eTrade 2004 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2004 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

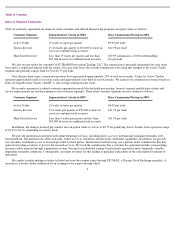

2004, we primarily segmented our domestic retail customers and offered them pricing programs on equity trades as follows:

We also execute trades for customers of E*TRADE Professional Trading, LLC. The commission is primarily determined on a per share

basis and is a negotiated amount with the traders. On a per trade basis, the average commission is less than that charged to the Active Trader

segment and generally ranges from $1.50 to $1.75 per trade.

Over the past three years, commission revenues have represented approximately 23% of total net revenues. Trades by Active Traders

represent approximately half of our retail trades and approximately one-

third of our total trades. We analyze our commission revenues based on

Daily Average Revenue Trades (“DART”s) and average commission per trade.

We recently announced a refined customer segmentation model that included new pricing, lowered segment qualification criteria and

service enhancements for our three primary retail customer segments. These retail customer segments are now defined as follows:

In addition, the changes lowered per contract fees on option trades to as low as $0.75 for qualifying Active Traders from a previous range

of $1.25 to $1.50, depending on activity levels.

We provide institutional customers with online brokerage services, including direct access to international exchanges through a web-

based platform. The platform also offers real-time, online access to statements and electronic settlement capabilities. In addition, we provide

our customers worldwide access to research provided by third parties. Institutional customers may use a portion of the commissions that they

generate in trading securities to pay for the research services. We track the commissions that a customer has generated and the corresponding

research credits awarded through a proprietary system. Pricing for institutional trading is individually negotiated and is frequently variable

depending on market conditions. Consequently, we report revenues for this trading as principal transactions in the consolidated statement of

operations.

We conduct market-making activities in listed and over-the-counter issues through ETCM-ES, a Chicago Stock Exchange specialist. A

specialist is a broker-dealer authorized by an exchange to be a party through which

4

Customer Segment

Segmentation Criteria in 2004

Base Commission Pricing in 2004

Active Trader

27 trades or more per quarter

$9.99 per trade

Serious Investor

15-

26 trades per quarter or $50,000 or more in

assets in combined retail accounts

$12.99 per trade

Main Street Investor

Less than 15 trades per quarter and less than

$50,000 in assets in combined retail accounts

$19.99 commission + $3.00 order handling

fee per trade

Customer Segment

Segmentation Criteria in 2005

Base Commission Pricing in 2005

Active Trader

15 trades or more per quarter

$6.99 per trade

Serious Investor

9-14 trades per quarter or $50,000 or more in

assets in combined retail accounts

$11.99 per trade

Main Street Investor

Less than 9 trades per quarter and less than

$50,000 in assets in combined retail accounts

$14.99 per trade