XM Radio 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

XM SATELLiTE RADiO 2 001 Annual Report

FiNANCiALS 2001

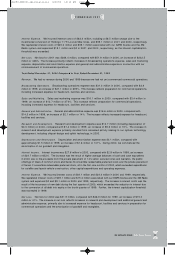

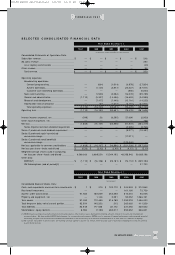

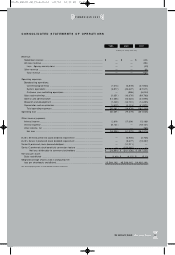

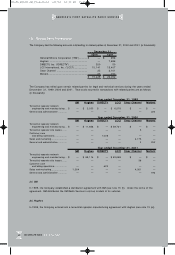

CONSOLiDATED STATEMENTS OF OPERATiONS

(In thousands, except share data)

Revenue:

Subscriber revenue ...................................................................................... $ — $ — $ 246

Ad sales revenue .......................................................................................... — — 294

Less: Agency commissions ...................................................................... — — (43)

Other revenue .............................................................................................. — — 36

Total revenue ............................................................................................ — — 533

Operating expenses:

Broadcasting operations:

Content/ programming .............................................................................. (1 ,0 14 ) (6,878 ) (27,924)

System operations .................................................................................... (2,877) (23,22 7) (6 7,57 1)

Customer care and billing operations.......................................................... — (856 ) (6,034 )

Sales and marketing ..................................................................................... (3,351) (16,078 ) (99,789)

General and administrative............................................................................. (14,49 6) (16,624 ) (24 ,5 95)

Research and development ............................................................................ (7,440) (12,7 01 ) (14,255)

Depreciation and amortization........................................................................ (1 ,5 13 ) (3,115 ) (41,971)

Total operating expenses ........................................................................... (30,691) (79,479 ) (282,13 9)

Operating loss ................................................................................................. (30,6 91 ) (79,4 79 ) (281,60 6)

Other income (expense):

Interest income ............................................................................................. 2,916 27,606 15,198

Interest expense ........................................................................................... (9,121) —(18,1 31)

Other income, net ........................................................................................ — — 16 0

Net loss ................................................................................................... (3 6,89 6) (51,8 73 ) (284 ,37 9)

8.25% Series B preferred stock dividend requirement ......................................... — (5,9 35 ) (3,76 6)

8.25% Series C preferred stock dividend requirement ......................................... — (9,277 ) (19,387)

Series B preferred stock deemed dividend ......................................................... — (11,2 11 ) —

Series C preferred stock beneficial conversion feature ....................................... — (123 ,0 42 ) —

Net loss attributable to common stockholders ........................................ $ (36,896) $ (201,338) $ (30 7,532)

Net loss per share:

Basic and diluted ......................................................................................... $ (2.40) $ (4.15 ) $ (5.13)

Weighted average shares used in computing net

loss per share-basic and diluted ..................................................................... 15 ,3 44 ,1 02 48,50 8,04 2 59,920 ,19 6

See accompanying notes to consolidated financial statements.

200 1

200 0199 9

81690_XM2001_AR_Financials 4/9/02 12:32 PM Page 15