Ulta 2012 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2012 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pre-opening expense includes non-capital expenditures during the period prior to store opening for new,

remodeled and relocated stores including rent during the construction period for new and relocated stores, store

set-up labor, management and employee training, and grand opening advertising.

Interest expense includes interest costs and unused facility fees associated with our credit facility, which is

structured as an asset based lending instrument. Our credit facility interest is based on a variable interest rate

structure which can result in increased cost in periods of rising interest rates.

Income tax expense reflects the federal statutory tax rate and the weighted average state statutory tax rate for the

states in which we operate stores.

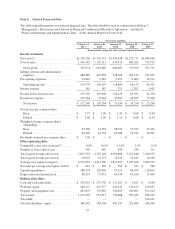

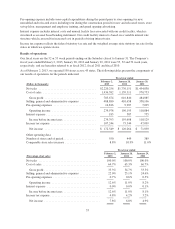

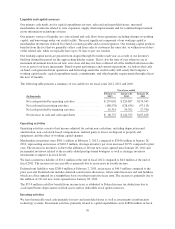

Results of operations

Our fiscal years are the 52 or 53 week periods ending on the Saturday closest to January 31. The Company’s

fiscal years ended February 2, 2013, January 28, 2012 and January 29, 2011 were 53, 52 and 52 week years,

respectively, and are hereafter referred to as fiscal 2012, fiscal 2011 and fiscal 2010.

As of February 2, 2013, we operated 550 stores across 45 states. The following tables present the components of

our results of operations for the periods indicated:

Fiscal year ended

(Dollars in thousands)

February 2,

2013

January 28,

2012

January 29,

2011

Net sales ....................................... $2,220,256 $1,776,151 $1,454,838

Cost of sales .................................... 1,436,582 1,159,311 970,753

Gross profit ................................... 783,674 616,840 484,085

Selling, general and administrative expenses ........... 488,880 410,658 358,106

Pre-opening expenses ............................. 14,816 9,987 7,095

Operating income .............................. 279,978 196,195 118,884

Interest expense .................................. 185 587 755

Income before income taxes ...................... 279,793 195,608 118,129

Income tax expense ............................... 107,244 75,344 47,099

Net income ................................... $ 172,549 $ 120,264 $ 71,030

Other operating data:

Number of stores end of period ...................... 550 449 389

Comparable store sales increase ..................... 8.8% 10.9% 11.0%

Fiscal year ended

(Percentage of net sales)

February 2,

2013

January 28,

2012

January 29,

2011

Net sales .......................................... 100.0% 100.0% 100.0%

Cost of sales ....................................... 64.7% 65.3% 66.7%

Gross profit ...................................... 35.3% 34.7% 33.3%

Selling, general and administrative expenses .............. 22.0% 23.1% 24.6%

Pre-opening expenses ................................ 0.7% 0.6% 0.5%

Operating income ................................. 12.6% 11.0% 8.2%

Interest expense .................................... 0.0% 0.0% 0.1%

Income before income taxes ......................... 12.6% 11.0% 8.1%

Income tax expense .................................. 4.8% 4.2% 3.2%

Net income ...................................... 7.8% 6.8% 4.9%

33