Ulta 2015 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2015 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.expect to capture operational efficiencies in new enterprise inventory capabilities to help fund those investments

in-store labor and tools. We will also pursue opportunities to optimize our marketing spend to maximize

effectiveness. Finally, we plan to drive scale and cost efficiencies across the enterprise.

Our market

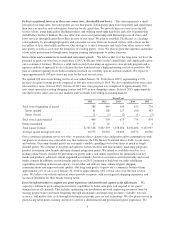

We operate within the large and growing U.S. beauty products and salon services industry. This market

represents approximately $127 billion in sales, according to Euromonitor International and IBIS World Inc. The

approximately $74 billion beauty products industry includes cosmetics, haircare, fragrance, bath and body,

skincare, salon styling tools and other toiletries. Within this market, we compete across all major categories as

well as a range of price points by offering prestige, mass and salon products. The approximately $53 billion salon

services industry consists of hair, skin and nail services.

Competition

Our major competitors for prestige and mass products include traditional department stores, specialty stores, drug

stores, mass merchandisers and the online businesses of national retailers as well as pure-play e-commerce

businesses. The market for salon services and products is highly fragmented. Our competitors for salon services

and products include chain and independent salons.

Stores

Our stores are predominantly located in convenient, high-traffic locations such as power centers. Our typical

store is approximately 10,000 square feet, including approximately 950 square feet dedicated to our full-service

salon. We opened 103 (100 net of closings) stores in fiscal 2015 and the average investment required to open a

new Ulta Beauty store is approximately $1.2 million, which includes capital investments, net of landlord

contributions, pre-opening expenses and initial inventory, net of payables. Our net investment required to open

new stores and the net sales generated by new stores may vary depending on a number of factors, including

geographic location. Our retail store concept, including physical layout, displays, lighting and quality of finishes,

has evolved over time to match the rising expectations of our guests and to keep pace with our merchandising

and operating strategies. Approximately 98% of our stores feature our most current store design. We expect the

net investment to open a new store in 2016 will increase due to store enhancements and boutique additions. As of

January 30, 2016, we operated 874 stores in 48 states.

Salon

We offer a full range of services in all of our stores, focusing on the three key pillars of hair, skin health and

brow services. Our current Ulta Beauty store format includes an open and modern salon area with approximately

eight to ten stations and the majority of our stores offer brow services. The entire salon area is approximately 950

square feet with a concierge desk, skin treatment room or dedicated skin treatment area, semi-private shampoo

and hair color processing area. We employ licensed professional stylists and estheticians who offer highly skilled

services as well as an educational experience, including consultations, styling lessons, skincare regimens and at-

home care recommendations.

Ulta.com

Our e-commerce business represented approximately 6% of our total sales and grew 47.5% in fiscal 2015. We

offer more than 20,000 beauty products from hundreds of brands. Ulta.com is also an important resource for our

guests to access product and store information, beauty trends and techniques. We continue to enhance the site

with a collection of tips, tutorials and social content. We expect Ulta.com to maintain rapid growth with the long-

term goal of 10% of total sales. We are in the process of significantly improving our e-commerce fulfillment

capabilities through new distribution centers and systems.

5