Wacom 2013 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2013 Wacom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(For the years ended March 31)

(For the years ended March 31)

(For the years ended March 31)

(For the years ended March 31)

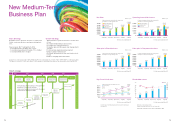

Overview of Business Performance

Wacom Co., Ltd. and Its Subsidiaries

’12 28,507

29,406

’13

(Millions of yen)

(Millions of yen)

Sales

Operating

income

Brand Business

UP 3.2%

DOWN 4.5%

5,125

4,895

’12

’13

Operating

income

Operating

income

1,091

5,554

’12

’13

2012

¥40,706

Sales Breakdown by Business

31,056

11,683

’13

’12

(Millions of yen)

(Millions of yen)

Sales

Component Business

UP 165.8%

UP 409.3%

1.0%

Brand Business %

2013

¥61,068

Other Business 1.3%

Component Business 28.7%

Component Business 50.9%

48.1

Our results by business sector

Brand business

In the Brand business, sales increased as a result of robust growth

in the Cintiq series and strong sales of our Bamboo Stylus series.

Overall business growth, however, was limited by various factors

including the delay new product launches and a stagnated market.

In Professional Products, sales grew thanks to the well-received

launches of Cintiq 24HD touch and Cintiq 22HD in July. Both of

them feature a wide format and full HD resolution display. Cintiq

13HD, announced in March, was well received by the market, how-

ever, due to the launch delay, results are not included in the current

consolidated fiscal period. Sales of Intuos5, our professional pen

tablet, did not achieve the same level of sales as the previous fiscal

year due to inventory overhang of previous model in the beginning

of the current fiscal year, a shift in demand to Cintiq series, and the

slow sales through major retail partners in U.S.

In Consumer Products, the Bamboo Stylus duo for touch screens

and paper was released in April, and the pocket-sized Bamboo

Stylus pocket for touch screens was launched in September. Over-

all sales of Consumer Products progressed favorably, supported by

increasing sales in the Bamboo Stylus series and existing pen

tablet models. In December, the Bamboo Stylus feel incorporating

our EMR pen sensor technologies joined the Bamboo Stylus family.

In Business Products, sales decreased due to poor sales of prod-

ucts in non-signature categories, although the STU series of LCD

signature tablets generated favorable sales in Japan and Europe.

Looking at sales by region, in the U.S., sales remained broadly in

line with the previous fiscal year owing to the off-set of an increase

in Consumer Products against a decrease in Business Products. In

Europe, sales increased supported by favorable performance of

Bamboo Stylus series and STU series and despite an appreciation

of the yen against the Euro and a sluggish economy in South

Europe. In Japan, sales were slightly lower than the previous fiscal

year as the Intuos5 sales fell short of expectations and Business

Products sales decreased despite favorable sales of the Cintiq

series. In Asia and Oceania, sales in China decreased due to grow-

ing anti-Japanese sentiment. Regional sales as a whole decreased

despite favorable growth of the Cintiq series and Bamboo Stylus

series due to sluggish sales of other products.

As a result of the above, sales in the Brand business category for

the fiscal year ended March 31, 2013 increased 3.2% to ¥29,406

million, with operating profit decreasing 4.5% to ¥4,895 million.

Component business

Sales during the fiscal period under review increased significantly,

primarily due to commercial production of Wacom’ s pen sensor

system. The component was adopted by Samsung for its Galaxy

Note 8.0 tablet in February, in addition to the Galaxy Note 10.1

tablet released in August and the Galaxy Note II, a new generation

smartphone launched last October. As for tablets and notebook

PCs on Windows 8, our pen sensor system was regularly adopted

by major PC manufacturers and has gained new customers such as

Dell etc.

Reflecting the above initiatives and outcomes, sales in the Compo-

nent business category for the fiscal period under review increased

165.8% to ¥31,056 million, while operating profit increased 409.3%

to ¥5,554 million.

Other business

In the Software business, sales increased owing to improved oper-

ating efficiency arising from stronger partnerships with major

distributors, and to securing new projects.

As a result of the above, sales in the Other business category for

the fiscal period under review increased 17.5% to ¥606 million, with

operating profit increasing 46.0% to ¥102 million.

606

’13

516

’12

Sales

Other Business

UP 17.5%

UP 46.0%

102

’13

70

’12

Other Business

22

Brand Business 70.0%

Overview of Business Performance

How did the global economy affect

our business in our 30th year?

Wacom Co., Ltd. and Its Subsidiaries

Despite support in the domestic economy from reconstruc-

tion demand following the Great East Japan Earthquake, in

the current fiscal year (April 1, 2012 to March 31, 2013),

growth slowed in the U.S. due to the prolonged debt problem

in Europe and growing anti-Japanese sentiment in China.

With regard to forex, the yen further strengthened temporarily

in the middle of the fiscal year; however the trend reversed

due to the expectation of monetary policy easing by the cen-

tral bank following the new government starting in Japan in

late 2012. Meanwhile, in the IT industry, there was a rapid

growth in new product categories including smartphones and

tablets. Manufacturers ramped up efforts to grow market

share as global OS makers developed and launched hard-

ware.

In markets where Wacom Group participates, a number of

trends have become evident.

In Professional Products, we are seeing increased adoption of

3D technologies for industrial design by the automobile and

home appliance industries, and usage for content creation in

the movie and game industries. In Consumer Products, we

are seeing a growing need for intuitive input-by-hand func-

tions following an increase in tablets and e-book devices. We

are also seeing increased demand in traditional uses such as

illustrations, photo retouching and web design. In Business

Products, use of LCD pen tablet products is increasing with a

growing demand for security improvement and paperless

environments across a broad range of sectors, including

pharmaceuticals, education and finance. Electronic settle-

ment using digital signatures, in particular, is gaining attention

as a remarkably effective way to improve information security

and operational efficiency, while reducing document manage-

ment costs. In our Component business, we are seeing

increased utilization of pen or multi-touch technologies in

smartphones, tablets and e-book readers using Android OS.

Moreover, Samsung’ s Galaxy Note Series, the models of

smartphones and tablets incorporating our pen technologies,

have increased and established a new high-growth category.

In addition, PC manufacturers launched new tablets based on

Windows 8, Microsoft’s next generation OS.

Against this background, Wacom Group aimed for further

growth through active online marketing and sales activities,

developing new products, expanding the product lineup for

tablet devices and strengthening the development systems

for pen applications. We also focused on enhancing our SCM

system in Shanghai, China, developing a new ERP system in

Asia and Oceania. The Company has announced its new

medium-term business plan, “WAP1215” (FY March, 2014 to

FY March, 2016), that aims to grow the business and enhance

corporate value. According the new business plan, Wacom

will strive to achieve consolidated net sales of ¥120 billion or

more, an operating profit margin of 15% or more, and ROE of

30% or more by FY March, 2016.

As a result, consolidated net sales increased 50.0% to

¥61,068 million, operating profit increased 94.6% to ¥7,915

million, ordinary profit increased 94.2% to ¥7,559 million and

net profit increased 118.7% to ¥4,770 million.

0

10

5

15

20

25

30

0

5

10

15

20

25

30

40

50

60

70

80

(Yen)

(%)

(%)

’09 ’10 ’11 ’12 ’13

’09 ’10 ’11 ’12

’09 ’10 ’11 ’12

(For the years ended March 31)

(For the years ended March 31)

(For the years ended March 31)

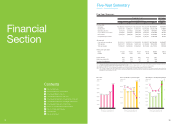

Net income per share (basic)

ROE/ROA

Equity ratio

12.24 13.66

’13

29.81

15.53

12.25

10.7

7.1

11.7

7.1

14.2

10.9

7.3

9.4

68.1

69.4

64.8

Note: ROA equals net income/average total assets.

55.2

’13

58.1

21

(ROE)

(ROA)

19.9

11.3