United Technologies 2008 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2008 United Technologies annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2United Technologies Corporation

Dear Shareowner

UTC delivered strong results in 2008 despite the economic challenges which accelerated across

the world’s economies as the year progressed. As in years past, this reflected the competitive-

ness of the Corporation’s businesses in markets worldwide and the maturity of its operating

disciplines and management team. We believe we are well positioned to continue to outper-

form peers in 2009.

The board increased the dividend by just over 20 percent in October. In the decade ending

2008, dividends increased more than 300 percent and paralleled earnings increases over the

same period. Free cash flow again exceeded net income and liquidity remains high. We early

retired $500 million of long term debt maturing in 2009 following a $1.25 billion issuance in

December on attractive terms.

Revenues reached $58.7 billion, 7 percent above the prior year. Earnings grew 15 percent to

$4.90 per share. Notwithstanding these exceptional results, UTC’s stock price contracted along

with virtually all others in 2008. However, we outperformed peers and market averages as we

have so often in the past. We anticipate continued outperformance and took advantage of

price weakness to accelerate share repurchase to $3.2 billion for the year, a record for UTC.

We look ahead to 2009 with confidence despite market and economic uncertainties. Preparing

for contracting markets while continuing to invest in long term product development were

management’s focus throughout 2008. Restructuring costs totaled $357 million for the year

and were well in excess of one time gains. Company funded research and development

increased $100 million to $1.8 billion. We see unusual opportunities to field new products

and believe these will vindicate management’s and investors’ confidence in building on UTC’s

already leading market franchises worldwide.

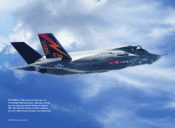

Notable developments in 2008 included completion of flight test at Airbus of Pratt & Whitney’s

new Geared Turbofan engine. This next generation engine promises 12 percent lower fuel

consumption and more than half reductions in both nitrogen oxides and noise over engines

currently in flight. Sikorsky’s X2 Technology demonstrator flew first in August and is confirming

expectations of flight at speeds exceeding 250 knots while preserving a helicopter’s traditional

advantages of hover and vertical flight. Both products reflect decades of development and

offer exceptional promise.

George David, Chairman, and Louis Chênevert, President and Chief Executive Officer