Vectren 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 Vectren annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Carl L. Chapman

Chairman, President & CEO

2012 secured the advancement of many of Vectren’s strategic initiatives and

proved it was a year in which we focused on laying the groundwork – literally

and figuratively – for our company’s continued success. The combination of

accomplishments for the year and initiatives that are now beginning to bear fruit

in our utility and nonutility companies demonstrate why our financial performance

exceeded shareholder expectations and why investing in our company for the

long term is a prudent decision.

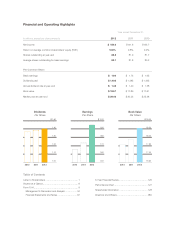

Reported net income rose again this year to $159 million, or $1.94 per share,

compared to 2011 results of $141.6 million or, $1.73 per share. These

outstanding financial results were driven by the strong performance of the

utility group and exceptional performance of the Infrastructure Services group.

Vectren’s utility earnings were $138 million, compared to $122.9 million in 2011.

Lower interest expense as a result of refinancing activity completed late in 2011

and early 2012 and operating expenses that were generally flat compared to

2011 helped deliver this favorable performance. Results of our three natural gas

utilities rose by about $7 million year-over-year. For our electric utility, whose

results increased slightly, another catalyst of the growth in revenue year-over-year

was the full calendar year of new electric base rates, which were put into effect

with regulatory approval in May 2011.

Nonutility results were stronger than expected at $21.7 million, compared

to $23.8 million in 2011. Keep in mind, 2011 results included a $15.2 million

gain from the sale of Vectren Source, a residential and small commercial gas

marketing firm. The bright spot of our nonutility portfolio of businesses continues

to be our Infrastructure Services group, which had an exceptional year and nearly

tripled earnings from $14.9 million in 2011 to $40.5 million in 2012. Earnings at

Energy Systems Group (ESG), our energy services company, were essentially flat

year-over-year, and our commodity-driven businesses, Vectren Fuels (Fuels) and

ProLiance Energy (ProLiance), were challenged in 2012 as expected. Weakness

in coal prices in 2012 and lower natural gas prices over the last several years

negatively impacted results for our coal and wholesale gas marketing operations.

We’ll walk through more detailed results of these businesses and expectations

for 2013 throughout this letter.

Letter to Shareholders

1