eTrade 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 eTrade annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Index to Financial Statements

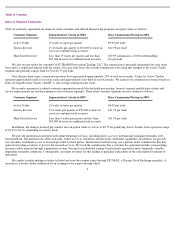

Maturity of Loan Portfolio. The following table shows the contractual maturities of our loan portfolio at December 31, 2004, including

scheduled principal repayments. This table does not, however, include any estimate of prepayments. These prepayments could significantly

shorten the average loan lives and cause the actual timing of the loan repayments to differ from those shown in the following table (in

thousands):

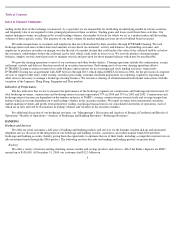

The following table shows the distribution of those loans that mature in more than one year between fixed and adjustable interest rate

loans at December 31, 2004 (in thousands):

Delinquent, Nonperforming and Other Problem Assets

Due in

Total

< 1 Year

1-5 Years

> 5 Years

Real estate loans:

One

-

to four

-

family:

Fixed rate

$

24,282

$

3,353

$

497,785

$

525,420

Adjustable rate

18

282

3,388,467

3,388,767

Home equity lines of credit and second mortgage

—

2,728

3,617,355

3,620,083

Other

—

1,628

124

1,752

Total real estate loans

24,300

7,991

7,503,731

7,536,022

Consumer and other loans:

Recreational vehicle

443

47,919

2,517,567

2,565,929

Marine

85

49,253

674,787

724,125

Automobile

26,753

542,957

13,679

583,389

Credit card

203,169

—

—

203,169

Other

468

16,204

4,783

21,455

Total consumer and other loans

230,918

656,333

3,210,816

4,098,067

Total loans

$

255,218

$

664,324

$

10,714,547

$

11,634,089

Interest Rate Type

Total

Fixed

Adjustable

Real estate loans:

One

-

to four

-

family

$

501,138

$

3,388,749

$

3,889,887

Home equity lines of credit and second mortgage

169,815

3,450,268

3,620,083

Other

991

761

1,752

Total real estate loans

671,944

6,839,778

7,511,722

Consumer and other loans:

Recreational vehicle

2,565,486

—

2,565,486

Marine

724,040

—

724,040

Automobile

556,636

—

556,636

Other

18,116

2,871

20,987

Total consumer and other loans

3,864,278

2,871

3,867,149

Total loans

$

4,536,222

$

6,842,649

$

11,378,871

We continually monitor our loan portfolio to anticipate and address potential and actual delinquencies. Based on the length of the

delinquency period, we reclassify these assets as nonperforming and, if necessary, take possession of the underlying collateral. Once we take

possession of the underlying collateral, we classify the property as other assets on our consolidated balance sheets.

13