basis for further operational success and growth. ERICH STAMMINGER, 46 /// GLOBAL MARKETING AND NORTH AMERICA / GERMAN We will > consistently bring best products, communication and above all adidas-Salomon passion to all our markets. 22 THE GROUP... -

Page 27

... in competition and sport. With our new team in North America, we are ready to give our competition a real taste of what adidas means to consumers, globally. That means fine-tuning our distribution, enhancing our brand message, and improving our retail presence. In Europe, we will expand our market... -

Page 28

... to help athletes of all skill levels achieve peak performance with every product we bring to the market. > We are a global organization that is socially and environmentally responsible, creative and financially rewarding for our employees and shareholders. 24 THE GROUP CORPORATE MISSION STATEMENT -

Page 29

...> In the medium term, we will extend our leading market position in Europe, expand our share of the US footwear market and be the fastest growing major sporting goods supplier in Asia and Latin America. The resulting top-line growth, together with strict cost control and working capital improvements... -

Page 30

... North America Inc. /// Portland, Oregon / USA (14) Taylor Made Golf Co. Inc. /// Carlsbad, California / USA (15) Arc'Teryx Equipment, Inc. /// Vancouver / Canada (16) Bonfire Snowboarding, Inc. /// Portland, Oregon / USA ASIA (17) adidas-Salomon International Sourcing Ltd. /// Hong Kong / China (18... -

Page 31

/// /// /// 15 /// /// 16 /// /// /// /// /// /// /// 10 /// /// 5/// /// /// 13 /// /// 14 /// /// /// /// /// /// 3/// /// 2 1 /// /// 4 /// /// /// /// /// /// /// 6 9 /// /// /// /// /// /// 12 /// 11 /// /// /// /// 7 /// /// /// /// /// ///8 /// /// /// /// 19 /// 18 /// 21 /// /// ///... -

Page 32

...MARCH /// Salomon S Core technology is awarded Innovation in Surfing during the 2003 Australian Surfing Hall of Fame awards. APRIL /// Mavic-adidas Cycling is formed as a new operational unit to manage the Group's road cycling and mountain biking activities. SEPTEMBER /// New product launches such... -

Page 33

... Football Association enter into a long-term partnership. JULY /// adidas signs a sponsorship agreement for the UEFA EURO 2004â„¢ in Portugal and is now partner of all major football competitions. NOVEMBER /// Just eight months after the laying of the foundation stone, the new adidas factory outlet... -

Page 34

... of the year, company-specific issues dampened our full year share price development compared with competitors, despite improving stock market conditions. 1) All of the shares carry full dividend rights. HISTORICAL PERFORMANCE OF THE adidas-Salomon SHARE AND IMPORTANT INDICES AT YEAR-END 2003 in... -

Page 35

... adidas backlog development in North America and disappointed the market given the doubledigit growth rates in previous quarters. SHARE PRICE ADVANCES IN Q3 /// During the third quarter, the improved economic outlook due to interest rate reductions in the USA and Europe supported the general stock... -

Page 36

... mainly include retail investors, made up 13% of the shares outstanding (2002: 19%). adidas-Salomon Management, which comprises current members of the Executive and Supervisory Boards, continued to hold less than 5%. Information regarding Directors' Dealings can be found in the Corporate Governance... -

Page 37

...307,403 3,738 21 18 Hold 36% Buy 58% 1) At year-end SHAREHOLDER STRUCTURE 1) Rest of the world 4% Management < 5% Other, undisclosed holdings 13% North America 34% to Annual General Meeting approval reported by Deutsche Börse AG Germany 16% Europe (excl. Germany) 28% 1) As at May 2003 33 -

Page 38

My mission: Keep my fists up. Longer than my opponent. My secret? Train, train, train. Power, speed, stamina, punch, reflex. Again and again. Over and over. That helps. But not my opponents. /// Laila Ali IBA Super Middleweight Champion Power, speed, stamina -

Page 39

... Page 36 Our Brands and Divisions /// Page 38 adidas Sport Performance /// Page 40 adidas Sport Heritage /// Page 44 adidas Sport Style /// Page 48 Salomon /// Page 52 TaylorMade-adidas Golf /// Page 56 Brand Strategies /// Page 60 STRATEGY /// Group Strategy /// Our Brands and Divisions /// Brand... -

Page 40

... adidas Sport Style adidas Sport Heritage adidas Sport Performance Salomon TaylorMade-adidas Golf FOCUSED RESOURCES Marketing Operations Sales Our Strategy /// To achieve our goal of leadership in the sporting goods sector, adidas-Salomon continually focuses on strengthening and developing... -

Page 41

... our status as the fastest growing sporting goods supplier over the next five years. ACHIEVING EXCELLENCE IN EXECUTION /// Great products and marketing are vital to success in our industry, but sales success often depends on consistent on-time retail delivery, ensuring best quality and the ability... -

Page 42

.... Our Product Portfolio /// One of the key strengths of our Group lies in the range of our brands. Each brand, with its own distinct identity, is clearly focused to meet the needs of a specific sector within the sporting goods market. This differentiation is crucial and helps us maximize... -

Page 43

..., nordic and snowboard products, Salomon is actively expanding its presence in summer and alternative sports as well as soft goods. All products are highly innovative and performanceoriented. Bonfire is a supplier of snowboard-specific and snowboard lifestyle apparel, with a focus on innovative and... -

Page 44

... given us a true understanding of what "performance products" really are. Products which can be used by serious, regular and occasional athletes who buy because they are directly involved in or strongly inspired by sport performance. 40 STRATEGY OUR BRANDS AND DIVISIONS /// adidas SPORT PERFORMANCE -

Page 45

Venue: Paris, August 25, 2003, 10.10 p.m. Event: Men's 100 meters final Time: 10.07 seconds - gold medal for Kim Collins Outfitter: adidas 41 -

Page 46

... new Ground Control Systemâ„¢ and our new JetConcept full body swimsuit, adidas Sport Performance products are designed to enhance an athlete's performance at all levels of competition. Through ensuring that our products are "Engineered to Perform", our goal is to meet and satisfy the specific needs... -

Page 47

adiStar LIGHTSPRINT A high-quality sprint shoe with seven exchangeable spikes in the forefoot and a fulllength Pebax spike plate with strategically placed cut-outs to reduce weight. The midfoot stripes are made of heat-reflective material. 43 -

Page 48

... than 75 years ago with the sporting lifestyle of today's world. The result is the perfect fusion of sport authenticity and global street style. We target trend-setters and youth around the world who love and purchase products inspired by our genuine and unique heritage in sport. 44 STRATEGY OUR... -

Page 49

Venue: Madrid, June 15, 2003, 9.45 a.m. Location: Carrer de Valencia Occasion: Waiting for Julio Outfitter: adidas 45 -

Page 50

... by original adidas products in style, experience and craftsmanship, and updated for today's context (re-designed). 1972 MÃœNCHEN BAG This large rectangular team bag in PU leather is a one-to-one copy of the vintage sports bag introduced in 1972 for the Olympic Games in Munich. 46 STRATEGY OUR... -

Page 51

..., elastane top with narrow straps and deep scoop neck. This vest was worn by Brazilian athlete Joaquim Cruz during the Los Angeles Olympic Games in 1984. SHOT A one-to-one copy from the 1984 Olympic collection, the Shot was the leading shot put shoe of its time. It features all original materials... -

Page 52

..., unique and inspirational. It is where sports passion meets fashion and is becoming an increasingly important part of the sporting goods market. The demand comes from premium fashion-conscious consumers who are more likely to be over 25 than under. These products, are part of our unique partnership... -

Page 53

Venue: Berlin, November 5, 2003, 2.50 p.m. Studio: Potsdamer Platz Occasion: Styling session for music video Outfitter: adidas 49 -

Page 54

... other sportswear line. It combines fashion elegance and sports functionality in chic sportswear for everyday life in a way that never existed before. EXCLUSIVE WOMEN'S KNIT TOP This women's top features an elegant low-gauge knit and the typical Yohji Yamamoto 3-stripes execution. 50 STRATEGY OUR... -

Page 55

WALLET L STRIPES A leather wallet with attachable chain that features a "Vasereli Art" inspired logo graphic. 51 -

Page 56

..., it's all about Freedom Action Sports. These are individual, no-rules sports. It's the off-road experience. About gliding to new adventures. About succeeding in a niche. Whatever the environment - snow, trails, rocks, street or water - Salomon offers products to consumers looking for unrestricted... -

Page 57

Venue: New Zealand Mountain: Mount Cook Occasion: Thrill & Fun Equipment: Salomon 53 -

Page 58

... has a pipeline of products that no other supplier of winter sporting goods can match. In summer sports products, too, continuous product innovation is a critical factor in the fast sales growth of these products. CROSSMAX® 10 Skier-X carving ski featuring top-end Salomon technologies such as the... -

Page 59

ELLIPSEâ„¢ 10.0 A custom-fit ski boot combining the special features of hard and soft alpine boots, with 3-D micro-adjustable buckles for maximum precision and comfort. 55 -

Page 60

TaylorMade-adidas Golf At TaylorMade-adidas Golf, the actions of the finest players in the world speak for the performance of our golf clubs: TaylorMade was the No. 1 driver, No. 1 fairway wood and No. 1 iron on the PGA Tour in 2003 - for the second consecutive year. 56 STRATEGY OUR BRANDS AND ... -

Page 61

Venue: Sandwich, July 17, 2003, 2.15 p.m. Event: British Open Location: Sand Trap, Hole 14 Equipment: TaylorMade-adidas Golf 57 -

Page 62

... golfer who wants to play better, TaylorMade-adidas Golf's ambition is to improve on what we have done before, to push current boundaries and to create original technologies and designs that are the cornerstones of the world's leading golf products. TOUR LIMITED GLOVE A traditionally styled golf... -

Page 63

Z-TRAXION 3-STRIPE An adidas golf shoe that unites cutting-edge performance technologies with a rich upper that is timeless in appearance, making for a comfortable, high-traction shoe appealing to serious golfers of all ages. 59 -

Page 64

... as well as point-of-sale and public relations activities and will be supported by a special Internet site. It features 22 adidas athletes from various sports and regions, including boxing legend Muhammad Ali, longdistance runner Haile Gebrselassie, football icon David Beckham and NBA star Tracy... -

Page 65

...products inspired by our brand's unique heritage in football, Olympic sports, tennis and basketball. Additionally, we will expand our fashion distribution in 2004 as well as increase our focus in the North American market. We expect this division to comprise 25 to 30% of adidas sales in the mid term... -

Page 66

Salomon /// AT SALOMON, OUR ORIGINS ARE IN WINTER SPORTS. WE ARE THE WORLD'S MARKET LEADER IN TERMS OF SALES, PRODUCT INNOVATION AND RACING RESULTS. TO BE BETTER SEASONALLY BALANCED, HOWEVER, WE HAVE DEVELOPED OUR PRESENCE SIGNIFICANTLY BEYOND WINTER SPORTS OVER THE PAST FEW YEARS, TAKING LEADING ... -

Page 67

... sales among the golf public. adidas GOLF LINE CONTINUES TO GROW AND THRIVE /// adidas Golf, the footwear and apparel arm of TaylorMade-adidas Golf, rapidly expanded its product line and market share during the past several years and is currently the fastest growing golf footwear brand in the world... -

Page 68

Competing hard My never-ending goal is to compete hard on every shot I hit. To win every tournament I enter. The pressure of competing motivates me to play better - it's more of a thrill than pressure. /// Se Ri Pak 2002 LPGA Champion -

Page 69

...Board Report /// Page 112 Supervisory Board /// Page 114 Executive Board /// Page 116 REPORTING /// Group Management Report /// Global Operations /// Sustainability /// Employees /// Corporate Governance Group Management Report /// Page 66 Economic and Sector Development /// Page 66 Group Business... -

Page 70

... as the year progressed. While development of gross domestic product (GDP) is the main indicator for our business environment, consumer spending, consumer confidence and exchange rates are also important, because they have proven in the past to reliably project future developments in our industry... -

Page 71

... holiday season. During the same period, lower inventory levels helped to improve product sell-through at retail. STATE OF THE SPORTING GOODS INDUSTRY IN EUROPE IMPROVES /// In Europe, the general retail environment remained tough throughout the 12-month period and was characterized by a high number... -

Page 72

..., adidas sales grew 5% on a currency-neutral basis. In euro terms, sales declined by 3% to â,¬ 4.950 billion from â,¬ 5.105 billion in 2002. Drivers of the currency-neutral growth were the Sport Performance running and training categories helped by evolutions of our successful technologies ClimaCool... -

Page 73

... sales in Japan, China and India. In euro terms, adidas sales in Asia declined 3% to â,¬ 839 million in 2003 from â,¬ 867 million in 2002. At Salomon, currency-neutral sales were down 9%. This development is mainly related to continued poor winter business in Japan, with alpine product sales... -

Page 74

...markets, adidas-Salomon has licensing agreements with independent companies, which manage the design, development, manufacture and distribution of specific product lines. Currently, adidas has 18 licensees that source products from 154 suppliers in 24 different countries. In 2003, net licensee sales... -

Page 75

... the Group's gross margin by more than 1.0 percentage points. As a result of these developments and the decrease in sales in euro terms, Group gross profit was nearly stable with the prior year's level at â,¬ 2.814 billion (2002: â,¬ 2.819 billion). EUROPE LEADS GROUP GROSS MARGIN EXPANSION /// On... -

Page 76

...effects. Costs which are directly attributable to production are included within the cost of sales. Detailed information regarding adidas-Salomon employees, human resources policy and performance incentives is included in this report (see Employees). MARKETING WORKING BUDGET in % of net sales 1999... -

Page 77

... 1999 2000 2001 2002 2003 482 437 475 477 490 year-end EMPLOYEES BY FUNCTION 1) in % 2003 2002 OPERATING PROFIT BY QUARTER â,¬ in millions Q1 2003 Q1 2002 Own retail Sales Logistics Marketing Central functions & administration Production Research & development IT 1) At 116 98 62 69 270 243 42... -

Page 78

...% year-over-year increase in line with the development of the Group's net income. The total number of shares outstanding increased by 31,250 shares in 2003 to 45,453,750 as a result of the second and third exercise periods of Tranche II of the management stock option plan (MSOP) of adidas-Salomon AG... -

Page 79

...we expect to influence our business materially. However, in North America, recent data flow has provided further evidence of an improving retail environment. Especially sporting goods retailers have stated their intention to expand square footage. INCOME BEFORE TAXES BY QUARTER â,¬ in millions NET... -

Page 80

...level of 886. MULTI-NATIONAL R&D ACTIVITIES AT adidas-Salomon /// For brand adidas, the majority of our research and development activities are located in Herzogenaurach, Germany, and Portland / Oregon, USA. For Salomon and TaylorMade-adidas Golf, the research and development of products is located... -

Page 81

... in the Group's trade terms management and concerted collection efforts at all brands. Year-end receivables development was also impacted by lower fourth quarter revenues in North America compared to the particularly strong sales in the region during the same period in the prior year. TOTAL ASSETS... -

Page 82

... long-term promotion contracts in football. OTHER NON-CURRENT LIABILITIES INCREASE /// Other noncurrent liabilities nearly doubled to â,¬ 35 million in 2003 from â,¬ 19 million in 2002, primarily due to an increase in the negative fair value of financial instruments used for hedging activities... -

Page 83

..., and included the purchase of tangible, intangible and financial assets. Spending for property, plant and equipment such as investments in adidas own-retail activities, including major spending for the opening of our new factory outlet in Herzogenaurach, and IT projects decreased by â,¬ 4 million... -

Page 84

... effects related to the convertible bond issue as this amount was reported as equity (see note 15). However, even excluding these positive effects, the Group's net borrowings reduction continued successfully with a decrease for the third year in a row and significantly exceeded Management's targets... -

Page 85

... STRUCTURE â,¬ in millions 2003 Total cash and short-term financial assets Bank borrowings Commercial paper Asset-backed securities Private placements Convertible bond Gross total borrowings Net total borrowings 279 124 29 109 684 279 1,225 946 2002 76 633 234 147 560 0 1,574 1,498 < 1 year... -

Page 86

... in 2002. The main driver of this improvement was increased expansion of distribution as part of our efforts to better balance the proportion of apparel sales in our Sport Heritage business. adidas SPORT PERFORMANCE /// ADISTAR TR TRAIL RUNNING SHOE 82 REPORTING GROUP MANAGEMENT REPORT /// adidas -

Page 87

... TOP-LINE GROWTH DRIVER /// An increasingly important part of brand adidas revenues are own-retail activities. Own retail within adidas consists of four components: concept stores, concession corners in emerging markets, factory outlets and Internet sales. At the end of 2003, adidas operated 173... -

Page 88

... marketing working budget and higher bad debt expenses in Europe. Despite this development, gross margin expansion drove adidas operating profit up 6% to â,¬ 365 million in 2003 versus â,¬ 343 million in the prior year. Similarly, operating margin increased 0.6 percentage points to 7.4% of sales... -

Page 89

...â„¢ match ball, the PredatorPulseâ„¢ and F50 football boots (see Brand Strategies and Group Management Report / Outlook). Gross margin in the segment is expected to improve, reflecting increased own-retail sales, lower clearance sales and an improving product mix. Therefore, operating profit should... -

Page 90

...and adidas own-retail activities were the main contributors to growth in each of these markets. POSITIVE ORDER BACKLOG DEVELOPMENT CONTINUES /// At the end of 2003, orders in Europe were up 9% on a currencyneutral basis with particularly strong growth rates in France, Spain and the UK. In euro terms... -

Page 91

... lower demand for many adidas product lines throughout the year were the reasons for this weak development. This led to a significantly higher portion of clearance sales than in the prior year. NORTH AMERICAN BUSINESS TO BE STABILIZED IN 2004 /// Year-end backlogs for North America decreased 18% on... -

Page 92

... strong sales increases in 2002 during and after the FIFA Football World Cupâ„¢. Japan, Hong Kong, Taiwan and, in particular, China all delivered solid growth, more than offsetting declines in Australia. adidas IN ASIA SET TO DELIVER SOLID CURRENCY-NEUTRAL GROWTH AGAIN IN 2004 /// The order backlog... -

Page 93

... customers suggest that currency-neutral sales are expected to again grow at double-digit rates during 2004. The primary drivers of adidas revenue growth in Latin America for 2004 will be improved brand positioning in major markets as well as increased adidas own-retail activities. adidas NET SALES... -

Page 94

... America and Japan in 2002 / 03. In euro terms, sales were down 4% to â,¬ 658 million in 2003 from â,¬ 684 million in 2002. REVENUE GROWTH LARGELY DRIVEN BY INCREASED SALES OF SUMMER SPORTS PRODUCTS /// Winter sports product sales, about 67% (2002: 69%) or â,¬ 440 million of Salomon's total sales... -

Page 95

... related cycling products SALOMON NET SALES BY REGION Latin America 1% Asia 10% Europe 64% North America 25% PROVISION OF BACKLOG INFORMATION ON SALOMON NOT MEANINGFUL /// Because of the strong seasonality of Salomon's business and the often short-term nature of orders within the winter sports... -

Page 96

...CATEGORIES. IN EURO TERMS, HOWEVER, REVENUES DECLINED 10% TO â,¬ 637 MILLION IN 2003 VERSUS â,¬ 707 MILLION IN 2002. GROSS MARGIN DECLINED 3.3 PERCENTAGE POINTS TO 45.5% OF SALES VERSUS 48.8% IN THE PRIOR YEAR AS A RESULT OF LOWER METALWOOD AND GOLF BALL MARGINS. OPERATING PROFIT, HOWEVER, DECREASED... -

Page 97

...leading position in golf's largest category (see Brand Strategies and Group Management Report / Outlook). In addition, we expect our growing market share in the iron category to continue and anticipate ongoing above-average growth for adidas Golf products in 2004. Gross margin in the segment is also... -

Page 98

... FOR SAFEGUARDING OUR STRONG COMPETITIVE POSITION GLOBALLY AND FOR SUSTAINING THE SUCCESS OF OUR GROUP INTO THE FUTURE. RISK MANAGEMENT PHILOSOPHY /// Risk management at adidas-Salomon addresses both short-term operational as well as long-term strategic risks. Opportunity-focused, but risk-aware... -

Page 99

... the Group's suppliers are located in the emerging markets of Asia (see Global Operations). As a result, adidas-Salomon is exposed to risks associated with business activities in these countries. Among others, this includes changes in duties, tariffs or currency exchange rates, or trade restrictions... -

Page 100

... responsibilities to our workers and the environment. Malpractice in these areas can have a significant impact on the reputation and operational efficiency of our Group and its suppliers. Our Social and Environmental Affairs (SEA) team monitors the factories of adidas-Salomon suppliers to ensure... -

Page 101

... and earning power form a solid basis for our future business development. We have taken appropriate precautions against typical business risks that could negatively affect our financial standing and profitability situation. adidas SPORT PERFORMANCE /// a 3® TWIN STRIKE RUNNING SHOE 97 -

Page 102

... to increase price pressure on major vendors. However, projected increases in private consumption have led major retailers to announce significant expansion plans for the first time in five years. adidas SPORT PERFORMANCE /// ADISTAR SINGLET SHIRT 98 REPORTING GROUP MANAGEMENT REPORT /// OUTLOOK -

Page 103

... adidas business in North America. This will be supported by a new management team, which was put in place in January 2004. The primary focus of our activities will be to enhance relationships with retail partners by fine-tuning our distribution strategy, launching a major brand advertising campaign... -

Page 104

... levels throughout the year. In particular, this technology will be highlighted at the Summer Olympics in August. For ClimaCool®, we are targeting sales of four million pairs of shoes and five million pieces of apparel. In addition, we will focus distribution of our premium running product... -

Page 105

...-retail activities will again be the major driver of increased personnel requirements. Personnel expenses (including production) are expected to increase in line with the number of newly hired employees in 2004. R&D SPENDING TO REMAIN FOCUSED ON TECHNOLOGICAL INNOVATIONS /// In 2004, adidas-Salomon... -

Page 106

... Global Operations activities and the Group's overall success (see Risk Management). The different types of supplier we utilize can be categorized as follows: > Main factories: Suppliers who have a direct contractual business relationship with adidas-Salomon. These companies manufacture our product... -

Page 107

...-market specifically within our all-important football category we have introduced a special program aimed at reducing the time between retailer purchase orders and product delivery. This has the benefit of increasing sales while reducing both the inventory carrying costs as well as close-out sales... -

Page 108

... policies and values. The SOE detail the Group's requirements regarding labor, health, safety and environmental issues in our suppliers' factories and form the foundation for our international factory-monitoring program. ENSURING COMPLIANCE /// Before our suppliers can be approved business partners... -

Page 109

...Socially Responsible Investment (SRI) products for a growing number of European banks, fund managers and institutional investors. The final decision of the board of directors was based on two independent surveys prepared by Stock at Stake, Ethibel's research arm. Both the survey of the global sports... -

Page 110

... of sales within the Group. Despite our diverse backgrounds, what unites all adidas-Salomon employees is our passion for competition and a sporting lifestyle. (For information on the number of employees and their functions, please see Group Management Report / Group Business Performance.) EMPLOYEES... -

Page 111

... success factor for any modern company is its people and their talent. From a human capital management point of view, we created the talent management program "Fit for Gold", that addresses career planning, identification of qualified internal candidates and development of leadership competencies... -

Page 112

...Annual General Meeting on the corporate website. DIRECTORS' DEALINGS AND CHANGES IN SHAREHOLDER STRUCTURE /// Pursuant to §15 a of the German Securities Trading Act (WpHG), our Executive and Supervisory Boards are required to disclose without delay the purchase and sale of adidas-Salomon shares in... -

Page 113

...-Salomon share has developed by an annual average of 1% more favorably than the stock market prices of a basket of competitors of adidas-Salomon globally and in absolute terms has not fallen ("relative performance"). The compensation from the stock option plan consists of a performance discount... -

Page 114

... management stock option plan (MSOP) do not provide a possibility of limitation (cap) for extraordinary, unforeseeable developments. The compensation report does not include information on the value of stock options (Article 4.2.3). 1) > adidas-Salomon does not specify age limits for Executive Board... -

Page 115

... standards and market conditions. Our Corporate Governance Officer regularly monitors the conformity of adidas-Salomon with compliance rules and reports to the Executive and Supervisory Boards. In 2004, we will enable our shareholders to exercise their voting rights at the Annual General Meeting via... -

Page 116

... of the stock option plan (MSOP) for management executives of adidas-Salomon AG and its affiliated companies. In August, the Executive Board reported to us in detail about business development and future business strategy in North America. Further, we discussed in detail the key financial points of... -

Page 117

... Wirtschaftsprüfungsgesellschaft, Frankfurt am Main, audited the financial statements of adidas-Salomon AG for the year under review as prepared by the Executive Board in line with the provisions of the German Commercial Code (HGB) as well as the management report. The auditor issued an... -

Page 118

... BY THE ANNUAL GENERAL MEETING AND SIX REPRESENT adidas-Salomon EMPLOYEES. THROUGH THEIR DIVERSE PROFESSIONAL BACKGROUNDS AND NATIONALITIES, THEY MIRROR THE INTERNATIONAL NATURE AND THE BROAD SCOPE OF OUR GROUP'S ACTIVITIES. HENRI FILHO /// CHAIRMAN 72, French Management Consultant Deputy Chairman... -

Page 119

... Board members, being up to five years, will expire at the end of this year's Annual General Meeting. 1) Not relevant for determining the maximum number of Supervisory Board appointments under § 100 para. 2 no.1 AktG (German Stock Corporation Act) 2) Employee representative adidas SPORT... -

Page 120

... computer science, he began his professional career with Reebok International Ltd. in 1983, where he worked ten years in various operations and product functions. In 1993, he joined adidas AG 2) as Head of Worldwide Development. He was appointed to the Executive Board in 1997 and is responsible for... -

Page 121

... Bros. International as well as working as an independent consultant. Robin Stalker joined adidas AG 2) as the Head of Corporate Services and Group Reporting in 1996. Since February 2000, he has been Chief Financial Officer of adidas-Salomon AG and was appointed to the Executive Board, responsible... -

Page 122

Making sure I'm playing a game that I love. I go out and have fun. I play every game like it's my last. And I want to make sure that everyone who watches me becomes a fan of basketball. And of me. /// Tracy McGrady 2003 NBA Top Scorer -

Page 123

...Page 145 Shareholdings /// Page 152 Supplementary Information /// Page 156 Glossary /// Page 156 Segmental Information /// Page 160 Summary of Key Financial Data /// Page 162 FINANCIAL ANALYSIS /// Executive Board Statement /// Independent Auditor's Report /// Consolidated Financial Statements (IFRS... -

Page 124

... Board (IASB). The consolidated financial statements also comply with § 292a German Commercial Code (HGB), which exempts adidas-Salomon AG from the obligation of reporting consolidated financial statements under German GAAP. The Group management report additionally complies with the requirements... -

Page 125

... financial statements give a true and fair view of the net assets, financial position, results of operations and cash flows of the adidas-Salomon Group for the business year in accordance with International Financial Reporting Standards. Our audit, which also extends to the group management report... -

Page 126

... Inventories Other current assets Total current assets Property, plant and equipment, net Goodwill, net Other intangible assets, net Long-term financial assets Deferred tax assets Other non-current assets Total non-current assets Total assets Accounts payable Income taxes Accrued liabilities and... -

Page 127

...INCOME STATEMENT â,¬ in thousands (Note) 2003 Net sales Cost of sales Gross profit Selling, general and administrative expenses Depreciation and amortization (excl. goodwill) Operating profit Goodwill amortization Royalty and commission income Financial expenses, net Income before taxes Income taxes... -

Page 128

... other long-term assets Interest received Net cash used in investing activities Financing activities: (Decrease)/Increase in long-term borrowings Proceeds from issue of convertible bond Dividends of adidas-Salomon AG Dividends to minority shareholders Exercised share options Decrease in short-term... -

Page 129

...hedges, net of tax Net gain on net investments in foreign subsidiaries, net of tax Currency translation Balance at December 31, 2003 The accompanying notes are an integral part of these consolidated financial statements. Fair values of financial instruments 17,727 Retained earnings Total 116,094... -

Page 130

STATEMENT OF MOVEMENTS OF FIXED ASSETS â,¬ in thousands Goodwill Software, patents, trademarks and concessions ACQUISITION COST December 31, 2001 Currency effect Additions Changes in companies consolidated Transfers Disposals December 31, 2002 Currency effect Additions Changes in companies ... -

Page 131

Technical equipment and machinery Other equipment, furniture and fittings Advance payments / construction in progress Total tangible assets Shares in affiliated companies Participations Other financial assets Total financial assets 130,086 (6,870) 11,593 1,469 6,208 (12,987) 129,499 (6,645) ... -

Page 132

NOTES /// adidas-Salomon AG, a listed German stock corporation, and its subsidiaries design, develop, produce and market a broad range of athletic and sports lifestyle products. The Group's headquarters are located in Herzogenaurach, Germany. adidas-Salomon has divided its operating activities by ... -

Page 133

... reporting dates. The fair value of a currency option is determined using generally accepted models to calculate option prices. The fair market value of an option is influenced not only by the remaining term of the option but also by further determining factors, such as the actual foreign exchange... -

Page 134

...to the short product life cycle of sporting goods. The Group spent approximately â,¬ 86 million and â,¬ 85 million on product research and development for the years ending December 31, 2003 and 2002 respectively. Investments The Group classifies its investments into the following categories: trading... -

Page 135

.... Equity Compensation Benefits Share options are granted to members of the Executive Board of adidas-Salomon AG as well as to the Managing Directors /Senior Vice Presidents of its affiliated companies and to further senior executives of the Group in connection with the management stock option plan... -

Page 136

... to an "unrealized" profit compared with using the exchange rate at the booking date: > Foreign currency receivables and liabilities > Derivative financial instruments to the extent they do not represent a hedge > Available-for-sale securities Deferred Taxes Deferred tax assets must be included to... -

Page 137

... this year's presentation. 6 /// SHORT-TERM FINANCIAL ASSETS Short-term financial assets are classified as available-for-sale investments with fair value changes recognized in the income statement as incurred. They mainly comprise investment funds as well as marketable equity securities. Subsequent... -

Page 138

... shares) in 1998. A portion is being used for the development of adidas-Salomon's international headquarters "World of Sports", and is included under property, plant and equipment. The remaining part, not needed in the future by adidas-Salomon, has a size of 77 hectares and is to be sold. According... -

Page 139

... shares in unconsolidated affiliated companies of â,¬ 3 million at December 31, 2003 and 2002. Long-term financial assets further include investments which are mainly related to a deferred compensation plan (see note 18). These are mainly invested in insurance products and are measured at fair value... -

Page 140

...year Bank borrowings Commercial paper Asset-backed securities Private placements Total 0 0 0 0 0 Between 1 and 3 years 104 0 0 0 104 Between 3 and 5 years 529 234 147 299 1,209 After 5 years 0 0 0 261 261 633 234 147 560 1,574 Total Information regarding the Group's protection against interest rate... -

Page 141

... affiliated companies Deferred income Sundry Other current liabilities Marketing provisions mainly consist of provisions for distribution, such as discounts, rebates and sales commissions, as well as promotion. The usage of the restructuring provision was mainly related to warehouses and production... -

Page 142

...benefit plans are made at the end of each reporting period. Similar obligations include mainly long-term liabilities under a deferred compensation plan. The funds withheld are invested by the Group on behalf of the employees in certain securities, which are presented under long-term financial assets... -

Page 143

...These subsidiaries were mainly set up together with former independent distributors and licensees for the adidas brand. Salomon & Taylor Made Co., Ltd., Tokyo (Japan) is a public company, which has been listed on the Tokyo Stock Exchange since 1995. Minority interests evolved as follows in the years... -

Page 144

... property rights or licenses may also be conducted by subsidiaries. Distributable Profits and Dividends Distributable profits to shareholders are determined by reference to the retained earnings of adidas-Salomon AG and calculated under German Commercial Law. The Executive Board of adidas-Salomon... -

Page 145

... 5 years Total 43 58 3 104 Dec. 31 2002 41 58 6 105 23 /// FINANCIAL INSTRUMENTS Management of Foreign Exchange Risk The Group is subject to currency exposure, primarily due to an imbalance of its global cash flows caused by the high share of product sourcing invoiced in US dollars, while sales... -

Page 146

...2003 Forward contracts Currency options Total 234 504 738 Dec. 31 2002 307 522 829 Management of Interest Rate Risk It has been the policy of the Group to concentrate its financing on short-term borrowings, but to protect against liquidity risks with longer-term financing agreements, and to protect... -

Page 147

... in the cost of sales. A significant portion of the operating expenses comprises the marketing working budget. The marketing working budget consists of promotion and communication spending such as promotion contracts, advertising, retail support, events and other communication activities, however it... -

Page 148

... TAXES In general, adidas-Salomon AG and its German subsidiaries are subject to corporate and trade taxes. In general, a corporate tax rate of 25% plus a surcharge of 5.5% thereon is applied to earnings. The corporate tax rate was temporarily increased to 26.5% for 2003 in order to help to support... -

Page 149

... 5.04 5.04 Current taxes in the amount of â,¬ 1 million which relate to net investment hedges have been credited directly to shareholders' equity for the years' ending December 31, 2003 and 2002 (see also note 23). The effective tax rate of adidas-Salomon differs from an assumed tax rate of 40% as... -

Page 150

... 138 18 7 Salomon 2002 684 279 40.8 39 581 179 18 7 TaylorMade-adidas Golf 2003 637 290 45.5 67 391 67 12 9 2002 707 345 48.8 74 433 95 46 7 Headquarter / Consolidation 2003 Net sales third parties Gross profit in % of net sales Operating profit Assets Liabilities Capital expenditure Amortization... -

Page 151

SEGMENTAL INFORMATION BY REGION â,¬ in millions Europe 2003 Net sales Intersegment sales Net sales third parties Gross profit in % of net sales Operating profit Assets Liabilities Capital expenditure Amortization and depreciation excl. goodwill amortization 3,391 (26) 3,365 1,383 40.8 534 1,428 712 ... -

Page 152

... now reported as a decrease in short-term financial assets under investing activities. Accordingly, the effect of exchange rates on cash has also been adjusted. The Group acquired all outstanding shares of Arc'Teryx Equipment Inc. and Salomon Danmark ApS in 2002 (see also note 4). The fair value of... -

Page 153

... of Salomon S.A., this share option plan was linked with a fixed rate of 0.73 to the price of the shares of adidas-Salomon AG. These shares of Salomon S. A. were sold to adidas Salomon France S. A., which was treated as additional acquisition costs at adidas Salomon France S. A. 33 /// RELATED... -

Page 154

... INFORMATION Employees The average numbers of employees are as follows: EMPLOYEES Year ending December 31 2003 Sales companies Sourcing / Production Global marketing / Research and development Central functions Total 9,476 3,382 1,647 906 15,411 2002 8,935 3,198 1,512 816 14,461 Supervisory Board... -

Page 155

... regarding sales or purchases of adidas-Salomon shares for a total value of â,¬ 25,000 or more within any 30-day period during 2003. Information pursuant to § 161 German Stock Corporation Act (AktG) On April 7, 2003 the Executive Board and the Supervisory Board of adidas-Salomon AG issued the Group... -

Page 156

... S. A.S. 17 erima France S.a.r.l. 18 Mavic S. A. 19 adidas International B.V. 20 adidas International Trading B.V. 21 adidas International Marketing B.V. 22 adidas-Salomon International Finance B.V. 23 adidas Benelux B.V. 24 adidas Belgium N.V. 25 adidas (UK) Ltd. 1) 26 adidas (ILKLEY) Ltd. 1) 9) 27... -

Page 157

SHAREHOLDINGS OF adidas-Salomon AG, HERZOGENAURACH as at December 31, 2003 Company and Domicile Currency Equity (currency units in thousands) 34 Fortstewart Ltd. 2) 9) 35 Three Stripe Exports Ltd. 2) 9) 36 adidas International Re Ltd. 37 adidas-Salomon Espana S. A. 38 adidas Italy S.p. A. 39 Salomon... -

Page 158

... Inc. 3) 71 adidas America Inc. 3) 72 adidas Promotional Retail Operations Inc. 3) 73 adidas Sales Inc. 3) 74 adidas Village Corporation 3) 75 adidas Interactive Inc. 3) 76 adidas International, Inc. 3) 77 Taylor Made Golf Co. Inc. 78 Salomon North America, Inc. 79 Salomon Design Center Inc. 9) 80... -

Page 159

...-group India 6) Sub-group Mexico 7) Sub-group Salomon-Taylor Made UK 8) Four companies have not been included in the consolidated financial statements of adidas-Salomon AG. 9) Companies with no active business 10) The numbers refer to the number of the company which maintains the shareholding. 155 -

Page 160

... non-current liabilities divided by non-current assets and inventories. ATHLETIC SPECIALTY RETAILERS /// A major distribution channel for adidas products in terms of sales. These stores specialize in merchandising athletic footwear and apparel products to the 12-24 year-old urban consumer group. Key... -

Page 161

.... Agreement to exchange amounts of one currency for another currency at an agreed fixed rate at a future date. A currency in which a company conducts most of its business and reports its financial results to the parent company or the investing public. An intangible asset that quantifies the price... -

Page 162

... a particular asset (for example shares or foreign exchange) at a pre-determined price (strike price) on or before a specific date. Sales directly generated through a store operated by adidas. adidas own retail includes concept stores, concession corners, e-commerce and factory outlets. Professional... -

Page 163

..., supply chain business partners, shareholders, employees, international sports bodies, non-governmental organizations, the media, etc. The process of developing, producing and transporting products to customers. Women's Tennis Association Working capital is a company's short-term disposable capital... -

Page 164

adidas-Salomon SEGMENTAL INFORMATION: SIX YEAR OVERVIEW 1) â,¬ in millions 2003 BRANDS adidas Net sales Gross profit Operating profit Operating assets Salomon Net sales Gross profit Operating profit Operating assets TaylorMade-adidas Golf Net sales Gross profit Operating profit Operating assets 1) ... -

Page 165

adidas-Salomon SEGMENTAL INFORMATION: SIX YEAR OVERVIEW â,¬ in millions 2003 REGIONS Europe Net sales Gross profit Operating profit Operating assets North America Net sales Gross profit Operating profit Operating assets Asia Net sales Gross profit Operating profit Operating assets Latin America Net ... -

Page 166

... commission income Financial result Income before taxes Income taxes Minority interests Net income 2) P&L Ratios Gross margin SG&A expenses as a percentage of net sales Operating margin Effective tax rate Net income as a percentage of net sales 2) Working capital turnover Interest coverage Return on... -

Page 167

...-to-fixed-assets ratio Asset coverage I Asset coverage II Current asset intensity of investments Liquidity I Liquidity II Liquidity III Data Per Share â,¬ Basic earnings per share 2) Operating cash flow Dividend per share Dividend payout (in thousands) Number of outstanding shares at year-end (in... -

Page 168

...49(0)9132 84-3127 e-mail: investor.relations @adidas.de www.adidas-Salomon.com/en/investor/ adidas-Salomon is a member of DAI (German Share Institute), DIRK (German Investor Relations Association) and NIRI (National Investor Relations Institute, USA). This report is also available in German. CONCEPT... -

Page 169

... PRESS RELEASE 2003 FULL YEAR RESULTS ANNUAL REPORT PUBLICATION ANALYST AND PRESS CONFERENCES PRESS RELEASE, CONFERENCE CALL AND WEBCAST FIRST QUARTER 2004 RESULTS PRESS RELEASE, CONFERENCE CALL AND WEBCAST ANNUAL GENERAL MEETING IN FÃœRTH, BAVARIA, GERMANY WEBCAST DIVIDEND PAID 1) FIRST HALF 2004... -

Page 170

adidas-Salomon AG WORLD OF SPORTS /// ADI-DASSLER-STRASSE 1 91074 HERZOGENAURACH /// GERMANY TEL: +49(0)9132 84-0 /// FAX: +49(0)9132 84-2241 www.adidas-Salomon.com