Vectren 2012 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2012 Vectren annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

prepays ProLiance for natural gas delivery services during the seven months prior to the peak heating season in lieu of

maintaining gas storage. Vectren received regulatory approval on March 17, 2011, from the IURC for ProLiance to continue to

provide natural gas supply services to the Company’s Indiana utilities and Citizens Energy Group's utilities through March 2016.

Natural Gas Purchasing Activity in Ohio

On April 30, 2008, the PUCO issued an order which approved the first two phases of a three phase plan to exit the merchant

function in the Company's Ohio service territory. As a result, substantially all of the Company's Ohio customers now purchase

natural gas directly from retail gas marketers rather than from the Company.

The PUCO provided for an Exit Transition Cost rider, which allows the Company to recover costs associated with the first two

phases of the transition process. Exiting the merchant function has not had a material impact on earnings or financial

condition. It, however, has and will continue to reduce Gas utility revenues and have an equal and offsetting impact to Cost of

gas sold as VEDO, for the most part, no longer purchases gas for resale.

Total Natural Gas Purchased Volumes

In 2012, Utility Holdings purchased 61.0 MMDth volumes of gas at an average cost of $4.47 per Dth, of which approximately 97

percent was purchased from ProLiance and 3 percent was purchased from third party providers. The average cost of gas per

Dth purchased for the previous four years was $5.30 in 2011, $5.99 in 2010, $5.97 in 2009, and $9.61 in 2008.

Electric Utility Services

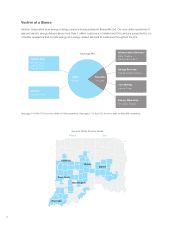

At December 31, 2012, the Company supplied electric service to approximately 142,100 Indiana customers, including

approximately 123,600 residential, 18,400 commercial, and 100 industrial and other customers. Average electric utility

customers served were approximately 141,700 in 2012, 141,400 in 2011, and 141,300 in 2010.

The principal industries served include polycarbonate resin (Lexan®) and plastic products; aluminum smelting and recycling;

aluminum sheet products, automotive assembly, steel finishing, pharmaceutical and nutritional products; automotive glass;

gasoline and oil products; ethanol; and coal mining.

Revenues

For the year ended December 31, 2012, retail electricity sales totaled 5,464.8 GWh, resulting in revenues of approximately

$553.9 million. Residential customers accounted for 36 percent of 2012 revenues; commercial 27 percent; industrial 35 percent;

and other 2 percent. In addition, in 2012 the Company sold 336.7 GWh through wholesale activities principally to the

MISO. Wholesale revenues, including transmission-related revenue, totaled $41.0 million in 2012.

System Load

Total load for each of the years 2008 through 2012 at the time of the system summer peak, and the related reserve margin, is

presented below in MW.

Date of summer peak load 7/24/2012 7/21/2011 8/4/2010 6/22/2009 7/21/2008

Total load at peak 1,259 1,220 1,275 1,143 1,167

Generating capability 1,298 1,298 1,298 1,295 1,295

Firm purchase supply 136 136 136 136 135

Interruptible contracts & direct load control 60 60 62 62 62

Total power supply capacity 1,494 1,494 1,496 1,493 1,492

Reserve margin at peak 19% 22% 17% 31% 28%

The winter peak load for the 2011-2012 season of approximately 895 MW occurred on January 12, 2012. The prior year winter

peak load for the 2010-2011 season was approximately 943 MW, occurring on December 14, 2010.