AIG 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 AIG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4Letter to Shareholders

strength and claims management expertise

enabled us to respond to a catastrophe of

this magnitude. I am extremely proud of

AIG’s actions, including our employees’

outstanding and generous response to the

victims of Hurricane Katrina and the other

disasters. Their financial support through

the AIG Disaster Relief Fund was

matched by personal commitment through

volunteer efforts and personal sacrifices on

behalf of AIG colleagues and customers in

need. AIG matched our employees’ contri-

butions to the Fund on a dollar-for-dollar

basis, and, in sum, the AIG Disaster Relief

Fund collected a total of $8.6 million in

2005. In addition, AIG’s claims personnel

turned in excellent performance in coming

to the aid of our policyholders along the

Gulf Coast.

AIG’s total shareholders’ equity at

December 31, 2005 was $86.32 billion, an

increase of 8.3 percent from year-end

2004. AIG remains among the most

strongly capitalized organizations in our

industry. Cash flow from our insurance

operations and our balance sheet remain

very strong. AIG invests an average of

$200 million a day, and the majority of

our portfolio consists of high quality fixed

income assets. Worldwide revenues in

2005 were $108.91 billion. For 2005, AIG

achieved a return on equity of 12.3 percent.

AIG’s ability to report solid earnings

and cash flow in the face of difficult

external and internal issues reflects the

diversity and strength of our major busi-

nesses – General Insurance, Life Insurance

& Retirement Services, Financial Services

and Asset Management. All are global

businesses, and all are well positioned in

their domestic and overseas markets.

AIG’s franchise is unmatched. Our entre-

preneurial culture also sets AIG apart from

others – something that has characterized

the organization from its earliest days –

and this will not change. Our network of

714,000 agents and brokers around the

world produce business from a worldwide

customer base of some 65 million cus-

tomers. Finally, our financial strength,

which is the bedrock of this company, pro-

vides us with a multitude of opportunities

around the globe.

In recent months, we have made

progress in stabilizing AIG’s ratings.

Currently, Standard & Poor’s rates AIG’s

long-term debt “AA”, and most of our

financial strength ratings are “AA+”.

Moody’s rates AIG’s long-term debt “Aa2”,

and our financial strength ratings are

either “Aa1” or “Aa2”. Fitch rates AIG’s

long-term debt “AA” and our financial

strength ratings are “AA+”. A.M. Best

rates AIG’s insurance companies “A+”.

At these levels, AIG’s ratings are among

the highest of any insurance and financial

services organization in the world.

Accounting Issues and Corporate Governance

As has been widely reported

during the past year, AIG con-

ducted an extensive internal

review, carried out in conjunction with

outside counsel and our independent

accounting firm. With the filing of our

2004 Annual Report on Form 10-K/A, we

restated our financial statements for the

years ended December 31, 2004, 2003 and

2002, along with affected Selected

Consolidated Financial Data for 2001 and

2000, and quarterly financial information

for 2004 and 2003. We also restated the

first three quarters of 2005. These actions

are consistent with AIG’s commitment to

correct all material errors and to provide

greater transparency in the company’s

financial statements and accounting in

the future.

Other important changes have

occurred in our corporate governance

procedures. Our Board of Directors has

adopted a majority voting guideline and a

mandatory retirement age of 73. The

Board has also put in place another

guideline to reflect its view that at least

two-thirds of AIG’s Board should be

independent, as defined by the New York

Stock Exchange, and approved a change

in AIG’s bylaws to provide that the role

of Chairman should be separate from that

of the CEO, and that the Chairman

should be selected from the independent

Directors. We are also providing greater

information in our financial statements

and continue to build an open and

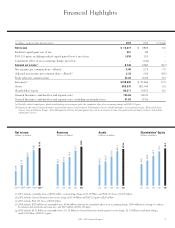

Our total shareholders’ equity

at year-end 2005

was $86.32 billion.