Unilever 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Unilever annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Disclaimer

Notes to the Annual Report & Accounts and Form

20-F 2002

This PDF version of the Unilever Annual Report & Accounts

and Form 20-F 2002 is an exact copy of the document

provided to Unilever’s shareholders.

Certain sections of the Unilever Annual Report & Accounts

and Form 20-F 2002 have been audited. Sections that have

been audited are set out on pages 66 to 112, 118 to 133

and 135 to 136. The auditable part of the directors’

remuneration report as set out on page 60 has also been

audited.

The maintenance and integrity of the Unilever website is the

responsibility of the directors; the work carried out by the

auditors does not involve consideration of these matters.

Accordingly, the auditors accept no responsibility for any

changes that may have occurred to the financial statements

since they were initially placed on the website.

Legislation in the United Kingdom and the Netherlands

governing the preparation and dissemination of financial

statements may differ from legislation in other jurisdictions.

Disclaimer

Except where you are a shareholder, this material is provided

for information purposes only and is not, in particular,

intended to confer any legal rights on you.

This Annual Report & Accounts and Form 20-F does not

constitute an invitation to invest in Unilever shares. Any

decisions you make in reliance on this information are solely

your responsibility.

The information is given as of the dates specified, is

not updated, and any forward-looking statements are

made subject to the reservations specified on page 2 of

the Report.

Unilever accepts no responsibility for any information

on other websites that may be accessed from this site

by hyperlinks.

Table of contents

-

Page 1

..., intended to confer any legal rights on you. This Annual Report & Accounts and Form 20-F does not constitute an invitation to invest in Unilever shares. Any decisions you make in reliance on this information are solely your responsibility. The information is given as of the dates specified, is not... -

Page 2

Meeting everyday needs of people everywhere Unilever Annual Report & Accounts 2002 and Form 20-F -

Page 3

... everywhere. Around the world our Foods and Home & Personal Care brands are chosen by many millions of individual consumers each day. Earning their trust, anticipating their aspirations and meeting their daily needs are the tasks of our local companies. They bring to the service of their consumers... -

Page 4

... About Unilever Description of business Business structure Foods Savoury and dressings Spreads and cooking products Health & wellness Beverages Ice cream and frozen foods Home & Personal Care Home care and professional cleaning Personal care Other operations Corporate venture activities Technology... -

Page 5

2 General information The Unilever Group Unilever N.V. (NV) is a public limited company registered in the Netherlands, which has listings of shares or certiï¬cates (depositary receipts) of NV on the stock exchanges in Amsterdam, London and New York and in France, Germany and Switzerland. Unilever ... -

Page 6

... 3 Global highlights Turnover â,¬ million 60 000 55 000 50 000 45 000 40 000 2000 48 066 2001 52 206 2002 48 760 Progress against targets Underlying sales growth(1) % Target is 5-6% by 2004 5 4 3 2 1 2000 1.5 Leading brands % turnover 78 2001 4.0 84 2002 4.2 89 Financial highlights (1) Turnover... -

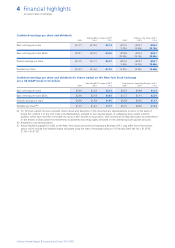

Page 7

... and dividends for shares traded on the New York Stock Exchange (on a UK GAAP basis) in US dollars 2000 New York â,¬0.51 shares of NV(a) 2001 2002 5.6p American Depositary Receipts of PLC 2000 2001 2002 Basic earnings per share Basic earnings per share (BEIA) Diluted earnings per share Dividend per... -

Page 8

... of â,¬0.8 billion, again ahead of plan. Energising our people We can only meet and sustain the objectives of our Path to Growth strategy if our people have a passion for winning and a culture that encourages and rewards enterprise. The development of Leaders into Action programmes and the days we... -

Page 9

... shampoo has been launched in Brazil, Chile, Mexico and Peru and is making good progress. In Foods, ice cream grew by over 10%, mostly volume. A responsible enterprise Clear values and committed social responsibility are essential to how Unilever conducts itself. At a time when the way businesses... -

Page 10

... labelled, advertised and communicated. Shareholders Unilever will conduct its operations in accordance with internationally accepted principles of good corporate governance. We will provide timely, regular and reliable information on our activities, structure, ï¬nancial situation and performance... -

Page 11

... product safety. Competition Unilever believes in vigorous yet fair competition and supports the development of appropriate competition laws. Unilever companies and employees will conduct their operations in accordance with the principles of fair competition and all applicable regulations. Business... -

Page 12

... of business Unilever is one of the world's leading suppliers of fast moving consumer goods in foods, household care and personal product categories. Business structure Our operations are organised into two global divisions - Foods and Home & Personal Care (HPC) - headed by Division Directors. This... -

Page 13

10 About Unilever Home & Personal Care Home care and professional cleaning We are one of the global leaders in the domestic home care market. Our products have been developed to meet the diverse requirements of consumers to clean and care for their homes and clothes. In laundry, they include ... -

Page 14

...number of suppliers around the world from 400 to one. Our global data warehouse, successfully established this year, is key to achieving common information across Unilever and supporting our regional businesses. On this foundation, we have built information systems to track and manage Path to Growth... -

Page 15

... 2002 we published a second Social Review (available online at www.unilever.com/environmentsociety). The Review explores what it means for us to be a responsible corporate citizen. It gives an insight into the day-to-day practice of our business around the world and our relationships with consumers... -

Page 16

... business growth, we surveyed over 100 000 Unilever people from 110 countries, giving us invaluable insights into our Path to Growth progress. The results will help further develop our human resources strategy. Career development at Unilever, as beï¬tting our Enterprise Culture, is a shared... -

Page 17

... a material loss in the context of the Group results. None of our directors or ofï¬cers are involved in any such material legal proceedings. Unilever has businesses in many countries and, from time to time, these are subject to investigation by competition and other regulatory authorities. The most... -

Page 18

... our share of the turnover or operating proï¬t of associates. References to sales growth are made on an underlying basis, excluding the effects of acquisitions and disposals. References to turnover growth include the effects of acquisitions and disposals. Reporting currency and exchange rates... -

Page 19

... sale of 19 food brands to ACH Food Companies, Inc., a subsidiary of Associated British Foods plc, was completed for a total of approximately US $360 million (â,¬383 million) in cash. These brands and related assets, acquired by Unilever in connection with the October 2000 acquisition of Bestfoods... -

Page 20

... review - highlights 17 Bestfoods Baking Company; European dry soups and sauces businesses; North American seafood business; and various other smaller businesses and brands. Public takeover offers made by Unilever during 2002 related to the following: On 14 August 2002, Unilever Overseas Holdings... -

Page 21

... and Axe. Laundry volumes grew by 4%, which was partly offset by pricing in a competitive environment to give an underlying sales growth of 1%, with market share being maintained. Central and Eastern Europe Underlying sales grew by 9% with particular strength in dressings, tea, household care and... -

Page 22

... in the second half of the year. Overall, sales growth in the year was held back by promotional price competition in mayonnaise, the exit from Hellmann's pourable dressings and the impact of lower butter prices on the margarine market. Unilever Annual Report & Accounts and Form 20-F 2002 02 1 467 -

Page 23

... North American growth rate by nearly 1%. Our Foods business recorded an underlying sales growth of just over 3% for the year. Group turnover Group operating proï¬t 2002 results compared with 2001 at constant 2001 exchange rates â,¬ million 2002 â,¬ million 2001 % Change Turnover Operating... -

Page 24

... across categories with the major contributions from marketing activities behind Knorr, Lipton, Lux, Dove and laundry brands. South Africa performed particularly well with good sales growth especially in Omo, Sunsilk, Rama, Axe and Lux in Home & Personal Care and Knorr, Lipton and Flora pro•activ... -

Page 25

...with Suntory in ready-to-drink tea has doubled the market share of Lipton to over 25%. Operating margin BEIA increased to 14.1% with gains from our savings programmes partly reinvested in increased advertising and promotions. 2001 results compared with 2000 at current exchange rates â,¬ million 2001... -

Page 26

... to hold strong market shares and our experienced local management are managing the business in a way which preserves its long-term health. Gross margins are being protected and new products have been launched in both Foods and Home & Personal Care to respond to reduced disposable incomes. Operating... -

Page 27

... of the world's largest food service businesses. It operates in more than 60 countries around the world. The business is focused on delivering innovative, relevant solutions to the professional chef and caterer, leveraging our consumer brands - already 85% of product sales - and our technology. In... -

Page 28

... at current exchange rates â,¬ million 2001 â,¬ million 2000 % Change Our Amora brand also had a successful year with increased sales and proï¬ts. Innovations, such as Amora Clip-Sauce in France and extensions into the chilled cabinet, helped drive growth. Turnover in olive oil declined mainly due... -

Page 29

... of several oil businesses, turnover fell 4% compared with 2001, whilst underlying sales grew by over 2%. Operating margin BEIA was slightly lower than in 2001 at 15.9%, after increased advertising and promotions investment. 2001 results compared with 2000 at current exchange rates â,¬ million 2001... -

Page 30

... and intangibles Operating proï¬t Operating margin Operating margin BEIA (25)% Health & wellness Consumers are increasingly demanding healthy food products. In 2001, our brands grew by meeting such needs, in both industrialised and developing markets. Unilever Annual Report & Accounts and Form... -

Page 31

...Cornetto Soft, Magnum 7 Sins, and others under Paddle Pop and Carte d'Or, delivered strong growth as they gave a new twist to a traditional favourite. North American ice cream brands Breyers and Ben & Jerry's also delivered good results. Unilever Annual Report & Accounts and Form 20-F 2002 02 616 -

Page 32

...the UK. Our frozen foods capability is a valuable asset across the portfolio, which we are now starting to test with other brands. 2001 results compared with 2000 at current exchange rates â,¬ million 2001 â,¬ million 2000 % Change Report of the Directors Turnover Operating proï¬t Group turnover... -

Page 33

... brands and products into our Foodsolutions business. We disposed of our Gorton's frozen seafood business in North America and the Frudesa business in Spain, but retained limited rights to use the Frudesa brand name. We also withdrew from frozen foods in Argentina. Unilever Annual Report & Accounts... -

Page 34

... by 11% and operating margin BEIA reached 15.2%. Our global brand teams, who are responsible for major innovations, ensured focus and delivery in every region, with support from our new network of Global Technology Centres. Critical to this success was our continued research and development focus on... -

Page 35

32 Operating review by category - Home & Personal Care position in Brazil and South Africa and to achieve market share gains in such countries as Morocco and Thailand. In Morocco, Omo overtook its rivals to become the market leader. In Thailand, new innovations helped the brand to extend its ... -

Page 36

Operating review by category - Home & Personal Care 33 Personal care 12 589 12 310 12 245 In 2002, the underlying sales growth of Sunsilk was strong with good performances in Brazil and Mexico and new market entries in Algeria and Central America. In Ghana and South Africa we launched our new Afro... -

Page 37

...shampoo and conditioner market within two months and contributed towards a 12% worldwide growth in our hair care business. The launch projected Unilever into a clear number one position in Japan, the second largest hair care market, with Lux, mod's hair and Dove. Sunsilk, our leading hair care brand... -

Page 38

... the balance sheet information at year-end rates of exchange. For deï¬nitions of key ratios referred to in this review please refer to page 115. Critical accounting policies The accounts comply in all material respects with UK generally accepted accounting principles and Netherlands law. To prepare... -

Page 39

... and sauces brands. This growth was offset by a 3% strengthening of the average exchange rate for the euro against the basket of Unilever currencies. As a result of the Bestfoods acquisition, the Group's share of joint venture turnover increased by 43% to â,¬692 million. Group operating proï¬t BEIA... -

Page 40

... Unilever aims to be in the top third of a reference group for Total Shareholder Return of 21 international consumer goods companies, as explained on pages 40 and 41. The Group's ï¬nancial strategy supports this objective and provides the ï¬nancial ï¬,exibility to meet its strategic and dayto-day... -

Page 41

... the Executive Committee of the Board. In addition to policies, guidelines and exposure limits, a system of authorities and extensive independent reporting covers all major areas of activity. Performance is monitored closely. Reviews are undertaken by the corporate internal audit function. The key... -

Page 42

... This high level of change absorbs considerable management time and can interrupt normal business operations. Report of the Directors Interest rate risk Foreign exchange rate risk 298 1 243 28 Further details on derivatives, foreign exchange exposures and other related information on ï¬nancial... -

Page 43

...: Unilever has a good corporate reputation and many of our businesses, which operate in around 100 countries around the world, have a high proï¬le in their region. Unilever products carrying our famous brand names are sold in over 150 countries. Should we fail to meet high product safety, social... -

Page 44

Financial review 41 Unilever's position relative to the TSR reference group Report of the Directors 7 14 21 98 99 00 01 02 The reference group, including Unilever, consists of 21 companies. Unilever's position is based on TSR over a three-year rolling period. In 2002 the following companies ... -

Page 45

... Unilever on page 138. Legal structure of the Group Shareholders Shareholders Directors The Chairmen and all of the directors are full-time executives and directors of both NV and PLC and, as well as holding speciï¬c management responsibilities, they are responsible for the conduct of the business... -

Page 46

... of relevance to the business - including issues of corporate social responsibility - and reviews our corporate relations strategy. The Committee is supplied with necessary information by the Corporate Development Director. Report of the Directors Unilever Annual Report & Accounts and Form 20... -

Page 47

... to answer questions at the Annual General Meetings of both NV and PLC. The members attending each meeting will not necessarily include the Chairman of the Committee, since these meetings take place at about the same time in Rotterdam and London respectively. A description of Unilever's compliance... -

Page 48

... our website at www.unilever.com. Both NV and PLC communicate with their respective shareholders through the Annual General Meetings. At the AGMs, each Chairman gives a full account of the progress of the business over the last year and a review of the current issues. A summary of their addresses is... -

Page 49

... 92/96. Group Treasurer 86/89. External appointments include: Non-executive director of Standard Chartered PLC. Charles Strauss President, Home & Personal Care North America and Global Prestige Business. Chairman, North America Committee Aged 60. Joined Unilever 1986 upon Unilever's acquisition of... -

Page 50

... Simon, Marketing Aged 57. Joined Unilever 2000 upon Unilever's acquisition of Bestfoods. Appointed Business President 2001. Previous position: Vice-President Strategies and Core Businesses Bestfoods. Member Nomination Committee Member External Affairs and Corporate Relations Committee 3 Chairman... -

Page 51

... Middle East. Harish Manwani, Latin America Aged 49. Joined Unilever 1976. Appointed Business President 2001. Previous position: Senior Vice-President, Home & Personal Care Category Group. Global Businesses Charles Strauss, Prestige Unilever Director see page 46. Function Simon Clift, Marketing Aged... -

Page 52

... general consultancy advice to Unilever Group companies on pension, communications and other human resource matters. Directors' remuneration policy The objective of Unilever's remuneration policy for directors is to attract, motivate and retain top class business executives who are able to direct... -

Page 53

... increase in earnings per share (BEIA) and underlying sales growth of the leading brands for the year in question. Personal targets are based on agreed key objectives relative to the director's speciï¬c responsibilities. At the end of each year the Remuneration Committee reviews the results against... -

Page 54

... in turn affects the growth in share price between grant and exercise of an option, is sufï¬cient. The Remuneration Committee has also taken account of the fact that the Executive Option Plans extend to Unilever executives worldwide and in many countries in which the Group operates it is not common... -

Page 55

...20 0 98 Unilever 99 FTSE 100 00 01 02 Directors' pensions The aim of the Remuneration Committee is that retirement beneï¬ts should be in line with good practice of major companies in continental Europe and the United Kingdom, bearing in mind the need to make the retirement beneï¬t position of the... -

Page 56

...2 300 530 1 160 880 (1) The accrued annual beneï¬ts are calculated on the basis that directors would have left service at 31 December 2002 and include all beneï¬ts provided from Unilever pension plans. Under the NV directors' arrangement, which operates on the basis of a justiï¬able expectation... -

Page 57

54 Remuneration report Directors' service contracts NV's and PLC's Articles of Association require that all directors retire from ofï¬ce at every Annual General Meeting. Directors' contracts of service with the Unilever Group are generally terminated no later than the end of the month in which the... -

Page 58

... Executive Option Plans and the UK Employee Sharesave Plan. Further information, including details of the NV and PLC ordinary shares acquired by certain group companies in connection with other share option plans, is given in note 29 on page 111. The voting rights of the directors who hold interests... -

Page 59

... provided for Netherlands based directors). Includes cash allowances in lieu of company car, entertaining allowance, ï¬nancial planning assistance and an allowance, where applicable, for UK-based directors to compensate for the fact that part of their remuneration is paid in the Netherlands... -

Page 60

... PLC shares under the UK Employee Sharesave Plan. Options in NV New York shares under the Executive Plan. Options in PLC shares in the form of American Depositary Receipts under the Executive Plan (1 ADR equivalent to 4 PLC shares). Granted in the year on the basis, where applicable, of earnings per... -

Page 61

...No options lapsed unexercised during the year. The market price of the ordinary shares at the end of the year was for NV â,¬58.55 and $61.71 and for ...market prices at 31 December 2002 are set out in the table on page 57. For footnotes please refer to page 57. Unilever Annual Report & Accounts and ... -

Page 62

... above, against a peer group of 20 comparator companies and will vary between 0% and 200% of the original number of conditional shares granted. (2) Price of shares at date of grant on 21 March 2002. (3) NV New York shares. (4) The award was made in the form of American Depository Receipts (1 ADR... -

Page 63

60 Remuneration report In addition, Advisory Directors beneï¬ted directly or indirectly from the following payments made in 2002: Lady Chalker: £40 800 paid to Africa Matters Limited for advice provided to Unilever's Africa Business Group by her and other consultants from that company; C X ... -

Page 64

... Committee considered reports from the Financial Director on the quarterly and annual ï¬nancial statements. It also reviewed proposed changes in accounting principles in response to the changes in Netherlands, UK and US law and UK GAAP. Audit of the Annual Accounts PricewaterhouseCoopers, Unilever... -

Page 65

... plans 30 Summarised accounts of the NV and PLC parts of the Group Five year record Additional information for US investors Principal group companies and ï¬xed investments Company accounts - Unilever N.V. Notes to the company accounts - Unilever N.V. Further statutory information - Unilever... -

Page 66

... ï¬nancial, operational, social and environmental risks and regulatory matters. The Boards of NV and PLC have also established a clear organisational structure, including delegation of appropriate authorities. The Group's control environment is supported through a Code of Business Principles, which... -

Page 67

... of directors' responsibilities Unilever's system of risk management has been in place throughout 2002 and up to the date of this report, and complies with the recommendations of 'Internal Control - Guidance for Directors on the Combined Code', published by the Internal Control Working Party... -

Page 68

... Code speciï¬ed for our review by the United Kingdom's Financial Services Authority and we report if it does not. We are not required to consider whether the directors' statements on internal control cover all risks and controls or to form an opinion on the effectiveness of the Group's corporate... -

Page 69

... its Annual Review and Annual Report & Accounts and Form 20-F Unilever adheres to the disclosure recommendations of the OECD Guidelines for Multinational Enterprises. Group companies Group companies are those companies in whose share capital NV or PLC holds an interest directly or indirectly... -

Page 70

... the difference between the fair value of consideration paid for new interests in group companies, joint ventures and associated companies and the fair value of the Group's share of their net assets at the date of acquisition) and identiï¬able intangible assets purchased after 1 January 1998 are... -

Page 71

... on market support costs such as advertising is charged against the proï¬t of the year in which it is incurred. Group turnover and Turnover Group turnover comprises sales of goods and services after deduction of discounts and sales taxes. It includes sales to joint ventures and associated companies... -

Page 72

... loss account 69 For the year ended 31 December Unilever Group â,¬ million 2002 â,¬ million 2001 â,¬ million 2000 Turnover 1 Less: Share of turnover of joint ventures 1 Group turnover 1 Cost of sales 2 Gross proï¬t Distribution, selling and administrative costs 2 Group operating proï¬t 1 Group... -

Page 73

... from group operating activities 26 Dividends from joint ventures Returns on investments and servicing of ï¬nance 27 Taxation Capital expenditure and ï¬nancial investment 27 Acquisitions and disposals 27 Dividends paid on ordinary share capital Cash ï¬,ow before management of liquid resources and... -

Page 74

... 268 2 104 29 554 Financial Statements Total capital employed 23 996 Capital and reserves include amounts relating to preference shares in NV which under United Kingdom Financial Reporting Standard 4 are classiï¬ed as non-equity. Minority interests in group companies are substantially all equity... -

Page 75

... consolidated accounts Unilever Group 1 Segmental information â,¬ million Analysis by geographical area 2002 Group turnover (a) Europe â,¬ million North America â,¬ million Africa, Middle East & Turkey â,¬ million Asia & Paciï¬c â,¬ million Latin America â,¬ million Total Share of turnover... -

Page 76

... accounts 73 Unilever Group 1 Segmental information continued â,¬ million Savoury and dressings â,¬ million Spreads and cooking products â,¬ million Health & wellness and beverages â,¬ million Ice cream and frozen foods â,¬ million Home care & professional cleaning â,¬ million Personal care... -

Page 77

... million Ice cream and frozen foods â,¬ million Home care & professional cleaning â,¬ million Personal care â,¬ million Other operations â,¬ million Analysis by operation (e) 2002 Group turnover At constant 2001 exchange rates Exchange rate adjustments At current 2002 exchange rates Trading result... -

Page 78

... accounts 75 Unilever Group 1 Segmental information continued â,¬ million Savoury and dressings â,¬ million Spreads and cooking products â,¬ million Health & wellness and beverages â,¬ million Ice cream and frozen foods â,¬ million Home care & professional cleaning â,¬ million Personal care... -

Page 79

...and Paciï¬c. Of the total exceptional items â,¬(1) million arose in the savoury and dressings segment and â,¬6 million arose in the spreads and cooking products segment. These amounts are taken into account in the calculation of operating proï¬t BEIA. Unilever Annual Report & Accounts and Form 20... -

Page 80

... of directors and Advisory Directors which form part of these accounts are given in the auditable part of the Remuneration report on pages 49 to 60. Financial Statements The average number of employees during the year was: '000 2002 '000 2001 '000 2000 Europe North America Africa, Middle East... -

Page 81

..., the computed rate of tax is the average of the standard rate of tax applicable in the European countries in which Unilever operates, weighted by the amount of proï¬t on ordinary activities before taxation generated in each of those countries. Unilever Annual Report & Accounts and Form 20... -

Page 82

....69 Outside Europe: Group companies Joint ventures Associates 1 831 60 (5) 1 886 Total 3 979 Basis of calculation: The calculations of combined earnings per share are based on the net proï¬t attributable to ordinary capital divided by the average number of share units representing the combined... -

Page 83

... the consolidated accounts Unilever Group 7 Combined earnings per share continued Millions of 1.4p share units 2002 2001 2000 Pence 2002 Pence 2001 Pence 2000 Average ordinary capital: NV PLC less: shares held by employee share trusts and companies Combined average number of share units for all... -

Page 84

... liabilities of joint ventures Interest in net assets of joint ventures Interest in net assets of associates Total joint ventures and associates Other ï¬xed investments Total ï¬xed investments 370 (96) 274 1 275 404 679 855 (147) 708 - 708 176 884 Unilever Annual Report & Accounts and Form 20... -

Page 85

...Finished goods and goods for resale Total stocks 1 720 2 780 4 500 2 105 3 238 5 343 (154) - 169 1 13 Debtors â,¬ million â,¬ million 2002 2001 Associated companies primarily comprise our investments in JohnsonDiversey Holdings Inc. and Langholm Capital. Other Unilever Ventures investments are... -

Page 86

... 444) (25 500) Total net funds/(debt) (16 966) (23 199) Current investments include short-term deposits, government securities and A- or higher rated money and capital market instruments. â,¬ million â,¬ million 2002 2001 NV Floating rate notes 2002 (US $) Floating rate notes 2003 (â,¬) Floating... -

Page 87

... within ï¬xed investments. (b) The ï¬xed interest rate of 10.9% in 2002 (2001: 11.0%) relates to one leg of a cross-currency interest rate swap of an intercompany loan: a corresponding interest charge is included in the US dollar ï¬xed rate liabilities. Unilever Annual Report & Accounts and Form... -

Page 88

... by United Kingdom Financial Reporting Standard 13, or because the amounts are not material. Unilever operates an interest rate management policy aimed at optimising net interest and reducing volatility. Derivatives are used to manage the interest rate exposure of debt and cash positions. The Group... -

Page 89

... Unilever policies. The objectives of Unilever's foreign exchange policies are to allow operating companies to manage foreign exchange exposures that arise from trading activities effectively within a framework of control that does not expose Unilever to unnecessary foreign exchange risks. Operating... -

Page 90

...consultants or by actuaries employed by Unilever. The actuarial assumptions used to calculate the beneï¬t obligations vary according to the country in which the plan is situated. In line with the accounting objective, assumptions are generally set reï¬,ecting long-term expectations and asset values... -

Page 91

... accounts Unilever Group 17 Pensions and similar obligations continued Additional information Group policy is that plans are formally valued at least every three years. The results of the valuations for the principal pension plans (that represent 90% of all deï¬ned beneï¬t pension plans by market... -

Page 92

... accounts 89 Unilever Group 17 Pensions and similar obligations continued FRS 17 Disclosures With the objective of presenting pensions and other post retirement beneï¬t plans' assets and liabilities at their fair value on the balance sheet, assumptions for FRS 17 are set by reference to market... -

Page 93

... 31 December 2001 Other post Long-term retirement rates of beneï¬t return plans expected Pension plans Pension plans Assets of principal plans: Equities Bonds Other Assets of other plans Total plan assets Present value of liabilities: Principal plans Other plans (a) 7 281 3 383 1 644 417 12 725... -

Page 94

... preparation of the Group's ï¬nancial statements, the proï¬t and loss account would have been as follows: â,¬ million 2002 â,¬ million 2001 Charged to operating proï¬t: Deï¬ned beneï¬t pension and other beneï¬t plans: Current service cost Special termination beneï¬ts Past service cost Gains... -

Page 95

... based on the market value of the funds plus the provisions held in the Group's accounts. â,¬ million Key pension plans 2002 â,¬ million Key pension plans 2001 â,¬ million Other post retirement beneï¬t plans 2002 â,¬ million Other post retirement beneï¬t plans 2001 Change in beneï¬t obligations... -

Page 96

...Pension plans 2002 % Key Pension plans 2001 % Key Pension plans 2000 % Other post retirement beneï¬t plans 2002 % Other post retirement beneï¬t plans 2001 % Other post retirement beneï¬t plans 2000 Weighted-average assumptions as at 31 December Discount rate Expected return on plan assets Salary... -

Page 97

...on: Accelerated depreciation Stock reliefs Pension and similar provisions Short-term and other timing differences Less asset ... Acquisition/disposal of group companies Proï¬t and loss account Other movements 31 December 910 187 17 (292) (318) 504 Unilever Annual Report & Accounts and Form 20-F... -

Page 98

... 2002 â,¬ million 2001 Restructuring provisions Other provisions Total Movements in restructuring provisions: 1 January Currency retranslation Acquisition/disposal of group companies Proï¬t and loss account: New charges Releases Utilisation 31 December Movements in other provisions: 1 January... -

Page 99

... for the Unilever Group as a whole. This information does not reï¬,ect the separate legal status of NV and PLC; information on capital and reserves attributable to each of NV and PLC is given in notes 21 and 23 on pages 97 and 98. â,¬ million Called up share capital â,¬ million Share premium account... -

Page 100

... to nominate persons for election as directors at general meetings of shareholders. The subsidiaries mentioned above have waived their rights to dividends on their ordinary shares in NV. For more information see 'Control of Unilever' on pages 138 to 141. Share options The Group operates a number of... -

Page 101

...481) Cumulative goodwill written off directly to reserves (5 298) (a) Arising from the legal integration of Bestfoods into Unilever, following which a number of group companies are partly held by Unilever United States, Inc. and therefore are ultimately owned jointly by NV and PLC. As a result of... -

Page 102

... in Unilever Bestfoods Robertsons thereby obtaining control. This transaction has been accounted for in accordance with United Kingdom Urgent Issues Task Force Abstract 31 ('UITF 31') 'Exchange of businesses or other non-monetary assets for an interest in a subsidiary, joint venture or associate... -

Page 103

... business disposed, Unilever has recognised a gain of â,¬98 million, after taking into account certain provisions recorded in respect of the disposal. Unilever's 33.3% interest in JohnsonDiversey Holdings Inc. is accounted for by Unilever as an associated undertaking. Unilever Annual Report... -

Page 104

...to items included in group operating proï¬t in the current year Of which related to items included in group operating proï¬t in prior years Total (406) 1 834 229 1 657 2 064 (407) 1 657 (1 131) 1 650 429 948 1 313 (365) 948 (485) 626 428 569 Unilever Annual Report & Accounts and Form 20-F 2002 -

Page 105

... of disposals made in previous years Total Management of liquid resources Purchase of current investments Sale of current investments (Increase)/decrease in cash on deposit Total Financing Issue/purchase of shares by group companies to/(from) minority shareholders Debt due within one year: Increases... -

Page 106

... executives for special performance. After the agreed number of years the awards will vest provided they are still employed by Unilever at that time. (vi) The North American Performance Share Plan A long-term incentive plan for North American managers awarding Unilever shares if company and personal... -

Page 107

...Other plans: North America, South Africa and United Kingdom. Group (a): The standard framework for these countries means, in principle, an annual grant of options over NV shares, at the same grant date, exercise price (the market price on the grant date) and grant size (including part-time employees... -

Page 108

...years 25.6% 3.3% 5.7% - - - - - 4 PLC option value information (b) Fair value per option (c) Valuation assumptions Expected option term Expected volatility Expected dividend yield Risk-free interest rate NV New York shares option value information (b) Fair value per option (c) Valuation assumptions... -

Page 109

... to key employees of the Group on a discretionary basis: The NV Executive Option Plan The NV Executive Option Plan provides for the granting of options to purchase shares of Unilever N.V. and, from 1997 onwards, also shares of Unilever PLC, at a price not lower than the market price on the day the... -

Page 110

...granted during each period. Estimated using Black Scholes option pricing method. Fair value per option of the NV Executive Option Plan. Fair value per option of the PLC Executive Option Plan. Fair value per option of the NA Executive Option Plan. Unilever Annual Report & Accounts and Form 20-F 2002 -

Page 111

...from Unilever at the end of this period. The North American managers participate in the North American Share Bonus Plan, the others in the Variable Pay in Shares Plan. The numbers below include the numbers under the plan for the directors described in the Remuneration report on page 50. A summary of... -

Page 112

Notes to the consolidated accounts 109 Unilever Group 29 Equity-based compensation plans continued Number of shares 2002 Weighted average price Number of shares 2001 Weighted average price Number of shares 2000 Weighted average price NV New York shares of â,¬0.51 Outstanding at 1 January Awarded ... -

Page 113

... information (b) Fair value per share award Actual compensation costs recognised (â,¬ million) (b) Weighted average of share awards granted during each period. (vi) The North American Performance Share Plan This long-term incentive plan for North American managers awards Unilever shares if company... -

Page 114

...Employee Option Plans Executive Option Plans Share Matching Plans TSR Long-Term Incentive Plan Restricted Share Plan North American Performance Share Plan (i) When under a North American Plan, in the form of PLC ADRs. (ii) When under a North American Plan, in the form of NV New York shares. Unilever... -

Page 115

...(7 293) (7 576) Net current assets Total assets less current liabilities Creditors due after more than one year Borrowings Trade and other creditors Provisions for liabilities and charges (a) Intra-group - NV/PLC Minority interests Capital and reserves (a) (b) Total capital employed (3 652) 17 084... -

Page 116

...Special ordinary dividends NV - euros per Fl. 1 of ordinary capital (d) PLC - pence per 1.25p of ordinary capital Consolidated balance sheet (a)(e) Goodwill and intangible assets Other ï¬xed assets and investments Stocks Debtors Acquired businesses held for resale Total cash and current investments... -

Page 117

...ow from operating activities Dividends from joint ventures Returns on investments and servicing of ï¬nance Taxation Capital expenditure and ï¬nancial investment Acquisitions and disposals Dividends paid on ordinary share capital Special dividend Cash ï¬,ow before management of liquid resources and... -

Page 118

... excluding associates. Net debt (borrowings less cash and current investments) expressed as a percentage of the sum of capital and reserves, minority interests and net debt. In calculating capital and reserves, the book value of shares or certiï¬cates held in connection with share option plans is... -

Page 119

... Group operating proï¬t Foods Home & Personal Care Other Operations 2 185 2 814 42 5 041 Net operating assets Foods Home & Personal Care Other Operations 22 768 1 577 389 24 734 Capital expenditure Foods Home & Personal Care Other Operations 805 466 27 1 298 Unilever Annual Report & Accounts... -

Page 120

...accounts. 2002 2001 2000 1999 1998 Year end $1 = Fl. â,¬1 = $ £1 = Fl. â,¬1 = £ Annual average $1 = Fl. â,¬1 = $ £1 = Fl. â,¬1 = £ Financial Statements 1.88 1.049 0.651 0.885 0.611 0.930 0.624 1.005 3.12 0.621 1.98 0.940 0.628 0.895 0.622 0.921 0.609 1.065 3.29 0.659 Noon Buying Rates in New... -

Page 121

... US investors Unilever Group Unilever´s consolidated accounts are prepared in accordance with accounting principles which differ in some respects from those applicable in the United States. The following is a summary of the effect on the Group's net proï¬t, combined earnings per share and capital... -

Page 122

... paid for new interests in group companies, joint ventures and associated companies and the fair value of the Group's share of their net assets at the date of acquisition) and identiï¬able intangible assets purchased after 1 January 1998 are capitalised and amortised in operating proï¬t over... -

Page 123

... lives. An analysis of goodwill by reporting segment is given below: Savoury and dressings Spreads and cooking products Health & wellness and beverages Ice cream and frozen foods Home care and professional cleaning Other operations â,¬ million Personal care Total As at 1 January 2002 Currency... -

Page 124

... expected return on plan assets, Unilever changed the method of valuing its pension plan assets from a market related value calculated by smoothing gains and losses over a ï¬ve year period to an actual fair value at the balance sheet date. Management believe that the actual fair value methodology... -

Page 125

... information for US investors Unilever Group Classiï¬cation differences between UK and US GAAP Revenue recognition Under US GAAP, certain sales incentive expenses which have been included in operating costs under Unilever's accounting would be deducted from turnover. The decrease in turnover... -

Page 126

... Eliminations Unilever Group Proï¬t and loss account for the year ended 31 December 2002 Group turnover Operating costs Group operating proï¬t Share of operating proï¬t of joint ventures Operating proï¬t Share of operating proï¬t of associates Dividends Other income from ï¬xed investments... -

Page 127

... subsidiaries Eliminations Unilever Group Proï¬t and loss account for the year ended 31 December 2001 Group turnover Operating costs Group operating proï¬t Share of operating proï¬t of joint ventures Operating proï¬t Dividends Other income from ï¬xed investments Interest Intercompany... -

Page 128

...ow from group operating activities Dividends from joint ventures Returns on investments and servicing of ï¬nance Taxation Capital expenditure and ï¬nancial investment Acquisitions and disposals Dividends paid on ordinary share capital Cash ï¬,ow before management of liquid resources and ï¬nancing... -

Page 129

126 Additional information for US investors Unilever Group â,¬ million Unilever Capital Corporation subsidiary issuer Unilever N.V. parent issuer/ guarantor Unilever PLC parent guarantor Unilever United States Inc. subsidiary guarantor Nonguarantor subsidiaries Eliminations Unilever Group ... -

Page 130

Additional information for US investors 127 Unilever Group â,¬ million Unilever Capital Corporation subsidiary issuer Unilever N.V. parent issuer/ guarantor Unilever PLC parent guarantor Unilever United States Inc. subsidiary guarantor Nonguarantor subsidiaries Eliminations Unilever Group ... -

Page 131

... next Annual Return of Unilever PLC. The main activities of the companies listed below are indicated according to the following key: Holding companies Foods Home & Personal Care Other Operations Unless otherwise indicated, the companies are incorporated and principally operate in the countries under... -

Page 132

.... Good Humor-Breyers Ice Cream (3) Slim•Fast Foods Company (3) Unilever Bestfoods (3) Unilever Bestfoods Foodsolutions (3) Unilever Capital Corporation Unilever Cosmetics International (3) Unilever Home & Personal Care (3) Unilever Ice Cream (3) Unilever United States, Inc. % Africa, Middle East... -

Page 133

... investments As at 31 December 2002 Unilever Group Principal group companies continued % Africa, Middle East and Turkey contd Morocco Knorr Bestfoods Morocco S.A. Unilever Maghreb S.A. Nigeria 50 Unilever Nigeria Plc Saudi Arabia 49 Binzagr Lever Ltd.* 49 Lever Arabia Ltd.* South Africa 59 Unilever... -

Page 134

... F Financial Statements F F F F F c F Ownership Activity a a a FP FP FP a F Associated companies % Europe United Kingdom 33 Langholm Capital Partners % North America United States of America 33 JohnsonDiversey Holdings Inc a P Ownership Activity b O Unilever Annual Report & Accounts and Form... -

Page 135

...the accounts of NV have been included in the consolidated accounts. The proï¬t and loss account mentions only income from ï¬xed investments after taxation as a separate item. The balance sheet includes the proposed proï¬t appropriation. The Board of Directors 4 March 2003 Unilever Annual Report... -

Page 136

... capital Shares numbered 1 to 2 400 are held by a subsidiary of NV and a subsidiary of PLC, each holding 50%. Additionally, 17 711 169 â,¬0.51 ordinary shares are held by NV and other group companies. Full details are given in note 29 on page 111. Financial Statements Share premium account The share... -

Page 137

... N.V. as auditors of NV. The present appointment will end at the conclusion of the Annual General Meeting. Corporate Centre Unilever N.V. Weena 455 PO Box 760 3000 DK Rotterdam J A A van der Bijl S G Williams Joint Secretaries of Unilever N.V. 4 March 2003 Unilever Annual Report & Accounts and... -

Page 138

... Financial Reporting Standard 4. As permitted by Section 230 of the United Kingdom Companies Act 1985, PLC's proï¬t and loss account does not accompany its balance sheet. On behalf of the Board of Directors N W A FitzGerald Chairman A Burgmans Vice-Chairman 4 March 2003 Unilever Annual Report... -

Page 139

... with share options 2 237 36 (36) 2 237 £ million 2002 £ million 2001 These are not expected to give rise to any material loss and include guarantees given for group companies, under which amounts outstanding at 31 December were: Of the above, guaranteed also by NV Remuneration of auditors... -

Page 140

... page and the information contained in the Report of the Directors on pages 2 to 61, Dividends on page 147 and Principal group companies and ï¬xed investments on pages 128 to 131. Financial Statements Corporate Centre Unilever PLC PO Box 68 Unilever House Blackfriars London EC4P 4BQ Unilever PLC... -

Page 141

... capital to £1 PLC nominal share capital. The subscription price for one new NV share would have to be the same, at the prevailing exchange rate, as the price for 6.67 new PLC shares. Under the Equalisation Agreement (as amended in 1981) the two companies are permitted to pay different dividends... -

Page 142

... hours before the meeting, either in paper or electronic format. You can cast one vote for each PLC ordinary 1.4p share you hold. United Holdings Limited, which owns half of the deferred stock, is not permitted to vote at General Meetings. Shareholder information Unilever Annual Report & Accounts... -

Page 143

... least 60 days before the date of the General Meeting, and it will be honoured unless, in the opinion of the Board of Directors, it is against the interests of the company. Under United Kingdom company law, • shareholders who together hold shares representing at least 5% of the total voting rights... -

Page 144

... exchange your Nedamtrust certiï¬cate at any time for the underlying ordinary or preference share (or vice versa). Hitherto the majority of votes cast by ordinary and preference shareholders at NV meetings have been cast by Nedamtrust. Nedamtrust's NV shareholding ï¬,uctuates daily - its holdings... -

Page 145

... of class Name of holder Number of shares held Approximate % held Deferred Stock Ordinary shares Naamlooze Vennootschap Elma United Holdings Limited Trustees of the Leverhulme Trust and the Leverhulme Trade Charities Trust The Capital Group Companies, Inc. Fidelity Management and Research Company... -

Page 146

... changes in exchange rates. However, over time the prices of NV and PLC shares do stay in close relation to each other, in particular because of our equalisation arrangements. If you are a shareholder of NV, you have an interest in a Netherlands legal entity, your dividends will be paid in euros... -

Page 147

... 562 38 35 Quarterly high and low prices for 2002 and 2001: 2002 1st 2nd 3rd 4th NV per â,¬0.51 ordinary share in Amsterdam (in â,¬) NV per â,¬0.51 ordinary share in New York (in $) PLC per 1.4p ordinary share in London (in pence) PLC per American Share in New York (in $) High Low High Low High... -

Page 148

... organisations that are generally exempt from United States taxes and that are constituted and operated exclusively to administer or provide pension, retirement or other employee beneï¬ts may be exempt at source from withholding tax on dividends received from a Netherlands corporation. An agreement... -

Page 149

...of the current Convention for a period of 12 months after the date on which the New Convention would otherwise be applicable. It is uncertain when the New Convention will be ratiï¬ed. Taxation on capital gains Under United Kingdom law, when you sell shares you may be liable to pay capital gains tax... -

Page 150

... Fl. 1) ordinary shares of NV registered in New York. The above exchange rates were those ruling on the dates of declaration of the dividend. Note 2: The ï¬nal euro dividend for 2002 is payable on 9 June 2003. The dollar dividend will be calculated with reference to the exchange rates prevailing on... -

Page 151

...-131 Property, plants and equipment 14 Operating and ï¬nancial review and prospects Operating results 15-39 Liquidity and capital resources 37-38, 63 Research and development, patents and licences, etc. 10, 13-14 Trend information 5-6, 15-34 Directors, senior management and employees Directors and... -

Page 152

...' funds Reserves Share capital Share option Share premium account Shareholders' funds Shares in issue Statement of total recognised gains and losses Stocks Tangible ï¬xed assets Turnover US equivalent or brief description Financial statements A business which is not a subsidiary or a joint venture... -

Page 153

...6907 e-mail: corporate.relations-london @unilever.com Unilever United States, Inc. Corporate Relations Department 390 Park Avenue, New York NY 10022-4698 Telephone + 1 212 906 4240 Telefax + 1 212 906 4666 e-mail: corporate.relations-newyork @unilever.com Unilever Annual Report & Accounts and Form... -

Page 154

... be obtained without charge from Unilever's Corporate Relations Departments. Unilever Annual Review 2002 Including Summary Financial Statement. Available in English or Dutch, with ï¬nancial information in euros, sterling and US dollars. Unilever Annual Report & Accounts and Form 20-F 2002 Available... -

Page 155

Design: Fitch: London Typesetting: Paufï¬,ey Limited Printed by: St Ives Westerham Press Ltd -

Page 156

For more information: www.unilever.com Unilever N.V. Weena 455, PO Box 760 3000 DK Rotterdam T +31 (0) 10 217 4000 F +31 (0) 10 217 4798 Unilever PLC PO Box 68, Unilever House Blackfriars, London EC4P 4BQ T +44 (0)20 7822 5252 F +44 (0)20 7822 5951