XM Radio 2001 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 XM SATELLiTE RADiO 2 0 0 1 Annual Report

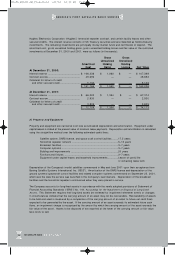

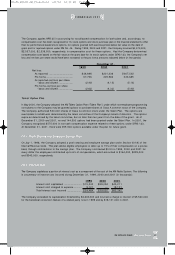

On September 9, 1999, the board of directors of the Company effected a stock split providing 53,514 shares

of stock for each share owned.

In 2000, at the request of the Company, one of the Class B common stockholders converted 1,314,9 14 shares

of the Company’s Class B common stock into Class A common stock on a one-for-one basis.

On July 14, 2000, the Company filed an application with the FCC to allow the Company to transfer its control

from Motient to a diffuse group of owners, none of whom will have controlling interest. On December 22, 2000,

the application was approved by the FCC. In 2001 , Motient converted the remaining 16,557,262 shares of the

Company’s Class B common stock into Class A common stock on a one-for-one basis.

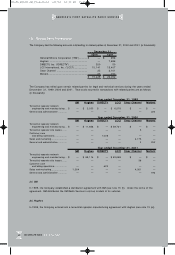

(b) Initial Public Offering

In October 1999, the Company completed an initial public offering of 10,241,000 shares of Class A common

stock at $12.00 per share. The offering yielded net proceeds of $114,134,0 00.

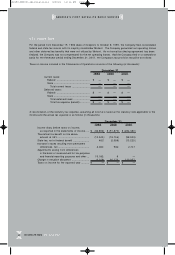

(c) 2000 Common Stock Offering and Sale of Series B Convertible Redeemable Preferred Stock

On January 31, 2000, the Company closed on a secondary offering of its Class A common stock and newly designated

Series B convertible redeemable preferred stock. The Company sold 4,000,0 00 shares of its Class A common

stock for $32.00 per share, which yielded net proceeds of $120,8 37,000. The Company concurrently sold 2,000,000

shares of its Series B convertible redeemable preferred stock for $50.00 per share, which yielded net proceeds of

$96,472,000. The Series B convertible redeemable preferred stock provides for 8.25% cumulative dividends that

may be paid in Class A common stock or cash. The Series B convertible redeemable preferred stock is convertible

into Class A common stock at a conversion price of $40 per share and is redeemable in Class A common stock

on February 3 , 2003. On February 9, 2000, the underwriters exercised a portion of the over-allotment option

for 370,000 shares of Class A common stock, which yielded net proceeds of approximately $11,233,000.

On August 1, 200 0, the Company entered into agreements with certain holders of its 8.25% Series B convertible

redeemable preferred stock to exchange their shares of 8.2 5% Series B convertible redeemable preferred stock

for shares of the Company’s Class A common stock. By August 31, 20 00, the Company had issued 1,700,016

shares of its Class A common stock in exchange for 1,132,711 shares of its 8 .25% Series B convertible

redeemable preferred stock. The Company recorded an $11,2 00,0 00 charge to earnings attributable to

common stockholders in the third quarter related to this transaction. This charge represents the difference in

the fair value of the stock issued upon this conversion in excess of the stock that the holders were entitled to

upon a voluntary conversion.

The Company paid the 2000 quarterly dividends on the 8.25% Series B convertible redeemable preferred stock

on May 1, 2000, August 1, 2000 and November 1, 2000 by issuing 62,318, 57,114 and 25,734 shares of Class

A common stock, respectively, to the respective holders of record. The Company paid the 2001 quarterly dividends

on February 1 , 2001, May 1, 2001, August 1, 2001 and November 1, 2001 by issuing 56,269, 178,099,

63,934 and 167,878 shares of Class A common stock, respectively, to the respective holders of record.

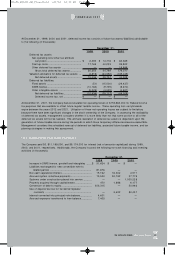

(d) Series C Convertible Redeemable Preferred Stock

On July 7, 2000, the Company reached an agreement for a private offering of 235,000 shares of its Series C

convertible redeemable preferred stock for $1,000 per share, which closed on August 8, 2000 and yielded net

proceeds of $206 ,379,000 and a stock subscription of $20,000,000 that earned interest at 7% per annum until

it was paid on November 30 , 2000. The stock subscription was received in November 2000 and provided an

additional $2 0,443,000. The Series C convertible redeemable preferred stock provides for 8.25% cumulative

dividends payable in cash. As no dividends have been declared on the Series C convertible redeemable preferred

stock, the value of the cumulative dividends has increased the liquidation preference. The Series C convertible

redeemable preferred stock is convertible, at the holders’ option, into Class A common stock at the conversion

price then in effect. Initially, the conversion price was $26.50, but is subject to change upon the occurrence of

certain dilutive events. The conversion price has been adjusted as discussed below. The Company must redeem

the Series C convertible redeemable preferred stock in Class A common stock on February 1, 2012. At its option,

the Company may redeem the Series C convertible redeemable preferred stock beginning on February 8, 2005

in cash or, at the holder’s option, in Class A common stock.

AMERiCA’S FiRST SATELLiTE RADiO SERViCE

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 30