eTrade 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

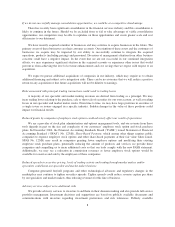

December 31, Variance

2006 2005 2004 2003 2002 2006 vs. 2005

Financial Condition:

Available-for-sale mortgage-backed

and investment securities $13,922.0 $12,763.4 $12,635.8 $ 9,906.2 $ 8,273.8 9 %

Total loans, net $26,656.2 $19,512.3 $11,785.0 $ 9,131.4 $ 7,365.7 37 %

Brokerage receivables, net $ 7,636.4 $ 7,174.2 $ 3,034.5 $ 2,297.8 $ 1,421.8 6 %

Total assets $53,739.3 $44,567.7 $31,032.6 $26,049.2 $21,455.9 21 %

Deposits $24,071.0 $15,948.0 $12,303.0 $12,514.5 $ 8,400.3 51 %

Corporate debt(1) $ 1,842.2 $ 2,022.7 $ 585.6 $ 695.3 $ 695.3 (9)%

Capital lease liability $ — $ — $ 0.2 $ 0.9 $ 4.4 *

Mandatorily redeemable capital

preferred securities(2) $ — $ — $ — $ — $ 143.4 *

Shareholders’ equity $ 4,196.4 $ 3,399.6 $ 2,228.2 $ 1,918.3 $ 1,505.8 23 %

* Percentage not meaningful.

(1) Corporate debt represents senior notes, mandatory convertible notes and convertible subordinated notes.

(2) Mandatorily redeemable capital preferred securities were deconsolidated beginning in 2003 in accordance with SFAS No. 150,

Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity. These securities are no longer

classified as preferred securities; however, they are in the balance sheet under other borrowings.

(Dollars in billions): At or For the Year Ended December 31, Variance

2006 2005 2004 2003 2002 2006 vs. 2005

Key Measures:

Retail client assets(1) $ 194.9 $ 177.9 $ 100.0 $ 82.9 $ 49.6 10 %

Customer cash and deposits(1) $ 33.6 $ 28.2 $ 18.7 $ 19.0 $ 17.3 19 %

Daily Average Revenue Trades 159,348 97,740 83,643 77,052 66,588 63 %

Average commission per trade $ 12.05 $ 13.82 $ 15.63 $ 16.41 $ 17.01 (13)%

Products per customer 2.1 2.1 1.9 1.7 N/A 0 %

Enterprise net interest spread (basis

points)(2) 285 249 229 N/A N/A 14 %

Enterprise interest-earning assets,

average(2) $ 45.4 $ 32.4 $ 26.2 N/A N/A 40 %

Operating margin (%) 41% 38% 33% 14% 21% 3 %

Compensation and benefits as a % of

revenue 19% 22% 24% 27% 25% (3)%

Total employees (period end) 4,126 3,439 3,320 3,455 3,478 20 %

(1) Customer cash and deposits, as well as retail client assets, have been re-presented to account for a methodology change in the metric to

settlement date from trade date reporting as of December 31, 2005 which reduced both metrics by $564 million. This is not a

methodology change in accounting policy and does not impact the reporting of these items on our balance sheet.

(2) The Enterprise net interest spread and Enterprise interest-earning assets, average for 2003 and 2002 are not presented as the information

was not tracked on an enterprise level for those years.

The selected consolidated financial data should be read in conjunction with Item 7. Management’s

Discussion and Analysis of Financial Condition and Results of Operations and Item 8. Financial Statements and

Supplementary Data.

18