Access America 2005 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2005 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ratio of 96.1% (+ 0.3 points or 95.8%

compared to the previous year).

Investments and financial results

At December 31st, 2005 the group's

financial investments amounted to

537.1 million euros (2004: 467.2

million euros). The relatively high

amount of cash and cash equivalents

(159 million euros or + 16.6%

compared to the 136 million euros

in 2004) is caused by the positive

cash flow in 2005, and the inverse

yield curve in the UK, which lead our

subsidiary to invest in short-term

papers.

Ordinary results of the investment

income increased to 23.3 million

euros (2004: 18.4 million euros) as

market interest rates recovered.

This increase was also due to a

higher investment portfolio on fixed

interest securities and short term

deposits. The realised result with

3.2 million euros (previous year: loss

of 11.5 million euros) returned to a

normal level after an exceptional

loss due to the sale of the Group’s

participation in a French subsidiary

in 2004. The accountancy result

was marginal in 2005 as the write-up

participations of a South American

subsidiary boosted the 2004 write-

ups’ result. Unrealized gains and

losses on exchange rates amounted

to 3.7 million euros thanks to a

re-evaluation of the U.S. and

Australian dollars against the Swiss

franc. In total, the described effects

tripled the financial result in 2005 to

30.5 million euros (2004: 10.1 million

euros).

Result before and after tax, and

return on equity

Despite a higher administration

expenses ratio, which included

exceptional non-recurrent items,

the strong increase in net earned

turnover (+9.3%), and modest

growing claims and commissions

ratios resulted in a stable net

operating result of 45.6 million euros,

up 2% compared to the 44.6 million

euros registered in 2004. Thanks to

the higher financial result and the

absence of an exceptional result

(2004: 3.2 million euros), profit

before taxes attained 76.1 million

euros (2004: 51.5 million euros,

+ 47.8%). Deducting the taxes on

profits of 27.0 million euros (2004:

27.8 million euros), which returned

to a normal level, profit after taxes

doubled to47.8 million euros

compared to the previous year’s

23.1 million euros (+ 107%).

Correspondingly, the return on

equity throughout the twelve-month

period ending December 31st, 2005,

was substantially higher (+93%) at

16.8%, up from 8.7% in 2004.

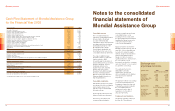

Changes in Group structure

2005 saw several changes in the

Group’s structure. These include

an increase or decrease in

shareholder stakes, and the sale

or closing of companies. Details

of these operations can be found

in the chapter “Notes of the

consolidated financial statements”,

starting on page 23 of this report.

19

All our lines of business posted

growth: +11 % in vehicle assis-

tance, +9 % in travel insurance

sales and +30 % in healthcare

services.

“

“

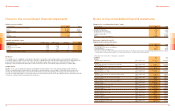

Turnover (Premium and Service

Revenue)

Mondial Assistance Group

achieved +11% growth in turnover

(gross written turnover, both

insurance premiums and service

fees), reaching 1,220.5 million

euros throughout the twelve-month

period ending December 31st, 2005.

The more favorable market condi-

tions within the three main lines of

business - travel insurance, vehicle

assistance and healthcare services

- helped generate this growth.

In the European market where new

vehicle sales were virtually stagnant

in 2005 (+ 0.7%), the need for

sophisticated automotive assistance

nevertheless led to an 11% growth

in turnover, primarily in Europe

and Brazil. Automotive assistance

represents 44% of total Group

turnover.

Travel insurance sales increased by

9% to reach an overall 45% share

of total turnover. This continued

positive development (compared

to previous years) can mostly be

attributed to the strong demand for

travel insurance in North America

and Asia, and the enhanced

prescription of e-commerce products

in North America and Europe.

The third line of business, healthcare

services, continues to expand. It

increased its turnover by 30% in

2005 for a current 6% of the

Group’s overall sales.

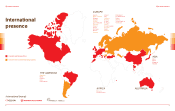

From a geographical perspective,

sales development was particularly

strong in certain markets, and all

regions registered growth. Turnover

increased in the Asia–Pacific region

by + 43% compared to 2004, the

Americas by + 29%, Europe (excluding

France) by + 7% and France with a

modest increase of 3%.

The fluctuation of currency

exchange rates also affected the

Group’s turnover in 2005, resulting

in a positive net increase of 16.0

million euros this year, (this was

mostly due to fluctuations of the

Brazilian Real, and the Australian

and Canadian Dollars), compared to

a hypothetical situation at constant

exchange rates in 2004.

Claims and Expenses

The claims ratio (including internal

claims administration costs, net of

reinsurance) in the insurance busi-

ness increased slightly to 61.9%

(2004: 61.6%), while claims reserves

were up by 4.1% to 131.4 million

euros. This development reflects

the resurgence in the travel insurance

activity: as travel insurance generates

claims with a longer run-off period

and higher average costs than assis-

tance activities, the ratio of claims

reserves to premiums, or claims paid,

is thus higher in travel insurance

than in assistance insurance.

Compared to 2004, Mondial

Assistance Group’s reported global

commission ratio (gross of reinsur-

ance) modestly increased to 17.5%

(both for insurance and service

activities).

Overall, operating entities maintained

efficient control of expenses despite

the powerful growth in turnover.

Nevertheless, general expenses

increased by 11.2% to 455 million

euros (2004: 409 million euros) due

to exceptional non-recurrent items.

Although claims and commissions

developed positively in an environ-

ment marked by a heavy increase

in premiums, the higher expenses

lead to a slightly worse combined

18

Review of operations

for the year 2005

Annual closing December 31st, 2005

Consolidated accounts