XM Radio 2001 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 XM SATELLiTE RADiO 2 0 0 1 Annual Report

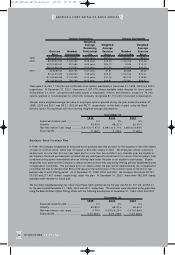

(h) Accrued Network Optimization Expenses

In December 2001, the Company determined that the planned number of terrestrial repeater sites could be reduced

due to a network optimization study that was conducted. The Company established a formal plan and recognized a

charge of $26,300,000 with respect to the terrestrial repeater sites no longer required. Included within the charge

is $8,595,000 for costs to be incurred in 2 002 related to these sites.

The Company estimated lease termination costs based upon contractual lease costs and expected negotiation

results as determined by discussions with landlords and consultants. Approximately 53% of these leases are

subject to master lease agreements with large tower companies. Based upon preliminary discussions with the

tower companies, the Company assumed that they would be able to swap a portion of the existing sites for other

sites in other areas in which terrestrial repeater networks will be developed in the future, without incurring all of the

contractual obligations. As a result, the Company estimated the total of the lease termination costs would be

substantially lower than the contractual lease obligations. The contractual payments amount to approximately

$35,100,000. Additionally, the Company’s leases typically contain a clause that requires the Company to return a

site to its original condition upon lease termination. The Company has established an accrual of $8,59 5,000 for

the estimated lease termination costs and costs to deconstruct the sites. The actual amount to be incurred could

vary significantly from this estimate.

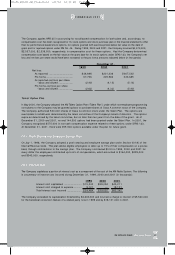

(i) Warrants

Sony Warrant

In February 2000, the Company issued a warrant to Sony exercisable for shares of the Company’s Class A common

stock. The warrant will vest at the time that the Company attains its millionth customer, and the number of shares

underlying the warrant will be determined by the percentage of XM Radios that have a Sony brand name as of the

vesting date. If Sony achieves its maximum performance target, the warrant will be exercisable for 2% of the total

number of shares of the Company’s Class A common stock on a fully-diluted basis. The exercise price of the Sony

warrant will equal 105% of fair market value of the Class A common stock on the vesting date, determined based

upon the 20-day trailing average. As the Company has commenced commercial operations and Sony began selling

its radios in the fourth quarter of 2001, the Company recognized $13 1,000 of compensation expense related to

this warrant in 2001.

CNBC Warrant

In May 2001, the Company granted a warrant to purchase 90,000 shares of Class A common stock consisting

of three 30,00 0 share tranches to purchase shares at $26.50 per share, which expire in 11, 12, and 13 years,

respectively. The warrants began to vest on September 25, 2001 when the Company reached its commercial

launch and will be vested on September 1, 2002, 2003 , and 2004, respectively. The Company recognized

$290,000 in non-cash compensation expense related to these warrants in 2001.

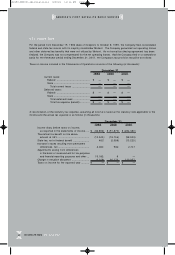

(j) Sales, Marketing and Distribution Agreements

The Company has entered into various joint sales, marketing and distribution agreements. Under the terms of these

agreements, the Company is obligated to provide incentives, subsidies and commissions to other entities that may

include fixed payments, per-unit radio and subscriber amounts and revenue sharing arrangements. The amount of

these operational, promotional, subscriber acquisition, joint development, and manufacturing costs related to these

agreements cannot be estimated, but are expected to be substantial future costs. During the years ended December

31, 1999, 2000 and 2001 the Company incurred expenses of $ 0, $0 and $19,545,000, respectively, in relation to

these agreements. The amount of these costs will vary in future years, but is expected to increase in the next year

as the number of subscribers and revenue increase.

(k) Programming Agreements

The Company has entered into various programming agreements. Under the terms of these agreements, the

Company is obligated to provide payments and commissions to other entities that may include fixed payments,

advertising commitments and revenue sharing arrangements. The amount of these costs related to these agreements

AMERiCA’S FiRST SATELLiTE RADiO SERViCE

81690_XM2001_AR_Financials 4/9/02 12:33 PM Page 38