Vectren 2012 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2012 Vectren annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

into the future. Continuous improvement initiatives throughout the utility group are being implemented to help reduce

waste, save time and resources and ideally, limit growth in operating expenses over the coming years. In 2012,

these initiatives resulted in sustainable savings of more than $7 million and have helped offset other cost increases.

Examples of the initiatives implemented last year include improved processes allowing the company to become

more efficient in completing work to reduce labor costs and recent amendments to post-retirement medical plans

providing better access to benefits for company retirees at lower costs.

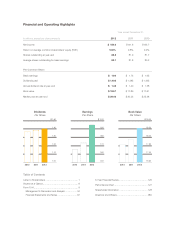

I would be remiss if I didn’t mention the work of our finance team and recent financing transactions that also helped

performance in 2012 and will do so again in 2013. Utility interest expense was down nearly $9 million from 2011

primarily due to refinancing. Our most recent example is a private placement note purchase agreement executed

in December to issue $125 million of senior notes averaging 25 years and an average interest rate of 3.9%. This

financing is expected to close in early June. In addition, during February, we announced the call of approximately

$122 million of debt due in 2039 with an interest rate of 6.25%. As a result of this most recent refinancing, I

anticipate the annualized interest expense related to our utility

operations will be further reduced by approximately $3 million annually.

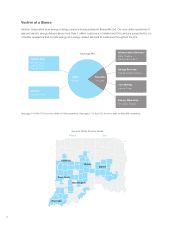

For our coal mining business, Vectren Fuels, we saw the past 12

months bring mild weather, weak demand, low natural gas prices and

the excess coal inventory of many coal-fired utilities that hampered

sales; unfortunately, we believe these challenging conditions are

likely to continue in 2013. For 2012, these market conditions led to a

decline in sales in which we sold 4.5 million tons and accordingly

earnings were challenged as we ended the year with a loss of ($3.5) million compared to a gain of $16.6 million in

2011. 2012 did end on an upswing, however, as we were able to secure a contract that will provide for 5.8 million

tons sold in 2014. Likewise, of the 5.5 million tons we expect to produce in 2013, 4.6 million tons are sold.

A slower-than-expected 2012 allowed us to lay the groundwork at our second Oaktown mine, making it ready

to open when sales have been secured. Oaktown 2 will join our underground mines, Oaktown 1 and Prosperity

that have been able to land regional and out-of-state customers. Our task ahead will be to ramp up production to

meet customer needs while ensuring safe operations and low production costs. We remain optimistic that market

conditions point to an improving 2014.

For our joint venture, ProLiance, we continue laying the groundwork to return to profitability by addressing items

within their control. The key contributing factor has been the reduction in fixed demand costs for both storage

and transportation contracts. As such, the company’s share of ProLiance’s losses were ($17.6) million, compared

to ($22.9) million in 2011. Through negotiations and by dropping some unutilized contracts as they expire,

Our strong balance sheet,

favorable credit ratings and

record of 53 consecutive years

of dividend growth demonstrate

why many choose to make an

investment in our company.

In echoing our focus on helping customers use energy wisely, we installed a dense pack unit on one of

our 245-megawatt coal-fired turbines at our A.B. Brown power plant, which allows us to burn less coal

while generating the same amount of electricity.

6