Ulta 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company is also involved in various legal proceedings that are incidental to the conduct of our business. In

the opinion of management, the amount of any liability with respect to these proceedings, either individually or

in the aggregate, will not be material.

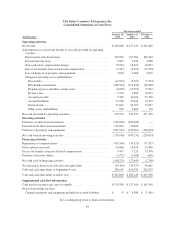

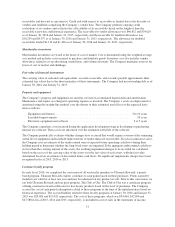

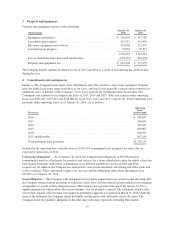

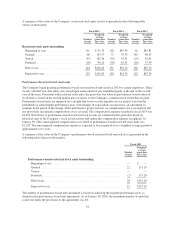

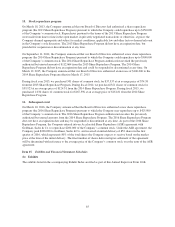

5. Accrued liabilities

Accrued liabilities consist of the following:

(In thousands)

January 30,

2016

January 31,

2015

Accrued vendor liabilities (including accrued property and equipment

costs) ...................................................... $ 27,894 $ 24,705

Accrued customer liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54,496 39,593

Accrued payroll, bonus and employee benefits . . . . . . . . . . . . . . . . . . . . . . . 61,068 50,931

Accruedtaxes,other ............................................ 20,486 17,824

Otheraccruedliabilities ......................................... 23,407 16,359

Accruedliabilities .............................................. $187,351 $149,412

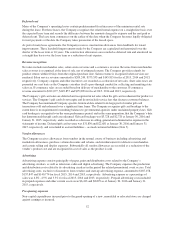

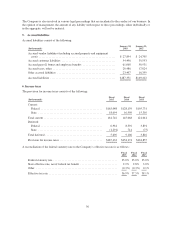

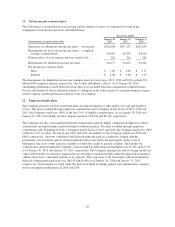

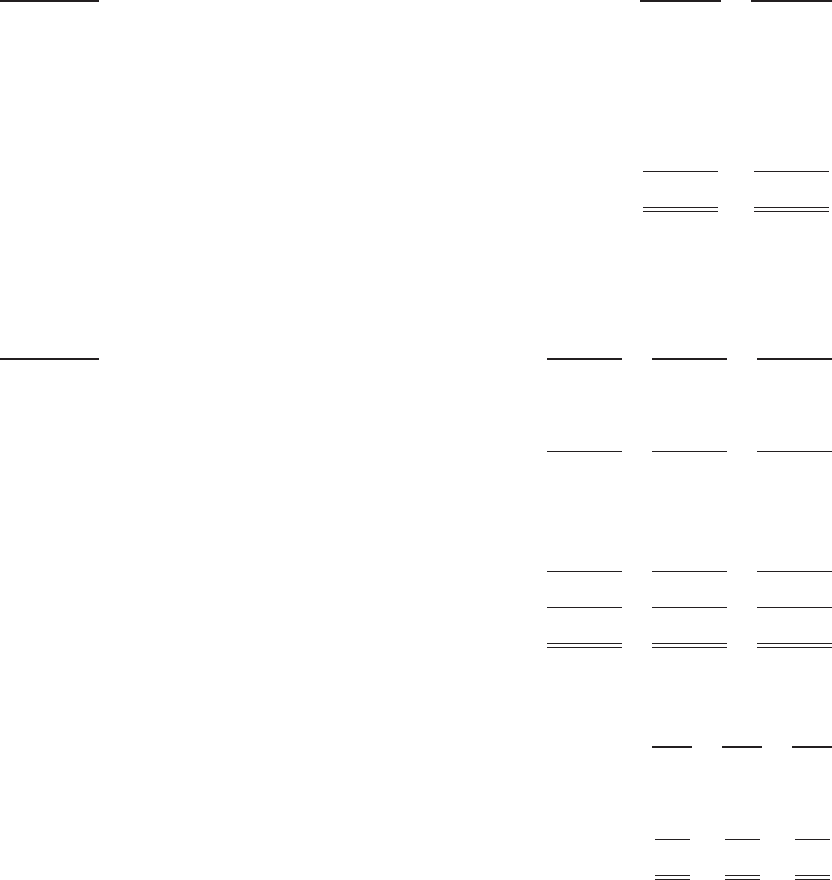

6. Income taxes

The provision for income taxes consists of the following:

(In thousands)

Fiscal

2015

Fiscal

2014

Fiscal

2013

Current:

Federal ........................................... $163,048 $128,159 $105,731

State ............................................. 18,694 16,909 15,310

Totalcurrent ......................................... 181,742 145,068 121,041

Deferred:

Federal ........................................... 6,981 8,392 3,891

State ............................................. (1,291) 714 (75)

Totaldeferred ........................................ 5,690 9,106 3,816

Provision for income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $187,432 $154,174 $124,857

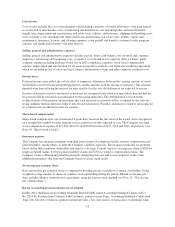

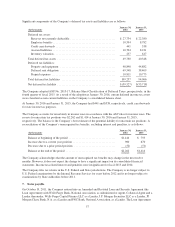

A reconciliation of the federal statutory rate to the Company’s effective tax rate is as follows:

Fiscal

2015

Fiscal

2014

Fiscal

2013

Federalstatutoryrate............................................. 35.0% 35.0% 35.0%

State effective rate, net of federal tax benefit . . . . . . . . . . . . . . . . . . . . . . . . . . 2.2% 2.8% 3.0%

Other ......................................................... (0.3%) (0.3%) 0.1%

Effectivetaxrate ................................................ 36.9% 37.5% 38.1%

56