Access America 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2928

Notes to the consolidated financial statements

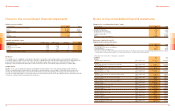

Changes in the consolidated shareholders’ equity

in thousand EUR 2005 2004

Shareholders’ equity on January 1st 268 033 263 653

Exchange rate differences 2 982 850

Net profit for the financial year 47 773 23 121

Unrealised gains on afs investments (561) 1 959

Unrealised losses on afs investments (196) 1 138

Dividends to shareholders (16 752) (20 432)

Others (327) (2 256)

Shareholders’ equity on December 31st 300 952 268 033

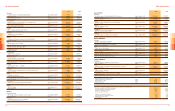

Disclosures of Article 663 a/b CO,

supplemented by voluntary information

in thousand EUR if not otherwise indicated 2005 2004

1. Contingent liabilities 57 972 48 335

2. Assets pledged as security for own obligations 129 129

3. Leasing obligations 78 618 98 329

4. Fire insurance value for tangible assets 85 932 76 400

5. Elvia Reiseversicherungs-Gesellschaft AG, Zurich and Elmonda belong to the the Allianz Suisse Insurance value added tax group and are therefore jointly and

severably liable for all value added tax liablities of the value added tax group to the Swiss Federal Tax Administration.

6. Participations with at least 20% of voting rights or capital share

EUROPE 2005 2004

Austria

ELVIA Assistance GmbH, Vienna Share capital in ATS 15 000 000 15 000 000

Purpose: Assistance and services Share 100% 100%

Belgium

Société Belge d’Assistance Internationale S.A., Bruxelles Share capital in EUR 7 709 000 7 709 000

Purpose: Insurance Share 94.10% 94.10%

Société Belge de Services Téléphoniques S.A., Bruxelles Share capital in EUR 74 400 74 400

Purpose: Services Share 94.39% 94.39%

Czech Republic

ELVIA Assistance s.r.o., Prague Share capital in CZK 30 000 000 30 000 000

Purpose: Services Share 100% 100%

France

Mondial Assistance Réunion S.A., Saint Denis (Reunion Island) Share capital in EUR 329 008 329 008

Purpose: Services Share 99.86% 99.86%

Gestion de Télésécurité et de Services S.A., Chatillon Share capital in EUR 720 000 720 000

Purpose: Services Share 99.86% 99.86%

France Secours International Assistance S.A., Bagnolet Share capital in EUR 2 745 000 2 745 000

Purpose: Services Share 90.98% 90.98%

FS2A S.A., Paris Share capital in EUR 10 775 000 37 000

Purpose: Insurance Share 90.98% 90.97%

Mondial Assistance France S.A., Paris Share capital in EUR 7 916 400 7 916 400

Purpose: Services Share 93.24% 93.24%

Fragonard Assurance S.A., Paris Share capital in EUR 25 037 000 37 000

Purpose: Insurance Share 93.24% 93.23%

Mondial Assistance S.A.S, Paris Share capital in EUR 20 088 900 20 088 900

Purpose: Holding Share 99.99% 99.99%

SACNAS International S.A., Paris Share capital in EUR 7 959 936 7 959 936

Purpose: Holding Share 99.88% 99.88%

SAGE S.A., Chatillon Share capital in EUR 22 500 22 500

Purpose: Services Share 99.86% 99.86%

Société Européenne de Protection et de Services d’Assistance à Domicile S.A., Paris Share capital in EUR 174 750 174 750

Purpose: Security and others Share 55.94% 55.94%

Société de Services Communs, Paris Share capital in EUR 221 067 221 067

Purpose: Services Share 95.14% 95.14%

Notes to the consolidated financial statements

Valuation reserve securities

in thousand EUR 2005 2004

Fixed-income securities and other investments

Cost 511 099 452 391

Fair value 519 158 460 931

Revaluation reserve 8 059 8 540

Shares

Cost 17 16

Fair value 22 20

Revaluation reserve 5 4

Intangible and tangible assets

in thousand EUR intangible assets tangible assets real estate Total

Balance value on December 31st, 2004 31 993 38 061 7 914 77 968

Exchange rate change 2 346 1 613 0 3 959

Additions 11 556 23 320 0 34 876

Change scope of consolidation 2 735 422 0 3 157

Disposals -3 235 -19 931 0 -23 166

Depreciations -6 626 -2 631 221 -9 036

Balance value on December 31st, 2005 38 769 40 854 8 135 87 758

Real Estate

The capitalised cost of buildings is calculated on the basis of acquisition cost and depreciation over a maximum of 50 years in

accordance with the useful life of the real estate. The gross capitalised values totalled 18.357 million Euros at the beginning of the

year and 18.639 million Euros at the end of the year. Accumulated depreciation amounted to 10.443 million Euros at the

beginning of the year and 10.504 million Euros at the end of the year. No unscheduled depreciation was recorded in 2005.

Tangible Assets

Tangible assets such as equipment, vehicles and hardware are depreciated over 3 to 10 years according to their useful lifes.

The gross capitalised values totalled 109.041 million Euros at the beginning of the year and 112.995 million Euros at the end of

the year. Accumulated depreciation amounted to 70.981 million Euros at the beginning of the year and 72.141 million Euros at

the end of the year. Expenditures to restore the future economic benefits from the assets are capitalised if they extend the useful life

of the asset, otherwise they are recognised as an expense.