XM Radio 2001 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

XM SATELLiTE RADiO 2 001 Annual Report

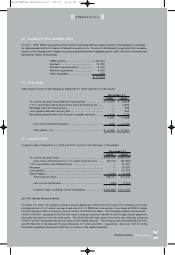

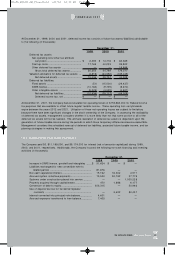

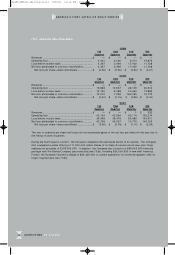

(e) Terrestrial Repeater System Contracts

As of December 31 , 2001, the Company had incurred aggregate costs of approximately $243,500,000 for its

terrestrial repeater system. These costs covered the capital costs of the design, development and installation

of a system of terrestrial repeaters to cover approximately 60 cities and metropolitan areas. In August 1999, the

Company signed a contract with LCCI calling for engineering and site preparation. As of December 31 , 2001, the

Company had paid $109,860,000 and accrued an additional $15 ,407,000 under this contract. The Company also

entered into a contract effective October 2 2, 1999 with Hughes for the design, development and manufacture of

the terrestrial repeaters. Payments under the contract are expected to be approximately $128,000,000 , which

could be modified based on the number of terrestrial repeaters that are required for the system. As of December

31, 2001, the Company had paid $95,788,000 and accrued an additional $7,685,000 under this contract.

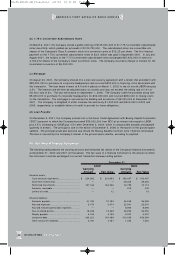

(f) GM Distribution Agreement

The Company has signed a long-term distribution agreement with the OnStar division of GM providing for the

installation of XM radios in GM vehicles. During the term of the agreement, which expires 12 years from the

commencement date of the Company’s commercial operations, GM has agreed to distribute the service to the

exclusion of other S-band satellite digital radio services. The Company will also have a non-exclusive right to

arrange for the installation of XM radios included in OnStar systems in non-GM vehicles that are sold for use in the

United States. The Company has significant annual, fixed payment obligations to General Motors through 2004.

These payments approximate $35 ,000,000 in the aggregate during this period. Additional annual fixed payment

obligations beyond 2004 range from less than $ 35,0 00,000 to approximately $130,000,000 through 2009,

aggregating approximately $400,0 00,0 00. In order to encourage the broad installation of XM radios in GM

vehicles, the Company has agreed to subsidize a portion of the cost of XM radios, and to make incentive payments

to GM when the owners of GM vehicles with installed XM radios become subscribers for the Company’s service.

The Company must also share with GM a percentage of the subscription revenue attributable to GM vehicles with

installed XM radios, which percentage increases until there are more than 8 million GM vehicles with installed XM

radios. The Company will also make available to GM bandwidth on the Company’s systems. The agreement is

subject to renegotiations at any time based upon the installation of radios that are compatible with a unified

standard or capable of receiving Sirius Satellite Radio, Inc.’s (“Sirius Radio”) service. The agreement is subject to

renegotiations if, four years after the commencement of the Company’s commercial operations and at two-year

intervals thereafter GM does not achieve and maintain specified installation levels of GM vehicles capable of receiving

the Company’s service, starting with 1,240 ,000 units after four years, and thereafter increasing by the lesser of

600,000 units per year and amounts proportionate to target market shares in the satellite digital radio service

market. There can be no assurances as to the outcome of any such renegotiations. GM’s exclusivity obligations

will discontinue if, four years after the Company commences commercial operations and at two-year intervals

thereafter, the Company fails to achieve and maintain specified minimum market share levels in the satellite digital

radio service market. Prior to 2001, the Company had not incurred any costs under the contract. As of December

31, 2001, the Company has paid $608,000 and accrued costs of $656,000 under the agreement.

(g) Joint Development Agreement

On January 12, 1999, Sirius Radio, the other holder of an FCC satellite radio license, commenced an action against

the Company in the United States District Court for the Southern District of New York, alleging that the Company

was infringing or would infringe three patents assigned to Sirius Radio. In its complaint, Sirius Radio sought money

damages to the extent the Company manufactured, used or sold any product or method claimed in their patents and

injunctive relief. On February 16, 2000, this suit was resolved in accordance with the terms of a joint development

agreement between the Company and Sirius Radio and both companies agreed to cross-license their respective

property. Each party is obligated to fund one half of the development cost for a unified standard for satellite radios.

Each party will be entitled to license fees or a credit towards its one half of the cost based upon the validity, value,

use, importance and available alternatives of the technology it contributes. The amounts for these fees or credits

will be determined over time by agreement of the parties or by arbitration. The parties have yet to agree on the

validity, value, use, importance and available alternatives of their respective technologies. The companies have agreed

to seek arbitration to resolve issues with respect to certain existing technology. If this agreement is terminated before

the value of the license has been determined due to the Company’s failure to perform a material covenant or obligation,

then this suit could be refiled.

FiNANCiALS 2001

81690_XM2001_AR_Financials 4/9/02 12:33 PM Page 37