Access America 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

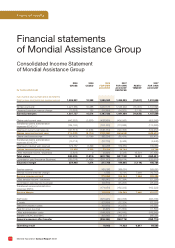

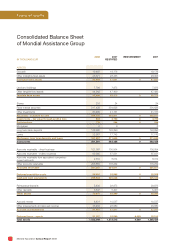

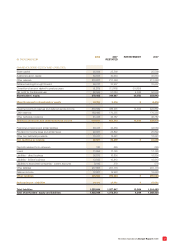

28 Mondial Assistance Annual Report 2008

Financial results

Review of Operations

For the year 2008

In 2008, Mondial Assistance reached

its targets by achieving 1.6 billion euros

gross turnover with a combined ratio

below 95%. This good result was possible

thanks to the insurance business whose

written premiums increased by +8.1%

compared to last year, along with stable

service revenues.

48% of the revenues come from travel

insurance products, such as trip cancella-

tion, medical costs coverage and medical

assistance. This line of business had a

growth of +2.8% in 2008 with a clear trend

to internet online business through travel

agents and airlines companies.

The business contributing to the half of

the total growth was automotive. Repre-

senting 39% of the total group revenues,

with mainly roadside assistance prod-

ucts, the line of business automotive

had a growth of +8.1%.

The remaining part of the business is

split between the third line of business

health and lifecare services, representing

8% of the total revenues, and the fourth

one property & others with 5% revenue

share. The corresponding products

sold mainly on the fi nance market had

respectively turnover increases of +7.1%

and +18.7%.

Geographically, the Americas and EMEA

regions were the main contributors

to the growth of revenues in volume,

respectively with +18.6% and +4.1%,

followed by Asia Pacifi c with +7.9%.

The strong growth, mainly coming

from France, Brazil, Italy and the USA,

was heavily impacted by -40.7 million

euros resulting from important foreign

exchange rates fl uctuations during the

year 2008, the major impacts being with

the British pound, the US dollar and the

Australian dollar.

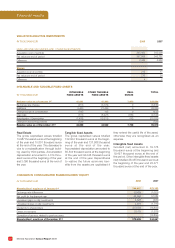

Turnover (Premiums and Service Revenue)

Compared to last year, the claims ratio

improved by 1.4% point from 58.4% to

57.8%. This comes from both a slight

improvement of the current year claims

ratio and also a better run-off from previ-

ous year claims.

Globally the commission ratio gross of

reinsurance moved from 20.7% in 2007

to 20.5% in 2008, which is very stable

as during last years and mostly driven by

the insurance business ratio of 23.9%.

In addition to those improvements, the

effi cient control of the costs has to be

emphasized as the general expenses

increased by only +5.1% to 565.2 million

euros and the general expenses ratio

decreased from 37% in 2007 to 36%

in 2008. In parallel, Headcounts increased

by +4.9% and full time equivalent

increased by +6.1%.

As a consequence of the above men-

tioned improvement, the combined ratio,

as a mix of insurance and service busi-

nesses, improved to 94.9%.

Claims and expenses

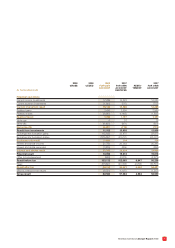

At December 31st, 2008, the Group’s

financial investments amounted to

581.6 million euros, which represent

40.5% of the total assets, compared to

562.4 million euros and 41% in 2007.

In 2008 there were 45 million euros less

long term bank deposits than in 2007,

especially in UK, and 52.3 million euros

more securities available for sale, mainly

coming from more cash invested in

money market mutual funds.

The investments and fi nancial results

decreased by -9.4 million euros in 2008

to 24.1 million euros, thereof -7.6 million

euros coming from exchange rates

result especially on contracts in British

pound, US dollar, Canadian dollar and

euro against Swiss franc. Furthermore,

the result from investments was lower

than in 2007 due to the economic crisis

and the impairment of some bonds.

Investments and fi nancial results