eTrade 2006 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2006 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sale of Unregistered Shares

In August 2006, we issued 847,276 shares of common stock in connection with our acquisition of

Retirement Advisors of America, Inc (“RAA”). No underwriters were involved, and there were no underwriting

discounts or commissions. The securities were issued under the exemption from registration provided under

Section 4(2) of the Securities Act. These shares of common stock were sold by the issuer in a transaction not

involving a public offering. We filed a registration statement on August 7, 2006, which was declared effective

immediately.

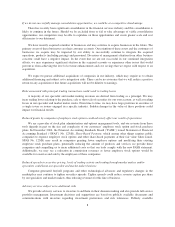

Performance Graph

The following performance graph shows the cumulative total return to a holder of the Company’s common

stock, assuming dividend reinvestment, compared with the cumulative total return, assuming dividend

reinvestment, of the Standard & Poor’s (“S&P”) 500 and the S&P Super Cap Diversified Financials during the

period from December 31, 2001 through December 31, 2006.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among E*TRADE Financial Corporation, The S & P 500 Index

And The S & P Super Cap Diversified Financials

$0

$50

$100

$150

$200

$250

12/01 12/02 12/03 12/04 12/05 12/06

E*TRADE Financial Corporation

S & P 500

S & P Super Cap Diversified Financials

12/01 12/02 12/03 12/04 12/05 12/06

E*TRADE Financial Corporation 100.00 47.41 123.41 145.85 203.51 218.73

S & P 500 100.00 77.90 100.24 111.15 116.61 135.03

S & P Super Cap Diversified Financials 100.00 81.40 113.27 126.97 138.91 170.85

• $100 invested on 12/31/01 in stock or index-including reinvestment of dividends. Fiscal year ending

December 31.

• Copyright ©2007, Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. All rights reserved.

www.researchdatagroup.com/S&P.htm

16