Access America 2005 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2005 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidation scope

The consolidated financial

statements of Mondial Assistance

Group comprise the annual

accounts of Elmonda and

subsidiaries, which are prepared in

accordance with the accounting

and valuation principles of the

Mondial Assistance Group.

Consolidated subsidiaries are

listed further in the notes to the

consolidated financial statements.

The stake in ISAAF Mondial

Assistance, Morocco, has been

further reduced in 2005.

In Luxembourg, the operation of

Sacnas RE has been closed down

and was liquidated. In Chile,

Compania de Asistencia

Sudamericana S.A. and CAS

Brokers S.A. were sold on

November 18th, 2005. Mondial

Assistance Germany GmbH,

Munich increased its interest in

Rehacare GmbH, Munich to a

majority participation.

Consolidation principles

Subsidiaries have been recorded

according to the full consolidation

method when subject to the

majority control of the Mondial

Assistance Group.

All intra-group transactions and

balances have been eliminated.

Interests in joint ventures are

recognised by including the

accounts using the proportionate

consolidation basis, i.e. by

including in the accounts under

the appropriate financial statement

headings the Group's proportion

of the joint venture revenues,

costs, assets and liabilities.

Equity investments in which the

Mondial Assistance Group owns at

least 20% of the voting rights are

accounted for using the equity

method, except for investments in

which the Mondial Assistance

Group is not able to exercise

significant influence, in which case,

the cost method is used.

Investments in which the company

owns less than 20 %, are ccounted

for under the cost method.

The equity and net income

attributable to minority

shareholders' interests are

diclosed separately in the balance

sheet and income statement

respectively.

The purchase method of accounting

is used for acquired businesses.

Companies acquired or disposed

of during the year are included in

the consolidated financial

statements from the date of

acquisition or to the date of

disposal respectively.

Foreign currency translation

The Group’s reporting currency is

the Euro (€). The functional

23

Notes to the consolidated

financial statements of

Mondial Assistance Group

Exchange rates

of principal currencies

(against 1 euro) 2005 2004

Balance Sheet year end rate

Australia (AUD) 1.6109 1.7489

Japan (JPY) 138.9000 139.8300

Brazil (BRL) 2.7515 3.6206

United Kingdom (GBP) 0.6853 0.7071

Switzerland (CHF) 1.5551 1.5437

USA (USD) 1.1797 1.3640

(against 1 euro) 2005 2004

Income Statement average rate

Australia (AUD) 1.6322 1.6904

Japan (JPY) 136.8628 134.4559

Brazil (BRL) 2.8979 3.6279

United Kingdom (GBP) 0.6839 0.6787

Switzerland (CHF) 1.5482 1.5660

USA (USD) 1.2443 1.2438

22

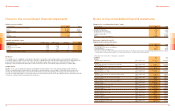

Cash Flow Statement of Mondial Assistance Group

for the Financial Year 2005

in thousand EUR 2005 2004

Net result of the period 47 773 23 121

Change in unearned premiums reserve 50 615 32 614

Change in claims and claim handling costs 5 181 15 046

Change in other technical reserves 4 218 1 094

Change in deferred acquisition costs -5 209 -596

Change in deposits held by others under reinsurance business assumed -3 456 -2 116

Change in deposits held under reinsurance business ceded 300 -111

Change in accounts receivable / payable on reinsurance business -9 015 -4 086

Change in loans and advances to banks and customers -13 644 603

Change in liabilities to banks and customers 4 972 477

Change in other receivables and liabilities 29 337 -37 783

Change in deferred tax assets / liabilities -4 477 -2 501

Adjustment for investment income/expenses not involving movements of cash 0 0

Adjustments to reconcile amortization of goodwill -17 091 2 577

Depreciations 4 015 10 370

Other -2 675 -1 938

Cash flow from operating activities 90 844 36 771

Change in securities available for sale* -59 333 -45 082

Change in real estate -282 3 018

Change in other investments 4 254

Change in cash and cash equivalents from the acquisition of cons. affiliated companies 2 022 34

Other 2 072 -11 059

Cash flow from investing activities -55 517 -52 835

Cash inflow from capital increases 245 51

Dividend payouts -16 551 -19 946

Other from shareholder equity and minority interests 3 632 -1 365

Cash flow from financing activities -12 674 -21 260

Change in cash and cash equivalents 22 653 -37 324

Cash and cash equivalents at beginning of period 135 859 173 183

Cash and cash equivalents at end of period 158 512 135 859

* including unreal. loss/gain reserves on investments available for sale