Vectren 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Vectren annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Laying the groundwork

2012 Annual Report and Form 10-K

Table of contents

-

Page 1

Laying the groundwork 2012 Annual Report and Form 10-K -

Page 2

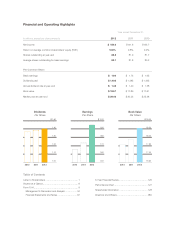

... at year-end Average shares outstanding for basic earnings 2012 $ 159.0 10.6% 82.2 82.1 2011 $141.6 9.8% 81.9 81.8 2010 $133.7 9.4% 81.7 80.2 Per Common Share Basic earnings Dividends paid Annual dividend rate at year-end Book value Market price at year-end $ 1.94 $ 1.405 $ 1.42 $ 18.57 $ 29... -

Page 3

... at Energy Systems Group (ESG), our energy services company, were essentially ï¬,at year-over-year, and our commodity-driven businesses, Vectren Fuels (Fuels) and ProLiance Energy (ProLiance), were challenged in 2012 as expected. Weakness in coal prices in 2012 and lower natural gas prices over... -

Page 4

... 2012, Vectren's Infrastructure Services is well-positioned for continued success, as the need for transmission and distribution pipeline expansion and upgrades remains strong. Laying the groundwork for reliability In no other area have we physically laid more groundwork than within energy delivery... -

Page 5

... business segment. For utilities, Infrastructure Services is successfully bidding to complete distribution and transmission pipeline work in multiple regions of the country. In fact, they added several ï¬rst-time large gas utility customers in 2012, which bodes well for 2013 and beyond. This group... -

Page 6

... capital project to expand our regional transmission system very much complements the ongoing improvements we're making at the distribution level and at our power plants to safely and reliably meet the energy needs of our 142,000 electric customers. Laying the groundwork for sustainable communities... -

Page 7

... renewable energy projects will see continued penetration as well given the number of states and utilities with renewable energy portfolio goals. Natural Gas Program Savings 2010 2011 2012 375 400 425 450 475 500 Natural Gas Savings (in thousands of MMBtu) Conservation Connection Vectren... -

Page 8

... related to our utility Our strong balance sheet, operations will be further reduced by approximately $3 million annually. For our coal mining business, Vectren Fuels, we saw the past 12 record of 53 consecutive years demand, low natural gas prices and months bring mild weather, weak of dividend... -

Page 9

... his tenure, successfully led and worked with teams on many key projects, including all of our rate case proceedings and the launch of the Choice program in Ohio. I feel conï¬dent in the future growth of Vectren - certainly after the unprecedented ï¬nancial performance of 2012, but also with the... -

Page 10

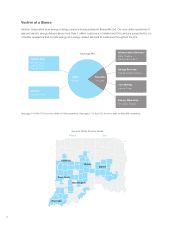

... Vectren Corporation is an energy holding company headquartered in Evansville, Ind. Our core utility operations of gas and electric energy delivery serve more than 1 million customers in Indiana and Ohio and are supported by our nonutility operations that provide energy and energy-related services... -

Page 11

... Commission file number: 1-15467 VECTREN CORPORATION (Exact name of registrant as specified in its charter) INDIANA (State or other jurisdiction of incorporation or organization) One Vectren Square (Address of principal executive offices) Registrant's telephone number, including area code: 812... -

Page 12

... filer Smaller reporting company Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which... -

Page 13

... OUCC: Indiana Office of the Utility Consumer Counselor PUCO: Public Utilities Commission of Ohio Throughput: combined gas sales and gas transportation volumes Access to Information Vectren Corporation makes available all SEC filings and recent annual reports free of charge through its website at... -

Page 14

... Management's Assessment of Internal Controls over Financial Reporting Other Information Part III 10 11 12 13 14 Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain... -

Page 15

... its electric customers and optimizes those assets in the wholesale power market. Indiana Gas and SIGECO generally do business as Vectren Energy Delivery of Indiana. VEDO provides energy delivery services to over 310,000 natural gas customers located near Dayton in west central Ohio. The Company... -

Page 16

...a more detailed description of the Utility Group's Gas Utility and Electric Utility operating segments. Gas Utility Services At December 31, 2012, the Company supplied natural gas service to approximately 997,400 Indiana and Ohio customers, including 911,300 residential, 84,400 commercial, and 1,700... -

Page 17

... to continue to provide natural gas supply services to the Company's Indiana utilities and Citizens Energy Group's utilities through March 2016. Natural Gas Purchasing Activity in Ohio On April 30, 2008, the PUCO issued an order which approved the first two phases of a three phase plan to exit the... -

Page 18

...the Company's electric transmission facilities as well as that of other Midwest utilities. The Company is an active participant in the MISO energy markets, where it bids its generation into the Day Ahead and Real Time markets and procures power for its retail customers at Locational Marginal Pricing... -

Page 19

... information provided by MISO. These purchase and sale transactions are accounted for on a net hourly position. Net purchases in a single hour are recorded as purchased power in Cost of fuel & purchased power and net sales in a single hour are recorded in Electric utility revenues. During 2012... -

Page 20

.... Coal mining generated approximately $236 million in revenues in 2012, compared to $286 million in 2011 and $210 million in 2010. Oaktown Mine Expansion In April 2006, Vectren Fuels announced plans to open two new underground mines. The first of two underground mines located near Vincennes, Indiana... -

Page 21

... transported via truck to its customers, which include the Company's power supply operations and other third party utilities. The mine opened in 2001, and the total plant and development costs to date are $200 million. Through December 31, 2012, approximately 7,500 acres of coal have been mined with... -

Page 22

... Item 8. At December 31, 2012, the ProLiance customer base was 2,012 customers, compared to 1,950 customers in 2011 and 1,789 customers in 2010. Vectren Source Vectren Source, a former wholly owned subsidiary, provided natural gas and other related products and services in the Midwest and Northeast... -

Page 23

...agreement relates to employees of Indiana Gas. In June 2010, the Company reached a three year labor agreement with Local 702 of the International Brotherhood of Electrical Workers, ending June 30, 2013. This labor agreement relates to employees of SIGECO. Infrastructure Services The Company, through... -

Page 24

...the equity capital markets to obtain financing when necessary or desirable. Utility Operating Risks Vectren's gas and electric utility sales are concentrated in the Midwest. The operations of the Company's regulated utilities are concentrated in central and southern Indiana and west central Ohio and... -

Page 25

..., the implementation of a straight fixed variable rate design mitigates most weather variations related to Ohio residential gas sales. Vectren's utilities are exposed to increasing regulation, including environmental and pipeline safety regulation. Vectren's utilities are subject to regulation by... -

Page 26

... by the EPA or other agencies to address global climate change or mandate renewable energy sources could substantially affect both the costs and operating characteristics of the Company's fossil fuel generating plants and natural gas distribution businesses. Further, such legislation or regulatory... -

Page 27

... natural gas, coal, and electricity could reduce earnings and working capital. The Company's regulated operations have limited exposure to commodity price risk for transactions involving purchases and sales of natural gas, coal, and purchased power for the benefit of retail customers due to current... -

Page 28

... laws or rates; and changing market conditions. Vectren's nonutility businesses support its regulated utilities pursuant to service contracts by providing natural gas supply services, coal, and infrastructure services. In most instances, Vectren's ability to maintain these service contracts depends... -

Page 29

... the health of the economy, weather, changes in the availability and location of natural gas supply and related transmission assets, the price of natural gas, and the availability of credit. Optimization opportunities at current market prices or a deterioration of the customer base may result in the... -

Page 30

... utilities or interstate pipelines that are used by the Company to transport power and natural gas could result in the Company being unable to deliver natural gas or electricity for a prolonged period. Further, Vectren relies on information technology networks and systems to operate its generating... -

Page 31

...the demand charges. VEDO's gas delivery system includes 5,500 miles of distribution and transmission mains, all of which are located in Ohio. Electric Utility Services SIGECO's installed generating capacity as of December 31, 2012, was rated at 1,298 MW. SIGECO's coal-fired generating facilities are... -

Page 32

...363 Mva. SIGECO owns utility property outside of Indiana approximating 24 miles of 138Kv and 345Kv electric transmission lines, which are included in the 1,014 circuit miles discussed above, located in Kentucky and which interconnects with Louisville Gas and Electric Company's transmission system at... -

Page 33

...Company's share-based compensation plans; however, no such open market purchases were made during the quarter ended December 31, 2012. Dividend Policy Common stock dividends are payable at the discretion of the board of directors, out of legally available funds. The Company's policy is to distribute... -

Page 34

... per share on common stock Dividends per share on common stock Balance Sheet Data: Total assets Long-term debt, net Common shareholders' equity 2012 $ $ $ 2,232.8 $ 352.5 $ 159.0 $ 82.0 82.1 1.94 $ 1.94 $ 1.405 $ 5,089.1 $ 1,553.4 $ 1,526.1 $ Year Ended December 31, 2011 2010 2009 2,325.2 $ 370... -

Page 35

... Group generates revenue primarily from the delivery of natural gas and electric service to its customers. The primary source of cash flow for the Utility Group results from the collection of customer bills and the payment for goods and services procured for the delivery of gas and electric services... -

Page 36

.... Nonutility Group results were impacted by a gain on the sale of retail natural gas marketer, Vectren Source, on December 31, 2011, totaling $15.2 million after tax. After tax charges related to legacy investments totaled $2.2 million, $9.2 million, and $6.9 million in 2012, 2011, and 2010... -

Page 37

...electric transmission and distribution business, which provides electric distribution services primarily to southwestern Indiana, and its power generating and wholesale power operations. In total, these regulated operations supply natural gas and/or electricity to over one million customers. Utility... -

Page 38

...base rates. The electric service territory has neither an NTA nor a decoupling mechanism; however, rate designs provide for a lost margin recovery mechanism that works in tandem with conservation initiatives. Tracked Operating Expenses Gas costs and fuel costs incurred to serve Indiana customers are... -

Page 39

... in 2012 compared to 2011 significantly increased due to natural gas transported to a natural gas fired power plant that was recently placed into service in the Vectren South service territory. Volumes delivered to this customer are based on a monthly fixed charge and began in 2010 when service was... -

Page 40

...weather in both periods, the Company provided refunds to customers in 2012 totaling $2.6 million pursuant to the statutory earnings test. Indiana regulation includes a statutory mechanism that can limit a utility's rolling twelve month net operating income to that authorized in its last general rate... -

Page 41

...587.6 GWh in 2010. The lower volumes sold in 2012 from Vectren South's primarily coal-fired generation result from increased sales of power in MISO from gas-fired electric generation due to low natural gas prices and more wind generation. Utility Group Operating Expenses Other Operating For the year... -

Page 42

... of Investments in Natural Gas Infrastructure Replacement Vectren monitors and maintains its natural gas distribution system to ensure that natural gas is delivered in a safe and efficient manner. Vectren's natural gas utilities are currently engaged in replacement programs in both Indiana and Ohio... -

Page 43

... rate case. To date, the Company has not initiated a filing requesting authority to recover costs using the Senate Bill 251 approach and continues to study its applicability to expenditures associated with its natural gas distribution operations. Pipeline Safety Law On January 3, 2012, the Pipeline... -

Page 44

... investments, a modified electric rate design that would facilitate a partnership between Vectren South and customers to pursue energy efficiency and conservation, and new energy efficiency programs to complement those currently offered for natural gas customers. The IURC issued an order in the case... -

Page 45

... all of the fixed cost recovery in the monthly customer service charge. This rate design mitigates most weather risk as well as the effects of declining usage, similar to the company's lost margin recovery mechanism in place in the Indiana natural gas service territories and the mechanism... -

Page 46

... with federal mandates in the Pipeline Safety Law, Indiana Senate Bill 251 is also applicable to federal environmental mandates impacting Vectren South's electric operations. The Company is currently evaluating the impact Senate Bill 251 may have on its operations, including applicability to the... -

Page 47

...The unamortized portion of the $411 million clean coal technology investment was included in rate base for purposes of determining SIGECO's new electric base rates approved in the latest base rate order obtained April 27, 2011. SIGECO's coal fired generating fleet is 100 percent scrubbed for SO2 and... -

Page 48

... to help customers conserve and manage energy costs; • Building a renewable energy portfolio to complement base load coal-fired generation in advance of mandated renewable energy portfolio standards; • Implementing conservation initiatives in the Company's Indiana and Ohio gas utility service... -

Page 49

... mandating a renewable energy portfolio standard is adopted, such regulation could substantially affect both the costs and operating characteristics of the Company's fossil fuel generating plants, nonutility coal mining operations, and natural gas distribution businesses. At this time and in... -

Page 50

... energy sources due to the long-term wind contracts and landfill gas investment. The Company continues to evaluate whether to participate in this voluntary program. Manufactured Gas Plants In the past, the Company operated facilities to manufacture natural gas. Given the availability of natural gas... -

Page 51

... Group provides the Company's regulated utilities natural gas supply services, coal, and infrastructure services. Nonutility Group earnings for the years ended December 31, 2012, 2011, and 2010, follow: (In millions, except per share amounts) NET INCOME CONTRIBUTION TO VECTREN BASIC EPS NET... -

Page 52

... digester projects into service in 2012. Coal Mining Coal Mining owns mines that produce and sell coal to the Company's utility operations and to third parties through its wholly owned subsidiary Vectren Fuels, Inc. (Vectren Fuels). Results from Coal Mining, inclusive of holding company costs... -

Page 53

... accounting. On March 17, 2011, an order was received from the IURC providing for ProLiance's continued provision of gas supply services to the Company's Indiana utilities and Citizens Energy Group through March 2016. Vectren Energy Marketing and Services, Inc (EMS), a wholly owned subsidiary, holds... -

Page 54

...'s service territory, and VEDO purchases receivables and natural gas from the third party. Prior to the sale, Vectren Source earned $2.8 million in 2011, compared to $3.7 million in 2010. Other Businesses Within the Nonutility business segment, there are legacy investments involved in energy-related... -

Page 55

... is required. The Company adopted this guidance, as amended for condensed quarterly reporting, for the quarterly reporting period ended March 31, 2012 by reporting comprehensive income as required. Goodwill Testing In September 2011, the FASB issued new accounting guidance regarding testing goodwill... -

Page 56

... other market based information to estimate the fair value of its Gas Utility Services operating segment, and that estimated fair value was compared to its carrying amount, including goodwill. Goodwill related to the Nonutility Group is also tested using market comparable data, if readily available... -

Page 57

... of the Company's dividends, and from time to time may be reinvested in utility operations or used for corporate expenses. The credit ratings of the senior unsecured debt of Utility Holdings and Indiana Gas, at December 31, 2012, are A-/A3 as rated by Standard and Poor's Ratings Services (Standard... -

Page 58

... assets, investments, or businesses to enhance or accelerate internally generated cash flow. Specifically for 2013, the Company plans to access the capital markets to refinance debt maturities or debt that is callable. The Company currently has firm commitments for a debt issuance totaling $125... -

Page 59

...is not guaranteed by Vectren or Citizens. New Share Issues The Company may periodically issue new common shares to satisfy the dividend reinvestment plan, stock option plan and other employee benefit plan requirements. New issuances added additional liquidity of $7.2 million in 2012, $7.9 million in... -

Page 60

... by Vectren Utility Holdings totaling $100 million, $5 million issued by Indiana Gas, and $1.4 million associated with the Company's nonutility operations. The Company expects that the majority of this debt maturing in 2013 will be refinanced using the long-term debt capital markets. (2) The Company... -

Page 61

... guaranteed by Utility Holdings' regulated utility subsidiaries, SIGECO, Indiana Gas, and VEDO. The proceeds from the sale of the notes, net of issuance costs, totaled approximately $99.5 million. These notes have no sinking fund requirements and interest payments are due semi-annually. These notes... -

Page 62

... guaranteed by Utility Holdings' regulated utility subsidiaries, SIGECO, Indiana Gas, and VEDO. The proceeds from the sale of the notes, net of issuance costs, totaled approximately $148.9 million. These notes have no sinking fund requirements and interest payments are due semi-annually. These notes... -

Page 63

... regarding energy prices and the capital and commodity markets; volatile changes in the demand for natural gas, electricity, coal, and other nonutility products and services; impacts on both gas and electric large customers; lower residential and commercial customer counts; higher operating expenses... -

Page 64

... strategies. Commodity Price Risk Regulated Operations The Company's regulated operations have limited exposure to commodity price risk for transactions involving purchases and sales of natural gas, coal and purchased power for the benefit of retail customers due to current state regulations... -

Page 65

..., coal, and natural gas through ProLiance. Open positions in terms of price, volume, and specified delivery points may occur and are managed using methods described below with frequent management reporting. The Company, as well as ProLiance, purchase and sell natural gas and coal to meet customer... -

Page 66

... that limit the types and degree of market risk that may be undertaken. The Company's customer receivables associated with utility operations are primarily derived from residential, commercial, and industrial customers located in Indiana and west central Ohio. However, some exposure from nonutility... -

Page 67

... Officer. Based on that evaluation, conducted under the framework in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission, the Company concluded that its internal control over financial reporting was effective as of December 31, 2012... -

Page 68

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Vectren Corporation: We have audited the accompanying consolidated balance sheets of Vectren Corporation and subsidiaries (the "Company") as of December 31, 2012 and 2011, and the related ... -

Page 69

... To the Board of Directors and Shareholders of Vectren Corporation: We have audited the internal control over financial reporting of Vectren Corporation and subsidiaries (the "Company") as of December 31, 2012, based on criteria established in Internal Control - Integrated Framework issued by the... -

Page 70

...At December 31, 2012 2011 ASSETS Current Assets Cash & cash equivalents Accounts receivable - less reserves of $6.8 & $6.7, respectively Accrued unbilled revenues Inventories Recoverable fuel & natural gas costs Prepayments & other current assets Total current assets Utility Plant Original cost Less... -

Page 71

... December 31, 2012 2011 LIABILITIES & SHAREHOLDERS' EQUITY Current Liabilities Accounts payable Accounts payable to affiliated companies Accrued liabilities Short-term borrowings Current maturities of long-term debt Total current liabilities Long-term Debt - Net of Current Maturities Deferred Income... -

Page 72

... AND SUBSIDIARY COMPANIES CONSOLIDATED STATEMENTS OF INCOME (In millions, except per share amounts) Year Ended December 31, 2012 2011 2010 OPERATING REVENUES Gas utility Electric utility Nonutility Total operating revenues OPERATING EXPENSES Cost of gas sold Cost of fuel & purchased power Cost of... -

Page 73

VECTREN CORPORATION AND SUBSIDIARY COMPANIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Year Ended December 31, 2012 2011 2010 $ 159.0 $ 141.6 $ 133.7 11.3 (4.6) 6.7 (3.3) 7.1 0.2 (1.6) 2.4 - (0.1) - (0.1) $ 9.0 168.0 $ (9.3) 3.8 (5.5) (41.6) 6.4 33.5 0.7 (1.0) (3.6) (0.3) 1.5 ... -

Page 74

...) on sale of business in 2011, net of other non-cash charges Changes in working capital accounts: Accounts receivable & accrued unbilled revenues Inventories Recoverable/refundable fuel & natural gas costs Prepayments & other current assets Accounts payable, including to affiliated companies Accrued... -

Page 75

VECTREN CORPORATION AND SUBSIDIARY COMPANIES CONSOLIDATED STATEMENTS OF COMMON SHAREHOLDERS' EQUITY (In millions, except per share amounts) Common Stock Balance at January 1, 2010 Net income Other comprehensive income Common stock: Issuance: option exercises & dividend reinvestment plan Dividends ... -

Page 76

... its electric customers and optimizes those assets in the wholesale power market. Indiana Gas and SIGECO generally do business as Vectren Energy Delivery of Indiana. VEDO provides energy delivery services to over 310,000 natural gas customers located near Dayton in west central Ohio. The Company... -

Page 77

... Company's regulated operations is valued at historical cost consistent with ratemaking treatment. Materials and supplies are recorded as inventory when purchased and subsequently charged to expense or capitalized to plant when installed. Nonutility inventory is valued at the lower of cost or market... -

Page 78

... utility operations affecting Ohio customers are subject to regulation by the PUCO. The Company's accounting policies give recognition to the ratemaking and accounting practices authorized by these agencies. Refundable or Recoverable Gas Costs & Cost of Fuel & Purchased Power All metered gas rates... -

Page 79

...for postretirement plan other than pensions) of the active participants at the time of the amendment. Asset Retirement Obligations A portion of removal costs related to interim retirements of gas utility pipeline and utility poles, certain asbestos-related issues, and reclamation activities meet the... -

Page 80

... energy markets, bidding its owned generation into the Day Ahead and Real Time markets and procuring power for its retail customers at Locational Marginal Pricing (LMP) as determined by the MISO market. MISO-related purchase and sale transactions are recorded using settlement information provided... -

Page 81

... taxes and a portion of utility receipts taxes are included in rates charged to customers. Accordingly, the Company records these taxes received as a component of operating revenues, which totaled $26.9 million in 2012, $29.3 million in 2011, and $33.8 million in 2010. Expense associated with excise... -

Page 82

... - Gas utility plant Electric utility plant Common utility plant Construction work in progress Total original cost Original Cost $ 2,614.3 2,463.6 52.0 46.9 $ 5,176.8 SIGECO and Alcoa Generating Corporation (AGC), a subsidiary of ALCOA, own the 300 MW Unit 4 at the Warrick Power Plant as tenants... -

Page 83

... Amounts currently recovered in customer rates related to: Unamortized debt issue costs & hedging proceeds Demand side management programs Indiana authorized trackers Ohio authorized trackers Premiums paid to reacquire debt Other base rate recoveries Total regulatory assets $ At December 31, 2012... -

Page 84

..., Miller Pipeline LLC, Minnesota Limited is included in the Company's nonutility Infrastructure Services operating segment. This acquisition positions the Company for anticipated growth in demand for gas transmission construction resulting from the need to transport new sources of natural gas and... -

Page 85

... continues to sell natural gas directly to customers in VEDO's service territory, and VEDO purchases receivables and natural gas from the third party. Vectren Source was a component of the Energy Marketing operating segment. 7. Investment in ProLiance Holdings, LLC ProLiance Holdings, LLC (ProLiance... -

Page 86

... in Accounts payable to affiliated companies in the Consolidated Balance Sheets. Vectren received regulatory approval on March 17, 2011, from the IURC for ProLiance to continue to provide natural gas supply services to the Company's Indiana utilities and Citizens Energy Group's utilities through... -

Page 87

... Legacy Holdings Within the nonutility group, there are legacy investments involved in energy-related infrastructure and services, real estate, a leveraged lease, and other ventures. As of December 31, 2012 and 2011, total remaining legacy investments included in the Other Businesses portfolio total... -

Page 88

...the Nonutility Group. 10. Income Taxes A reconciliation of the federal statutory rate to the effective income tax rate follows: Year Ended December 31, 2012 2011 2010 Statutory rate: State & local taxes-net of federal benefit Amortization of investment tax credit Depletion Energy efficiency building... -

Page 89

... 31, 2012, the Company has alternative minimum tax carryforwards which do not expire. In addition, the Company has $11.7 million in net operating loss and general business credit carryforwards, which will expire in 5 to 20 years. Indiana House Bill 1004 In May 2011, House Bill 1004 was signed into... -

Page 90

... 31, 2012, the Company maintains three qualified defined benefit pension plans, a nonqualified supplemental executive retirement plan (SERP), and a postretirement benefit plan. The defined benefit pension plans and postretirement benefit plan, which cover eligible full-time regular employees, are... -

Page 91

... $ 5.6 A portion of the net periodic benefit cost disclosed in the table above is capitalized as Utility plant. Costs capitalized in 2012, 2011, and 2010 are estimated at $3.7 million, $3.9 million, and $4.3 million, respectively. The Company lowered the discount rate used to measure periodic cost... -

Page 92

... older. Rather, the Company provides a subsidy to plan participants to purchase health coverage through a private Medicare exchange. This change in benefits provides a comparable benefit at a reduced cost made possible by current market pricing. Since this change in benefits was a significant event... -

Page 93

... bid prices quoted by an independent pricing service. When valuations are not readily available, fixed income securities are valued using primarily other Level 2 inputs as determined in good faith by the investment manager. The fair value of these funds totals $145.0 million at December 31, 2012 and... -

Page 94

... to make payments totaling approximately $1.0 million directly to SERP participants and approximately $3.5 million directly to those participating in the postretirement plan. Estimated retiree pension benefit payments, including the SERP, projected to be required during the years following 2012 are... -

Page 95

... pension plan numbers. The most recent Pension Protection Act Zone Status available in 2012 and 2011 is for the plan year end at January 31, 2012 and 2011 for the Central Pension Fund, December 31, 2011 and 2010 for the Pipeline Industry Benefit Fund, May 31, 2011 and 2010 for the Indiana Laborers... -

Page 96

... are qualified under sections 401(a) and 401(k) of the Internal Revenue Code and include an option to invest in Vectren common stock, among other alternatives. During 2012, 2011 and 2010, the Company made contributions to these plans of $6.7 million, $6.2 million, and $6.6 million, respectively. 94 -

Page 97

...% 2035, 6.10% 2039, 6.25% 2041, 5.99% 2042, 5.00% Total Utility Holdings Indiana Gas Fixed Rate Senior Unsecured Notes 2013, Series E, 6.69% 2015, Series E, 7.15% 2015... Total Indiana Gas SIGECO First Mortgage Bonds 2015, 1985 Pollution Control Series A, current adjustable rate 0.15%, tax exempt, 2012... -

Page 98

... guaranteed by Utility Holdings' regulated utility subsidiaries, SIGECO, Indiana Gas, and VEDO. The proceeds from the sale of the notes, net of issuance costs, totaled approximately $99.5 million. These notes have no sinking fund requirements and interest payments are due semi-annually. These notes... -

Page 99

... guaranteed by Utility Holdings' regulated utility subsidiaries, SIGECO, Indiana Gas, and VEDO. The proceeds from the sale of the notes, net of issuance costs, totaled approximately $149 million. These notes have no sinking fund requirements and interest payments are due semi-annually. These notes... -

Page 100

... by the board of directors for issuance through the Company's share-based compensation plans, benefit plans, and dividend reinvestment plan. At both December 31, 2012 and 2011, there were 391.3 million of authorized shares of common stock and all authorized shares of preferred stock, available for... -

Page 101

... 81.2 0.1 81.3 1.65 1.64 $ $ For the year ended December 31, 2012 and 2011 there were no antidilutive options outstanding. For the year ended December 31, 2010, options to purchase 308,800 additional shares of the Company's common stock were outstanding, but were not included in the computation of... -

Page 102

... Company's financial statements to its after tax effect on net income: (In millions) Total cost of share-based compensation Less capitalized cost Total in other operating expense Less income tax benefit in earnings After tax effect of share-based compensation Year Ended December 31, 2012 2011 2010... -

Page 103

... 31, 2012, 2011, and 2010, was a cost of $0.6 million, $1.7 million and $1.6 million, respectively. The Company has certain investments currently funded primarily through corporate-owned life insurance policies. These investments, which are consolidated, are available to pay deferred compensation... -

Page 104

... 2016, $1.2 in 2017, and $3.3 thereafter. Total lease expense (in millions) was $8.5 in 2012, $6.9 in 2011, and $7.3 in 2010. The Company's regulated utilities have both firm and non-firm commitments to purchase natural gas, electricity, and coal as well as certain transportation and storage rights... -

Page 105

... of Investments in Natural Gas Infrastructure Replacement Vectren monitors and maintains its natural gas distribution system to ensure that natural gas is delivered in a safe and efficient manner. Vectren's natural gas utilities are currently engaged in replacement programs in both Indiana and Ohio... -

Page 106

... investments, a modified electric rate design that would facilitate a partnership between Vectren South and customers to pursue energy efficiency and conservation, and new energy efficiency programs to complement those currently offered for natural gas customers. The IURC issued an order in the case... -

Page 107

... new, lower price. Deferrals related to coal purchases in 2012 have totaled approximately $24.7 million, bringing the total deferred balance as of December 31, 2012, to the expected level of $42.4 million. Vectren South Electric Demand Side Management Program Filing On August 16, 2010, Vectren South... -

Page 108

... phases of a three phase plan to exit the merchant function in the Company's Ohio service territory. As a result, substantially all of the Company's Ohio customers now purchase natural gas directly from retail gas marketers rather than from the Company. The PUCO provided for an Exit Transition Cost... -

Page 109

...The unamortized portion of the $411 million clean coal technology investment was included in rate base for purposes of determining SIGECO's new electric base rates approved in the latest base rate order obtained April 27, 2011. SIGECO's coal fired generating fleet is 100 percent scrubbed for SO2 and... -

Page 110

... mandating a renewable energy portfolio standard is adopted, such regulation could substantially affect both the costs and operating characteristics of the Company's fossil fuel generating plants, nonutility coal mining operations, and natural gas distribution businesses. At this time and in... -

Page 111

... energy sources due to the long-term wind contracts and landfill gas investment. The Company continues to evaluate whether to participate in this voluntary program. Manufactured Gas Plants In the past, the Company operated facilities to manufacture natural gas. Given the availability of natural gas... -

Page 112

... Ohio. The Electric Utility Services segment provides electric distribution services primarily to southwestern Indiana, and includes the Company's power generating and wholesale power operations. Regulated operations supply natural gas and/or electricity to over one million customers. In total... -

Page 113

... of Vectren Source's operations are included in the Energy Marketing operating segment in 2011 and 2010. Information related to the Company's business segments is summarized as follows: Year Ended December 31, 2012 2011 2010 (In millions) Revenues Utility Group Gas Utility Services Electric Utility... -

Page 114

... Group Gas Utility Services Electric Utility Services Other Operations Total Utility Group Nonutility Group Infrastructure Services Energy Services Coal Mining Energy Marketing Other Businesses Total Nonutility Group Corporate & Other Consolidated Income Taxes Year Ended December 31, 2012 2011 2010... -

Page 115

... Utility Group Gas Utility Services Electric Utility Services Other Operations, net of eliminations Total Utility Group Nonutility Group Infrastructure Services Energy Services Coal Mining Energy Marketing Other Businesses, net of eliminations and reclassifications Total Nonutility Group Corporate... -

Page 116

... investments Other utility & corporate investments Goodwill by operating segment follows: (In millions) Utility Group Gas Utility Services Nonutility Group Infrastructure Services Energy Services Consolidated goodwill Accrued liabilities consist of the following: (In millions) Refunds to customers... -

Page 117

...December 31, 2012 2011 2010 $ (22.7) $ (28.6) $ (2.5) (0.7) - (6.1) 0.1 (3.4) - $ (23.3) $ (32.0) $ (8.6) 2012 2011 $ 43.7 $ 38.7 2.7 2.5 (8.7) 2.5 37.7 43.7 $ - $ 0.2 $ 37.7 $ 43.5 As of December 31, 2012 and 2011, the Company has accruals related to utility and nonutility plant purchases totaling... -

Page 118

...) Information in any one quarterly period is not indicative of annual results due to the seasonal variations common to the Company's utility operations. Summarized quarterly financial data for 2012 and 2011 follows: (In millions, except per share amounts) 2012 Operating revenues Operating income Net... -

Page 119

... that covers the Company's officers and employees; and its Board Code of Ethics and Code of Conduct that covers the Company's directors are available in the Corporate Governance section of the Company's website, www.vectren.com. The Corporate Code of Conduct (titled "Corp Code of Conduct") contains... -

Page 120

... Compensation plan was approved by Vectren Corporation common shareholders after the merger forming Vectren and was most recently amended and reapproved at the 2011 annual meeting of shareholders. ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE Information required... -

Page 121

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES Information required by Part III, Item 14 of this Form 10-K is incorporated by reference herein, and made part of this Form 10-K, from the Company's Proxy Statement for its 2013 Annual Meeting of Shareholders, which will be filed with the Securities ... -

Page 122

...Specimen Change in Control Agreement Vectren Corporation At Risk Compensation Plan specimen unit award agreement for officers, effective January 1, 2013 Gas Sales and Portfolio Administration Agreement between Indiana Gas Company, Inc. and ProLiance Energy, LLC, effective April 1, 2012 Gas Sales and... -

Page 123

... 2000, (Filed and designated in Current Report on Form 8-K filed December 27, 2000, File No. 1-6494, as Exhibit 4.) Indenture dated October 19, 2001, among Vectren Utility Holdings, Inc., Indiana Gas Company, Inc., Southern Indiana Gas and Electric Company, Vectren Energy Delivery of Ohio, Inc., and... -

Page 124

... Note Purchase Agreement, dated December 20, 2012, among Vectren Utility Holdings, Inc., Indiana Gas Company, Inc., Southern Indiana Gas and Electric Company and Vectren Energy Delivery of Ohio, Inc. and the purchasers named therein. (Filed and designated in Form 8-K dated December 21, 2012 File No... -

Page 125

... severance benefits are provided in the amount of two times base salary for Mr. Chapman and one and one half times base salary for Messer's Benkert, Christian, Doty, and Bohls. Coal Supply Agreement for Warrick 4 Generating Station between Southern Indiana Gas and Electric Company and Vectren Fuels... -

Page 126

... Energy Group, Citizens Energy Services Corporation and ProLiance Energy, LLC, effective March 15, 1996. (Filed and designated in Form 10-Q for the quarterly period ended March 31, 1996, File No. 1-9091, as Exhibit 10-C.) Credit Agreement, dated September 30, 2010, among Vectren Utility Holdings... -

Page 127

...1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. VECTREN CORPORATION Dated February 15, 2013 /s/ Carl L. Chapman Carl L. Chapman, Chairman, President, and Chief Executive Officer Pursuant to the requirements of the Securities... -

Page 128

... Nonutility Total Total assets Utility Operating Statistics Gas distribution Operating revenues Margin Average customers (in thousands) Electric Operating revenues Margin Average customers (in thousands) Weather as a percent of normal Heating degree days (Ohio) Cooling degree days (Indiana) $ 2012... -

Page 129

... 2013 Peer Group include US domiciled companies that meet certain criteria involving primary business as defined by SIC, utility assets, nonutility activities and market capitalization. The specific criteria are provided in Vectren's 2013 Proxy Statement in the Compensation Discussion and Analysis... -

Page 130

...of the Vectren Corporation and/or Vectren Utility Holdings, Inc., 2012 Annual Report on Form 10-K to the Securities and Exchange Commission (excluding exhibits) may be obtained by shareholders free of charge by written request to Vectren Shareholder Services, One Vectren Square, Evansville, IN 47708... -

Page 131

... M. Ryan President - Vectren Ohio Eric J. Schach Vice President - VUHI, Energy Delivery John R. Talley President - ProLiance Energy Board Committees 1 Nominating and Governance 4 Corporate Affairs 2 Audit and Risk Management 5 Finance 3 Compensation and Beneï¬ts VUHI - Vectren Utility Holdings, Inc... -

Page 132

Corporate Headquarters Vectren Corporation One Vectren Square Evansville, Indiana 47708 (812) 491-4000 www.vectren.com Get Involved The Indiana Utility Shareholders Association is a shareholder-run organization focused on state and national issues that speciï¬cally impact utility shareholder value...