Ulta 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 ANNUAL

REPORT

Table of contents

-

Page 1

2015 ANNUAL REPORT -

Page 2

... month of operation. Remodeled stores are included in comparable sales unless the store was closed for a portion of the current or comparable prior year. (4) Net sales per average total square foot was calculated by dividing net sales for the year by the average square footage for those stores open... -

Page 3

...: retail stores, salon services and e-commerce. Operating proft rose 23.4%, and operating margin increased 20 basis points to 12.9% of sales. Earnings per share grew 25.1% to $4.98 per diluted share. Productive New Store Growth We opened 100 net new stores in 2015, increasing square footage by 13... -

Page 4

... drove incremental sales and margin dollars. Infrastructure Improvements We continue to invest in infrastructure to support our guest experience and growth, and capture scale efciencies. We opened our new distribution center in Greenwood, Indiana, in August of 2015 and successfully ramped this... -

Page 5

..., based upon the closing sale price of the common stock on July 31, 2015, as reported on the NASDAQ Global Select Market, was approximately $9,282,171,000. Shares of the registrant's common stock held by each executive officer and director and by each entity or person that, to the registrant... -

Page 6

... Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...Certain Relationships and Related Transactions, and Director Independence ...Principal Accountant Fees and Services... -

Page 7

... key executive personnel; ‰ customer acceptance of our rewards program and technological and marketing initiatives; ‰ our ability to sustain our growth plans and successfully implement our long-range strategic and financial plan; ‰ the possibility that our continued opening of new stores could... -

Page 8

... guest loyalty. We offer a comprehensive loyalty program, Ultamate Rewards, and targeted promotions through our Customer Relationship Management (CRM) platform. We also offer frequent promotions and coupons, in-store events and gifts with purchase. Convenience. Our stores are predominantly located... -

Page 9

... shopping experience. Loyal and active customer base. Over 18 million Ulta Beauty guests are active members of our Ultamate Rewards loyalty program. We use this valuable proprietary database to drive traffic, better understand our guests' purchasing patterns and support new store site selection... -

Page 10

...opening stores both in markets in which we currently operate and new markets. We expect to open approximately 100 new stores per year for the next several years. We opened 103 new stores during our fiscal year ended January 30, 2016 (fiscal 2015), representing a 13% increase in square footage growth... -

Page 11

..., high-traffic locations such as power centers. Our typical store is approximately 10,000 square feet, including approximately 950 square feet dedicated to our full-service salon. We opened 103 (100 net of closings) stores in fiscal 2015 and the average investment required to open a new Ulta Beauty... -

Page 12

...customer loyalty program, Ultamate Rewards, and targeted promotions through our CRM platform. We also offer promotions and coupons, in-store events and gifts with purchase. We believe our private label products, the Ulta Beauty Collection, are a strategically important category for growth and profit... -

Page 13

... the Ulta Beauty brand. Over 18 million active loyalty program members generated more than 80% of Ulta Beauty's annual total net sales. Ultamate Rewards enables customers to earn points based on their purchases. Points earned are valid for at least one year and may be redeemed on any product we sell... -

Page 14

... support from time to time from recruiting specialists for the retail and salon operations, regionally based human resource managers, a field loss prevention team, salon technical trainers, management trainers and vendor partners. Ulta Beauty stores are open seven days a week, eleven hours a day... -

Page 15

... and to manage the operations of our growing store base. We rely on computer systems to provide information for all areas of our business, including supply chain, merchandising, POS, e-commerce, marketing, finance, accounting and human resources. Our core business systems consist mostly of purchased... -

Page 16

...sales and profits are realized during the fourth quarter of the fiscal year due to the holiday selling season. To a lesser extent, our business is also affected by Mothers' Day as well as the "Back to School" season and Valentine's Day. Available information Our principal website address is www.ulta... -

Page 17

... our product categories, including prestige beauty products and premium salon services. Factors that could affect consumers' willingness to make such discretionary purchases include: general business conditions, levels of employment, interest rates, tax rates, the availability of consumer credit and... -

Page 18

...business, financial condition, profitability and cash flows. We currently operate four distribution facilities, which house the distribution operations for Ulta Beauty retail stores together with the order fulfillment operations of our e-commerce business. In 2014, we began a multi-year supply chain... -

Page 19

... price of our common stock may decline. For more information on our quarterly results of operations, see Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations." Our e-commerce business may be unsuccessful. We offer most of our beauty products for sale through... -

Page 20

... between product offerings online and through our stores and of opening up our channels to increased internet competition could have a material adverse effect on our business, financial condition, profitability and cash flows. We may not be able to sustain our growth plans and successfully implement... -

Page 21

... vendor partners to purchase prestige, mass and salon beauty products on reasonable terms. If these relationships were to be impaired, or if certain vendor partners were to change their distribution model or are unable to supply sufficient merchandise to keep pace with our growth plans, we may not... -

Page 22

... Ulta Beauty, including Ulta branded products and gifts with purchase and other promotional products, consistent with applicable regulatory requirements, we could suffer lost sales and be required to take costly corrective action, which could have a material adverse effect on our business, financial... -

Page 23

...marketability of our vendors' products or our Ulta branded products, resulting in significant loss of net sales. Our failure to comply with FTC or state requirements when we advertise our products (including prices) or services, or engage in other promotional activities, in digital (including social... -

Page 24

...delays in store openings could increase our store opening costs, cause us to incur lost sales and profits, and damage our public reputation, which could have a material adverse effect on our business, financial condition, profitability and cash flows. Our Ulta branded products and salon services may... -

Page 25

... effect on our business, financial condition, profitability and cash flows. Our secured revolving credit facility contains certain restrictive covenants that could limit our operational flexibility, including our ability to open stores. We have a $200 million secured revolving credit facility with... -

Page 26

..., other retailers and vendors concerning, among other things, their performance, strategy or accounting practices could cause the market price of our common stock to decline regardless of our actual operating performance. Use of social media may adversely impact our reputation or subject us to fines... -

Page 27

...cover actual losses. From time to time, we are subject to litigation claims in the ordinary course of our business operations regarding, but not limited to, employment matters, security of consumer and employee personal information, contractual relations with suppliers, marketing and infringement of... -

Page 28

... are predominantly located in convenient, high-traffic, locations such as power centers. Our typical store is approximately 10,000 square feet, including approximately 950 square feet dedicated to our fullservice salon. Most of our retail store leases provide for a fixed minimum annual rent and... -

Page 29

... for a distribution center located in Dallas, Texas. The Dallas warehouse is approximately 671,000 square feet and is expected to open in fiscal 2016. The lease expires on July 31, 2026 and has four renewal options with terms of five years each. Corporate Office Our principal executive office is in... -

Page 30

... Select Market under the symbol "ULTA" since October 25, 2007. Our initial public offering was priced at $18.00 per share. The following table sets forth the high and low sales prices for our common stock on the NASDAQ Global Select Market during fiscal years 2015 and 2014: Fiscal Year 2015 High Low... -

Page 31

... Annual Report on Form 10-K. Recent sales of unregistered securities None. Securities authorized for issuance under equity compensation plans The following table provides information about Ulta Beauty common stock that may be issued under our equity compensation plans as of January 30, 2016. Number... -

Page 32

... comparing the cumulative total stockholder return on Ulta Beauty's common stock with the NASDAQ Global Select Market Composite Index (NQGS) and the S&P Retail Index (RLX) for the period covering January 29, 2011 through the end of Ulta Beauty's fiscal year ended January 30, 2016. The graph assumes... -

Page 33

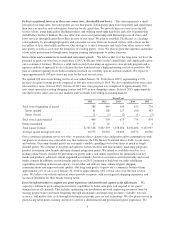

... Data," of this Annual Report on Form 10-K. Fiscal year ended(1) January 30, January 31, February 1, February 2, January 28, 2016 2015 2014 2013 2012 (In thousands, except per share and per square foot data) Income statement: Net sales(2) ...Cost of sales ...Gross profit ...Selling, general and... -

Page 34

... average total square foot was calculated by dividing net sales for the year by the average square footage for those stores open during each year. The sales for the 53rd week of fiscal 2012 were approximately $55 million. (7) The Company prospectively adopted Accounting Standards Update No. 2015-17... -

Page 35

... the time the service is provided. Gift card sales revenue is deferred until the guest redeems the gift card. Company coupons and other incentives are recorded as a reduction of net sales. Comparable sales reflect sales for stores beginning on the first day of the 14th month of operation. Therefore... -

Page 36

... state statutory tax rate for the states in which we operate stores. Results of operations Our fiscal years are the 52 or 53 week periods ending on the Saturday closest to January 31. The Company's fiscal years ended January 30, 2016, January 31, 2015 and February 1, 2014 were 52 week years and are... -

Page 37

...) January 30, 2016 Fiscal year ended January 31, 2015 February 1, 2014 Net sales ...Cost of sales ...Gross profit ...Selling, general and administrative expenses ...Pre-opening expenses ...Operating income ...Interest income, net ...Income before income taxes ...Income tax expense ...Net income... -

Page 38

... store sales calculation for fiscal 2015 and 2014. The total comparable sales increase included a 3.4% increase in average ticket and an 8.4% increase in transactions. We attribute the increase in comparable sales to our successful marketing and merchandising strategies. Gross profit Gross profit... -

Page 39

... decrease in gross profit margin in fiscal 2014 was primarily due to 10 basis points of deleverage in merchandise margins driven primarily by product and channel mix shifts and converting the remaining 50% of our loyalty program members to the Ultamate Rewards loyalty program. Selling, general and... -

Page 40

... sales, new brand additions and incremental inventory for instore prestige brand boutiques; and ‰ approximately $43 million due to the opening of the Company's fourth distribution center in Greenwood, Indiana. We had a current tax liability of $12.7 million at the end of fiscal 2015 compared... -

Page 41

...expansion of prestige boutiques and related in-store merchandising upgrades. In 2014, we embarked on a multi-year supply chain project which included adding capacity, with a fourth distribution center launched in August 2015 in Greenwood, Indiana, a fifth distribution center expected to open in 2016... -

Page 42

... at any time. On March 12, 2015, we announced that our Board of Directors authorized an increase of $100 million to the 2014 Share Repurchase Program effective March 17, 2015. During fiscal year 2013, we purchased 500,500 shares of common stock for $37.3 million at an average price of $74... -

Page 43

... our financial position or results of operations to date, a high rate of inflation in the future may have an adverse effect on our ability to maintain current levels of gross margin and selling, general and administrative expenses as a percentage of net sales if the selling prices of our products do... -

Page 44

... of the Board of Directors. Inventory valuation Merchandise inventories are carried at the lower of average cost or market value. Cost is determined using the weighted-average cost method and includes costs incurred to purchase and distribute goods as well as related vendor allowances including... -

Page 45

... accompanying consolidated financial statements. Customer loyalty program We maintain a customer loyalty program, Ultamate Rewards, in which program members earn points based on purchases. Points earned by members are valid for at least one year and may be redeemed on any product we sell. We accrue... -

Page 46

... reporting periods. We are currently evaluating the impact of this new standard on our consolidated financial position, results of operations and cash flows. Recently adopted accounting pronouncements In November 2015, the FASB issued ASU No. 2015-17, Balance Sheet Classification of Deferred Taxes... -

Page 47

... that material information relating to the Company is made known to the officers who certify our financial reports and to the members of our senior management and Board of Directors. Based on management's evaluation as of January 30, 2016, our Chief Executive Officer and Chief Financial Officer have... -

Page 48

... our employees, including our Chief Executive Officer, Chief Financial Officer, Controller and other persons performing similar functions. We have posted a copy of our Code of Business Conduct under "Corporate Governance" in the Investor Relations section of our website located at http://ir.ulta.com... -

Page 49

Part IV Item 15. Exhibits and Financial Statement Schedules (a) The following documents are filed as a part of this Form 10-K: Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets ...Consolidated Statements of Income ...Consolidated Statements of Cash Flows ...... -

Page 50

... with the standards of the Public Company Accounting Oversight Board (United States), Ulta Salon, Cosmetics & Fragrance, Inc.'s internal control over financial reporting as of January 30, 2016, based on criteria established in Internal Control - Integrated Framework issued by the Committee of... -

Page 51

...the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Ulta Salon, Cosmetics & Fragrance, Inc. as of January 30, 2016 and January 31, 2015, and the related consolidated statements of income, cash flows and stockholders' equity for each of the three years in... -

Page 52

Ulta Salon, Cosmetics & Fragrance, Inc. Consolidated Balance Sheets (In thousands, except per share data) January 30, 2016 January 31, 2015 Assets Current assets: Cash and cash equivalents ...$ 345,840 $ 389,149 Short-term investments ...130,000 150,209 Receivables, net ...64,992 52,440 Merchandise... -

Page 53

... Fiscal year ended January 31, February 1, 2015 2014 (In thousands, except per share data) January 30, 2016 Net sales ...Cost of sales ...Gross profit ...Selling, general and administrative expenses ...Pre-opening expenses ...Operating income ...Interest income, net ...Income before income taxes... -

Page 54

Ulta Salon, Cosmetics & Fragrance, Inc. Consolidated Statements of Cash Flows Fiscal year ended January 31, February 1, 2015 2014 (In thousands) January 30, 2016 Operating activities Net income ...$ 320,008 $ 257,135 $ 202,849 Adjustments to reconcile net income to net cash provided by operating ... -

Page 55

... 31, 2015 ... Stock options exercised and other awards ...Purchase of treasury shares ...Net income ...Excess tax benefits from stock-based compensation ...Stock compensation charge ...Repurchase of common shares ... Balance - January 30, 2016 ... See accompanying notes to financial statements. -

Page 56

... specialty retail stores selling cosmetics, fragrance, haircare and skincare products, and related accessories and services. The stores also feature full-service salons. As of January 30, 2016, the Company operated 874 stores in 48 states. As used in these notes and throughout this Annual Report on... -

Page 57

...one year and may be redeemed on any product we sell. Prior to this conversion, we ran both Ultamate Rewards and our prior program, The Club at Ulta. The Club at Ulta was a certificate program offering customers reward certificates for free beauty products based on the level of purchases. The Company... -

Page 58

... Net sales include merchandise sales, salon service revenue and e-commerce revenue. Revenue from merchandise sales at stores is recognized at the time of sale, net of estimated returns. The Company provides refunds for product returns within 60 days from the original purchase date. Salon revenue is... -

Page 59

...general and administrative expenses Selling, general and administrative expenses includes payroll, bonus, and benefit costs for retail and corporate employees; advertising and marketing costs; occupancy costs related to our corporate office facilities; public company expense including Sarbanes-Oxley... -

Page 60

.... The Company is currently evaluating the impact of this new standard on its consolidated financial position, results of operations and cash flows. Recently adopted accounting pronouncements In November 2015, the FASB issued ASU No. 2015-17, Balance Sheet Classification of Deferred Taxes. The new... -

Page 61

... years. A number of the Company's store leases provide for contingent rentals based upon sales. Contingent rent amounts were insignificant in fiscal 2015, 2014 and 2013. Total rent expense under operating leases was $181,487, $159,245 and $138,086 for fiscal 2015, 2014 and 2013, respectively. Future... -

Page 62

... and equipment costs) ...Accrued customer liabilities ...Accrued payroll, bonus and employee benefits ...Accrued taxes, other ...Other accrued liabilities ...Accrued liabilities ...6. Income taxes The provision for income taxes consists of the following: (In thousands) Fiscal 2015 $ 27,894 54,496... -

Page 63

...of unrecognized tax benefits may change in the next twelve months. However, it does not expect the change to have a significant impact on its consolidated financial statements. Income tax-related interest and penalties were insignificant for fiscal 2015 and 2014. The Company files tax returns in the... -

Page 64

... was less than twelve months at January 30, 2016. 10. Share-based awards Equity incentive plans The Company has had a number of equity incentive plans over the years. The plans were adopted in order to attract and retain the best available personnel for positions of substantial authority and... -

Page 65

.... The actual tax benefit realized for the tax deductions from option exercise and restricted stock vesting of the share-based payment arrangements totaled $14,970, $6,892 and $18,169, respectively, for fiscal 2015, 2014 and 2013. Employee stock options The Company measures share-based compensation... -

Page 66

...last reported sale price of our common stock on the NASDAQ Global Select Market on January 30, 2016 was $181.17 per share. Restricted stock units The Company issues restricted stock units to certain employees and its Board of Directors. Employee grants will generally cliff vest after three years and... -

Page 67

... Company's performance-based restricted stock unit activity is presented in the following table (shares in thousands): Fiscal 2015 Weightedaverage grant date fair value Number of units Performance-based restricted stock units outstanding Beginning of year ...Granted ...Vested ...Forfeited ...End... -

Page 68

... is not yet complete. 12. Employee benefit plans The Company provides a 401(k) retirement plan covering all employees who qualify as to age and length of service. The plan is funded through employee contributions and a Company match. In fiscal 2015, 2014 and 2013, the Company match was 100% of the... -

Page 69

... thousands) Balance at end of period Description Fiscal 2015 Allowance for doubtful accounts ...Shrink reserve ...Inventory - lower of cost or market reserve ...Insurance: Workers Comp / General Liability Prepaid Asset ...Employee Health Care Accrued Liability ...Fiscal 2014 Allowance for doubtful... -

Page 70

... the 13 weeks ending on the Saturday closest to April 30, July 31, October 31 and January 31. 2015 First (In thousands, except per share data) Second Third Fourth Net sales ...Cost of sales ...Gross profit ...Selling, general and administrative expenses ...Pre-opening expenses ...Operating income... -

Page 71

... discontinued at any time. On March 12, 2015, the Company announced that our Board of Directors authorized an increase of $100,000 to the 2014 Share Repurchase Program effective March 17, 2015. During fiscal year 2013, we purchased 501 shares of common stock for $37,337 at an average price of $74.58... -

Page 72

... of Bolingbrook, State of Illinois, on March 30, 2016. ULTA SALON, COSMETICS & FRAGRANCE, INC. By: /s/ Scott M. Settersten Scott M. Settersten Chief Financial Officer, Treasurer and Assistant Secretary Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed... -

Page 73

Ulta Salon, Cosmetics & Fragrance, Inc. Exhibit Index to Annual Report on Form 10-K For the Fiscal Year Ended January 30, 2016 Exhibit Number Filed Herewith Form Incorporated by Reference Exhibit File Number Number Filing Date Description of document 3.1 3.2 4.1 Amended and Restated Certificate ... -

Page 74

...Letter Agreement dated January 6, 2014 between Ulta Inc. and David Kimball* List of Subsidiaries Consent of Independent Registered Public Accounting Firm Certification of the Chief Executive Officer pursuant to Rules 13a-14(a) and 15d-14(a) of the Securities Exchange Act of 1934, as adopted pursuant... -

Page 75

...Filed Herewith Form Incorporated by Reference Exhibit File Number Number Filing Date 99 Proxy Statement for the 2016 Annual Meeting of Stockholders. [To be filed with the SEC under Regulation 14A within 120 days after January 30, 2016; except to the extent specifically incorporated by reference... -

Page 76

... Plans, the Ulta Salon, Cosmetics & Fragrance, Inc. 2002 Equity Incentive Plan and the Ulta Salon, Cosmetics & Fragrance, Inc. Second Amended and Restated Restricted Stock Option Plan of our reports dated March 30, 2016, with respect to the consolidated financial statements of Ulta Salon, Cosmetics... -

Page 77

... financial information; and b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. By: /s/ Mary N. Dillon Mary N. Dillon Chief Executive Officer and Director Date: March 30, 2016 -

Page 78

..., process, summarize and report financial information; and b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. By: /s/ Scott M. Settersten Scott M. Settersten Chief Financial... -

Page 79

...-Oxley Act of 2002), I, the undersigned Chief Executive Officer and Director of Ulta Salon, Cosmetics & Fragrance Inc. (the "Company"), hereby certify that the Annual Report on Form 10-K of the Company for the fiscal year ended January 30, 2016 (the "Report"), fully complies with the requirements of... -

Page 80

THIS PAGE INTENTIONALLY LEFT BLANK -

Page 81

... June 1, 2016, at: ULTA Beauty Company Headquarters 1000 Remington Boulevard, Suite 120 Bolingbrook, IL 60440 Jefrey Childs Chief Human Resources Ofcer David Kimbell Chief Merchandising and Marketing Ofcer Transfer Agent and Registrar American Stock Transfer & Trust Company Operations Center 6201... -

Page 82

PRESTIGE COSMETICS PRESTIGE SKIN CARE DERMALOGICA SKIN SERVICES THE SALON AT ULTA BEAUTY MASS COSMETICS BENEFIT BROW BAR ULTA BEAUTY COLLECTION PROFESSIONAL HAIR CARE -

Page 83

-

Page 84