Unilever 2002 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2002 Unilever annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Unilever Annual Report & Accounts and Form 20-F 2002

Report of the Directors

Sustaining the momentum

We are delighted to report a further year of sustained

growth towards the targets set in our Path to Growth

strategy. Leading brands grew by 5.4% and, with the build

up of our innovation programmes and marketplace activity,

we have gained momentum through the year and have

finished strongly.

Operating margin BEIA rose to 14.9%, a gain of 1%

over 2001. Another record high. The impact of devaluing

currencies this year means that whilst turnover is at the

same level as 2001 at constant rates of exchange, it has

declined by 7% at current rates. Similarly operating profit

BEIA increased by 0.5 billion at constant rates but was flat

at current rates of exchange. Figures in this statement are

at constant exchange rates.

In 2002 the global economy grew slowly and it was a

tougher environment in which to operate. Slower growth

and the uncertain economic and political context caused

turbulence in financial markets. Once again, our business

showed its resilience in tough times. Our people used their

skill, experience and total determination to deliver a robust

business performance.

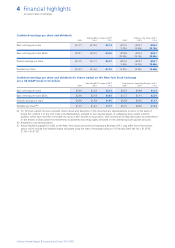

Earnings per share (BEIA) grew by 21% and for the second

year running our Total Shareholder Return (TSR) over one

year was in the top third of our peer group. Our challenge

is to sustain this over a three-year period and beyond.

We continued to generate a healthy cash flow from

operations. In addition, net proceeds from divestment

of non-core activities included 1.0 billion cash from

DiverseyLever, our institutional and industrial cleaning

business, with a minority interest retained in the merged

business of JohnsonDiversey. Other divestments included

Mazola in North America and Loders Croklaan, our industrial

speciality oils and fats business. In total, our cash flow

enabled us to reduce net indebtedness and, with the benefit

of lower interest rates, interest costs were 22% lower than

in 2001.

Meeting Path to Growth targets

We continued on track towards our Path to Growth targets

of 5-6% sustained top-line growth and operating margin

BEIA of 16% by 2004. Leading brands grew by over 5%

for the second year running. Innovation was key to this

success. Advertising was entirely focused on our leading

brands which constituted 89% of total turnover at the

end of the year.

A further healthy increase in operating margin has been

achieved whilst progressively increasing investment behind

our brands. Our restructuring programmes continue to

deliver on plan and the target of 1.6 billion procurement

savings was passed ahead of schedule. Furthermore,

by the end of the year we had reached the full Bestfoods

integration savings target of 0.8 billion, again ahead

of plan.

Energising our people

We can only meet and sustain the objectives of our Path to

Growth strategy if our people have a passion for winning

and a culture that encourages and rewards enterprise.

The development of Leaders into Action programmes and

the days we spend with our young leaders of tomorrow are

part of an overall programme to drive change. The results

are evident in the enthusiasm to win we see throughout the

business and the examples of innovation that are driving

faster growth and improved results. To recognise their

efforts we extended our long-term reward schemes and

variable pay to more employees.

The energy with which our colleagues throughout the

business have responded to the Enterprise agenda is

exceptional. They have risen to the challenge with great

determination as is clear from the results.

Brands and regions

In Home & Personal Care we have sustained the leading

brand growth in excess of 6%. In particular our personal

care brands continue to perform well and home care

margins increased sharply.

The extension of Dove from skin care to hair care

contributed to the spectacular performance of this brand,

which grew by over 25% for the fourth year running and

is now achieving sales of over 2 billion. Dove shampoo

and conditioners were rolled out across 31 more countries.

In deodorants Rexona, and particularly Rexona for Men,

grew strongly.

In Foods, the focus in the first half of the year was on

completing the Bestfoods integration, providing the firm

platform on which to leverage innovation and marketplace

activity in the second half. This has delivered accelerating

leading brand growth and for the full year it was 4.4%.

Knorr is proving a powerhouse of ideas for savoury products

and is being extended well beyond its original concept of

bouillon cubes. Bertolli is being extended to support

products which have an Italian heritage. Consumers

•Leading brands grow by 5.4%

•Operating margin BEIA of 14.9% is a new record

•Cash flow from operations increases to 7.9 billion

•Earnings per share (BEIA) grows 21%

Continued growth

Chairmen’s statement 5